What Is The Right Approach For Chevron Stock Post Q3 Earnings?

Image: Shutterstock

Key Takeaways

- The Chevron Corporation beat Q3 earnings estimates with a 7% year-over-year increase in oil output.

- However, near-term risks for the stock persist, such as declining revenue margins and uncertainty around recent acquisitions.

Chevron Corporation (CVX - Free Report) recently reported its third-quarter 2024 earnings, which beat estimates primarily due to production growth in key regions. Chevron achieved a 7% year-over-year increase in oil-equivalent output, with significant contributions from record U.S. production and new projects in the Gulf of Mexico.

Investments in fields like Anchor and Jack/St. Malo are projected to lift Gulf of Mexico production further, providing a growth engine that supports Chevron’s earnings and cash flow trajectory.

These are reasonably strong results, but are they enough to sway sentiment amid several near-term risks plaguing the company? Unfortunately, there appear to be some serious red flags, not least the declining revenue margins, pessimism on commodity prices and uncertainty surrounding the Hess (HES - Free Report) acquisition.

A Look at Major Issues Affecting Chevron

Chevron’s Q3 earnings reveal a 65% drop in profit from refining operations compared to last year, due to weaker refining margins in the United States and global markets. With these reduced margins, the downstream segment’s income is under strain, particularly in North America.

Annual EPS estimates for Chevron have been revised downward following the results, reflecting concerns about the company’s near-term profitability.

Image Source: Zacks Investment Research

Investor sentiment toward Chevron has turned negative due to concerns over future oil and gas prices. With commodity prices facing downward pressure and uncertain demand dynamics, market expectations have shifted. This outlook could limit Chevron’s earnings potential and impact its share performance as the energy market adjusts to anticipated price weakness, which is expected to persist in the near-term.

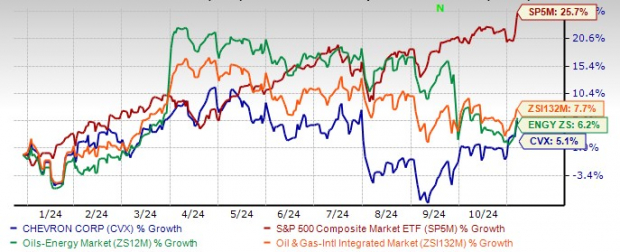

As it is, the market has not been impressed with the company this year. In 2024, the integrated company's stock has gained just around 5% against the S&P 500’s 26% climb. Chevron has also underperformed the Oil/Energy space and its subindustry during this period.

Chevron Year-to-Date Stock Performance

Image Source: Zacks Investment Research

Then there’s the question of the Hess deal. Chevron’s $53 billion buyout faces legal complications, with ExxonMobil (XOM - Free Report) disputing the transaction due to alleged right-of-first-refusal claims on Guyana assets. This arbitration could extend through the end of 2025, creating uncertainty over Chevron’s access to the valuable Guyana assets.

Other Hurdles in Chevron’s Path

Potential Increase in U.S. Oil Production: With the U.S. election results favoring a Republican administration, policies supporting increased hydrocarbon production may be enacted. Such an approach could lead to a significant rise in U.S. oil output, adding to global supply and putting downward pressure on oil prices. Increased domestic production would reduce dependency on foreign oil, potentially leading to a price reduction as supply levels rise.

Impact of Asset Divestments: Chevron is selling assets in Canada, Alaska, and Congo. It is expected to generate around $8 billion in proceeds by the end of Q4 2024. While these sales align with Chevron’s portfolio optimization, they will reduce Q4 production by approximately 45 thousand oil-equivalent barrels per day (MBOE/d).

Reliance on Debt for Share Buybacks: Chevron’s aggressive share repurchase strategy, which included $5.6 billion in free cash flow for the quarter, has been partly funded by debt. While this approach supports immediate shareholder returns, it raises concerns over sustainability. Continued reliance on debt for buybacks could strain Chevron’s financial flexibility, especially if oil prices decline.

A Word on Chevron's Valuation

Chevron’s valuation remains slightly higher than many of its peers. If we look at the price/earnings ratio, CVX’s shares have recently traded at 13 forward earnings multiple. This is higher than its international peers like Shell (SHEL), which trade closer to 8X. The premium could be seen as a risk, particularly if energy demand falters or oil prices remain under pressure, limiting the upside. The stock also has a poor Value Score of D despite its low share price.

Image Source: Zacks Investment Research

Amid this specter of doom and gloom, there appears to be a few positives to be excited about Chevron's stock.

3 Things That Stand Out for Chevron

Strong Cash Flow and Shareholder Returns: Chevron’s Q3 2024 results showcased a record $7.7 billion returned to shareholders, including $4.7 billion in share buybacks and $2.9 billion in dividends. With plans to repurchase $17.5 billion in shares annually, Chevron demonstrates strong cash flow and a commitment to consistent shareholder returns, backed by a solid balance sheet and disciplined capital management.

Production Growth in the Gulf of Mexico: Chevron has achieved significant milestones in the Gulf of Mexico, including the startup of its high-pressure Anchor project and enhanced production at the Jack/St. Malo and Tahiti fields. These developments, alongside other projects scheduled through 2025, are projected to boost the Gulf of Mexico production to 300,000 barrels per day by 2026, underscoring Chevron's commitment to long-term production growth and cash flow stability.

Image Source: Chevron Corporation

Asset Sales and Cost-Cutting Initiatives: Chevron’s high-grading strategy, involving $8 billion in non-core asset sales, positions the company to meet its $10-$15 billion divestiture target by 2026. Additionally, Chevron aims to achieve $2-$3 billion in cost reductions through technology optimization and operational efficiencies. This focus on portfolio refinement and expense management is set to boost Chevron’s profitability, enhancing cash flow.

Conclusion: Sell

Chevron’s stock currently presents several risks that could make it unappealing to investors. Despite strong production growth and new Gulf of Mexico projects, the company faces declining refining margins, pressuring profitability.

Additionally, downward revisions in EPS estimates reflect caution around Chevron’s earnings potential amid ongoing pessimism over oil prices. Legal uncertainties surrounding the Hess transaction further cloud Chevron’s access to Guyana assets. Coupled with valuation concerns and heavy reliance on debt-funded buybacks, these factors collectively signal caution.

Based on the current setup, Chevron’s stock is likely one to avoid. The stock currently carries a Zacks Rank #4 (Sell).

More By This Author:

Nvidia Stock Dips While Market Gains: Key Facts2 Intriguing Tech Stocks To Buy After Q3 Earnings: ANET, FTNT

Bear Of The Day: Hershey

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more