What Is WACC And Why Should I Care

How you would like to do the following calculation?

WACC = rD (1- Tc )*( D / V )+ rE *( E / V )

Where...

- rD = The required return of the firm's Debt financing

This should reflect the CURRENT MARKET rates the firm pays for debt. ThatsWACC.com calculates the cost of debt as the firm's total interest payments divided by the firm's average debt over the last year.

- (1-Tc) = The Tax adjustment for interest expense

Interest paid on debt reduces Net Income, and therefore reduces tax payments for the firm. This value of this 'interest tax shield' depends on the firm's tax rate. We calculate the tax rate as the firm's total Taxes divided by pre-Tax income for the last 3 years.

- (D/V) = (Debt/Total Value)

The % of the firm's value that is comprised of debt.

- rE= the firm's cost of equity

The firm's cost of equity is best (or, at least, most easily) calculated using the CAPM (Capital Asset Pricing Model).

Cost of Equity rE = rf + β(rM - rf) where...

rf = the 'Risk Free' rate of return

β = the firm's 'Beta'; the correlation between the firm's returns and the market

rM = the historical "Market" return

- (E/V) = (Equity/Total Value)

This is the nightmarish formula for the weighted average cost of capital, or WACC, paid by companies. WACC is the other side of ROIC, or return on invested capital.

Remember ROIC is the total return for shareholders that management creates based on the entire capital at its disposal – debt and equity combined. Morningstar.com, on their Key Ratios page, and Reuters.com, on their “Financial” page, offer ROIC numbers by company and stock symbol. The premium service of fastgraph.com offers both a 15-yr history, but graphing capabilities as well.

There is a new website that offers WACC calculations based on ticker symbol. This is a huge step forward for retail investors researching equities as it makes this valuable fundamental number accessible.

That’sWACC.com allows investors to plug in a stock symbol and up comes the WACC. That’sWACC Website

While not a popular comparison, the net of ROIC minus WACC tells shareholders if management is creating more returns than the capital is costing. A positive net return is considered as adding shareholder value while a negative net return is considered destroying shareholder value. However, just because a company does not generate their cost of capital does not mean the company stock is a bad investment; the net difference should be monitored. Just as earnings change every year, so does ROIC, and hence the net difference between ROIC and WACC.

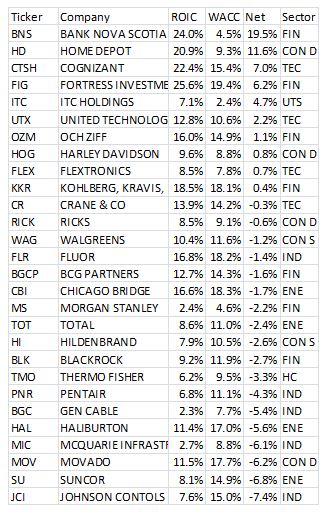

To see how useful this tool is, below is a table of My Investment Navigator's 28 top rated stocks, as of Sept 27, and the corresponding 2013 ROIC, 2013 WACC, and the difference between the two.

While WACC should not be the sole criteria for equity selection, its insight into management's ability to create long-term shareholder value makes its inclusion into your due diligence quite valuable.

Disclosure: BNS, FIG, ITC, UTX, OZM, KKR, RICK, BGCP, CBI, SU, JCI