What To Expect On Inflation, Fed Policy As Year End Approaches

On tap this week is the Fed’s rate decision, some key inflation data, and retail sales figures for November (which includes Black Friday). As well, discount giant Costco (COST) reports earnings for last quarter, explains John Eade, president of Argus Research.

Last week, the Dow Jones Industrial Average was up 0.01%, the S&P 500 gained 0.2%, and the Nasdaq advanced 0.7%. Year-to-date, the DJIA is up 9%, the S&P is up 20%, and the Nasdaq is higher by nearly 38%.

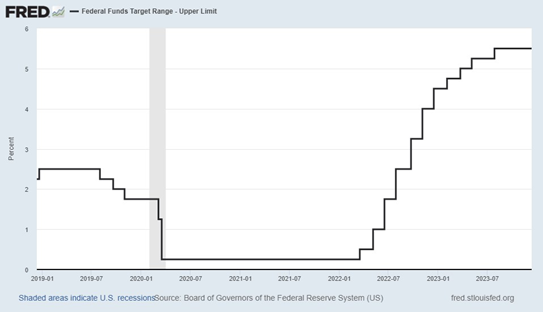

On the economic calendar, the Fed has its two-day meeting with an interest-rate decision coming on Wednesday. No change is expected and, as usual, analysts will be focused on Chairman Powell’s comments following the rate decision.

(Click on image to enlarge)

Source: Federal Reserve

In addition to rate news, Wednesday also features the Producer Price Index; Thursday includes Retail Sales; and Friday provides updates on Industrial Production and Capacity Utilization. On the earnings calendar, a few final key companies will report. On Wednesday, it’s Adobe. On Thursday, Jabil, Lennar Corp, and Costco. And on Friday, Progressive and Darden Restaurants.

As of last Friday, 497 of the S&P 500 companies have reported. So far, earnings are 7.2% above the same quarter last year – which is better than expected. Communication Services by far is performing the best, up 46%, while Energy (like last quarter) is performing the worst, down 33%.

Last week, the November jobs report got a lot of attention when it came out on Friday. It showed Nonfarm Payrolls increasing by 199,000 for November and a surprise drop in the Unemployment Rate to 3.7%, from 3.9%. The general takeaway was that the labor market is still strong but showing signs of softening, which could imply a soft landing for the economy.

Checking on the consumer sector, mortgage rates last week declined to 7.03% for the average 30-year fixed-rate mortgage. Rates are still near their highest level in more than 20 years. Gas prices dropped a penny to $3.23 per gallon for the average price of regular gas. That’s the lowest price since mid-January and down 15% since the recent high in August.

More By This Author:

Blue Chip Investors Can Bank On Old NationalThree Small Caps with Big "Upside"

A Trio of Midstream Energy Plays

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.