What I'm Watching In This "And Then There Were None" Market

This past week, the generals continued their retreat on modest capital flows while the troops resumed their rally. The generals (NDX 100) lost -3.98%, while the troops – the iShares Russell 3000 ETF (IWM) – gave up much of their early week gains to finish up 1.74%. The S&P 500 ended the week down -1.97%, with capital outflows outpacing inflows by nearly a 2:1 ratio.

This “And Then There Were None” market continues to broaden, with the Invesco S&P 500 Equal Weight ETF (RSP) finishing nearly flat (-0.08%), and dividend stocks leading the way higher, with the Schwab US Dividend Equity ETF (SCHD) finishing up 1.85%.

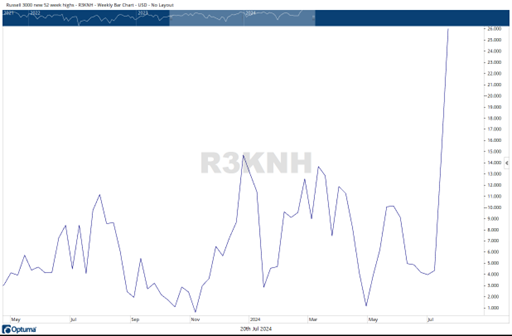

More evidence of market broadening was seen in market breadth. The NYSE Advance-Decline line closed higher for the week, creating a new, all-time, intra-week high. The number of stocks in the Russell 3000 making new 52-week highs reached a new 2024 high.

Both the trends of Capital Weighted Volume and Capital Weighted Dollar Volume pulled back this week but remain in solid uptrends. S&P 500 resistance is at 5,670, with support at 5,440. The troops (IWM) have support between 212 and 210, with resistance at 228.

More By This Author:

EEM: An Emerging Markets ETF To Consider As Wild Market Rotation Plays OutTech Stocks: No, You Shouldn't Sell Your Winners Due To A Couple Rough Days

Q2 Earnings Season: What I'm Expecting – And What To Do About It

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more