What If The Tech Bubble Burst?

Looking at a recent client survey, Deutsche Bank's Jim Reid reminds readers in his daily Chart of the Day note that "there have been huge fears that there is a bubble in US tech (and Bitcoin) with around 90% of respondents thinking both were in a bubble" which explains the rollercoaster in tech stock this week.

That said, Reid correctly caveats that his audience "is probably (on average) not the natural buyer of these assets so it’s a sentiment observation rather than a positioning tool" - in other words a bunch of poseurs (many of whom wish they were long bitcoin) something we have frequently said about that other Fund Manager Survey, from Bank of America. Even so, in most of the client meetings Reid has had this year, the topic of tech valuations comes up and as a result, he speculates as to "what impact a tech bubble bursting might have on the overall market."

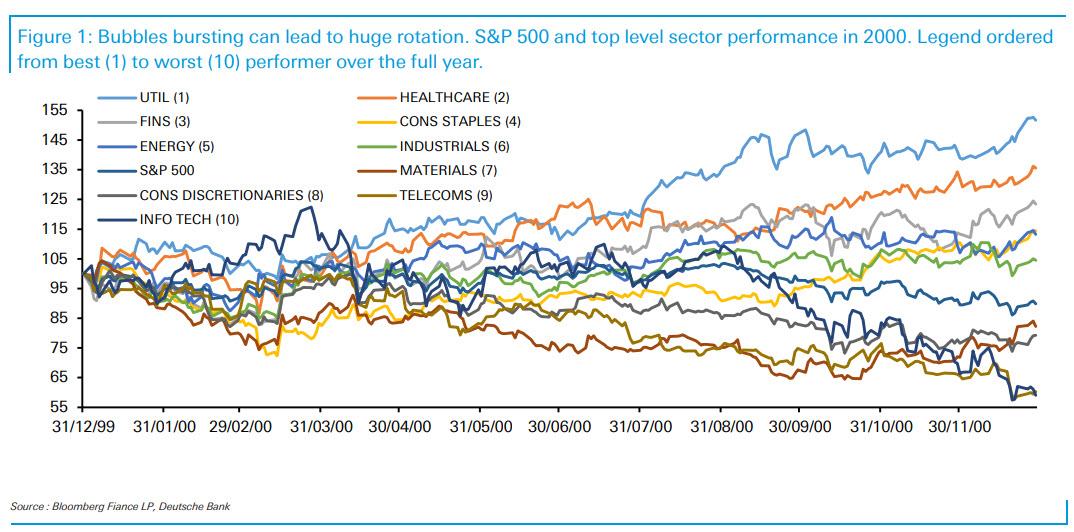

In today’s CoTD he looks at 2000 as a case study: the spectacular tech bubble burst in March 2000 and by YE had lost more than half its peak value. However, although the S&P 500 fell around -10% in 2000, six of the ten headline sectors were higher over the course of the year with Utilities (+51.7%), Healthcare (+35.5%), and Financials (+23.4%) leading the way!

(Click on image to enlarge)

Indeed at the frothy market peak at the end of March, only two non-tech sectors were up for the year. So before the bubble peaked there had been a move away from the old economy into tech and when the tech bubble burst there was a huge rotation back into the old economy, even if the overall index traded lower (with an associated telecom sector slump not helping).

While the parallels do not exactly match up with today - especially since a recession eventually caught up with the overall market in 2001 - nevertheless, Reid concludes that "a bubble bursting can lead to significant rotation with strong performance elsewhere even if it might not save the overall index." In other words, the best trade to hedge against a bursting of the 2021 tech bubble is to go long those sectors that are the least tech of all.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more