What Drives S&P 500 Rebalance Turnover?

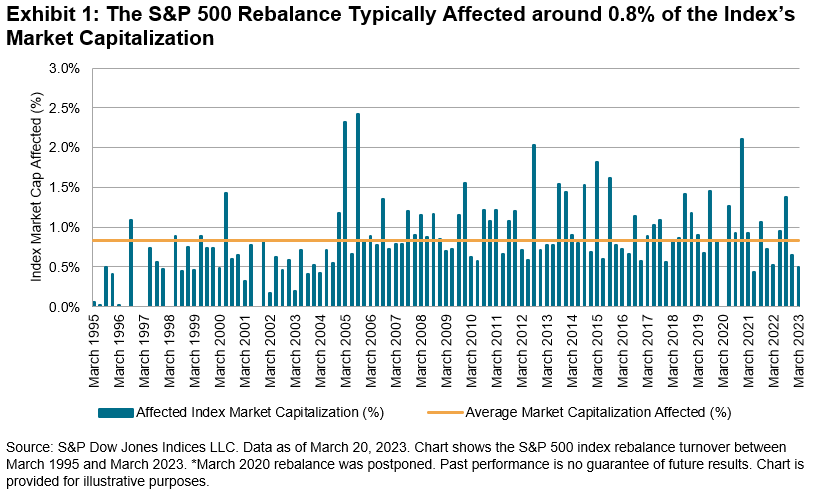

The S&P 500® undergoes quarterly updates—more colloquially known as rebalances—after the close of the third Friday in March, June, September, and December. These updates typically affect the S&P 500’s composition and have turnover implications for investors tracking the index. For example, Exhibit 1 shows the S&P 500 turnover at each rebalance between March 1995 and March 2023. The S&P 500 rebalance typically affected around 0.8% of the index’s market capitalization.

Importantly, rebalance turnover is not driven primarily by constituent changes in the S&P 500: around 90% of S&P 500 constituent changes since 1995 did not happen at a quarterly rebalance (see Exhibit 2). Unlike many other indices, S&P 500 constituent changes are made on an ongoing, as-needed basis to maintain the index’s 500 company count and to ensure the S&P 500 continues to meet its stated objective of measuring the large-cap U.S. equity segment.

Although some constituent changes do happen at rebalances—for example, Fair Isaac & Co replaced Lumen Technologies at March 2023 rebalance—the off-rebalance timing of many constituent changes is driven by the fact that most S&P 500 deletions are caused by events that affect companies’ eligibility for ongoing index membership. These events include M&A activity, spinoffs, restructurings, and companies entering Federal Deposit Insurance Corporation (FDIC) receiverships (e.g. here and here).

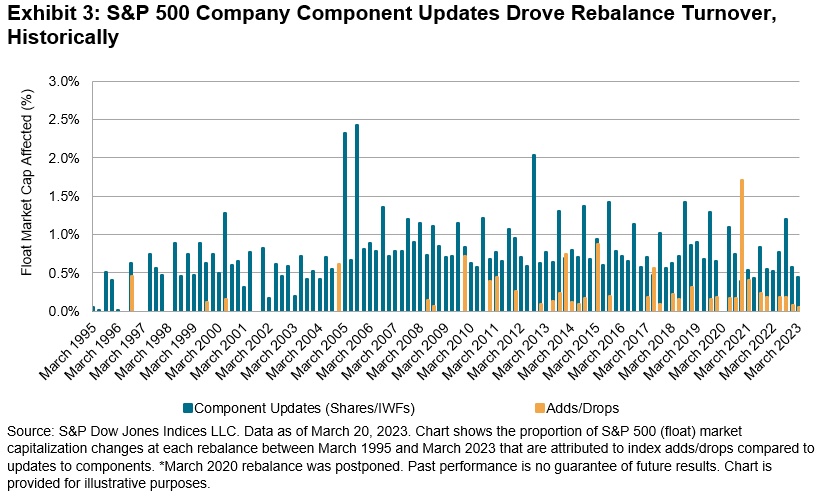

Instead, quarterly updates to company-specific information typically had a far bigger impact on S&P 500 rebalance turnover than constituent changes. Exhibit 3 separates the figures shown in Exhibit 1 into turnover caused by constituent changes versus turnover caused by updates to company-specific information. On average, the latter accounted for 90% of the quarterly rebalance turnover. These company-specific updates capture the impact on constituents’ market capitalizations from company actions such as mergers and acquisitions. And since the S&P 500 became free-float adjusted in 2004-2005, the company-specific changes also reflect updates to the proportion of a given company’s shares that are available to investors.

Overall, the S&P 500 rebalances offer quarterly updates that help the index meet its stated objective. But unlike other indices, constituent changes did not typically drive S&P 500 rebalance turnover: the ongoing, as-needed constituent changes typically occurred off-rebalance, as many deletions were driven by events affecting companies’ index eligibility. Instead, updates to company-specific information usually drove rebalance of turnover.

More By This Author:

Measuring Home Prices

Indexing Bond And Commodity Markets In The World Of The Upside Down

2023 Has Already Been Trepidatious

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.