What Did You Expect Them To Do?

Image Source: Pexels

Can you remember a day when the monthly jobs report was an afterthought? I’ve already been asked multiple times today about China’s retaliation to US tariffs on their imports.And, after a mid-morning plunge reversed somewhat, stocks fell again after Chair Powell seemed disinclined to cut rates during tariff uncertainty.What else did you expect them to do?

The announcement that China intends to impose additional 34% tariffs on US goods, matching the increase proposed by President Trump on Wednesday, seemed to catch markets by surprise.This was the first of the “what else did you expect them to do?” moments today.I suppose that I shouldn’t have been quite so surprised at the reaction, considering how skittish markets have become along with the relative lack of liquidity in the pre-market ahead of an employment report.

The jobs report itself did little to change market sentiment, despite a startling increase in March Nonfarm Payrolls. Those increased by 228,000, well above the 140k consensus.Some of that bounce was offset by February’s 151k revised lower to 117k, and a further downward -14K revision to January, but that is still an unexpected pickup in payrolls.However, the Unemployment Rate unexpectedly ticked up to 4.2% from last month’s 4.1%, which was also the expectation.I wouldn’t say that the numbers were ignored, but their usual importance was superseded by the global angst about tariffs.

That angst has translated into recession signals.Bond yields are off their earlier lows — 2-year Treasuries are down about 5 basis point at midday, but about 15bp above its low, while the 10-year is down about 9 bp, about 7bp above its nadir – but the recent plunge in yields is yet another sign of concern.Indeed, some of the decline in yields can be explained by safe haven demand, but a 30bp drop in 2- and 10-year yields in just two days reflects a greater underlying concern.Fed Funds futures are now indicating the likelihood for four 25bp rate cuts this year, up from three last week, with the first cut priced in for June instead of July.

Despite the recession concerns, in a speech in Virginia today, Chair Powell said,

We are well positioned to wait for greater clarity before considering any adjustments to our policy stance. It is too soon to say what will be the appropriate path for monetary policy.

Essentially, the Fed will “wait and see” the effects of tariffs before adjusting rates.Again, “what did you expect them to do?”No one has true clarity into how the tariffs might truly play out – stocks bounced after reports emerged that Vietnam would like to negotiate a situation where they aren’t subject to tariffs – but it is quite clear that some level of rising prices is to be expected.It would reward investors if those price hikes can be abated through negotiation.

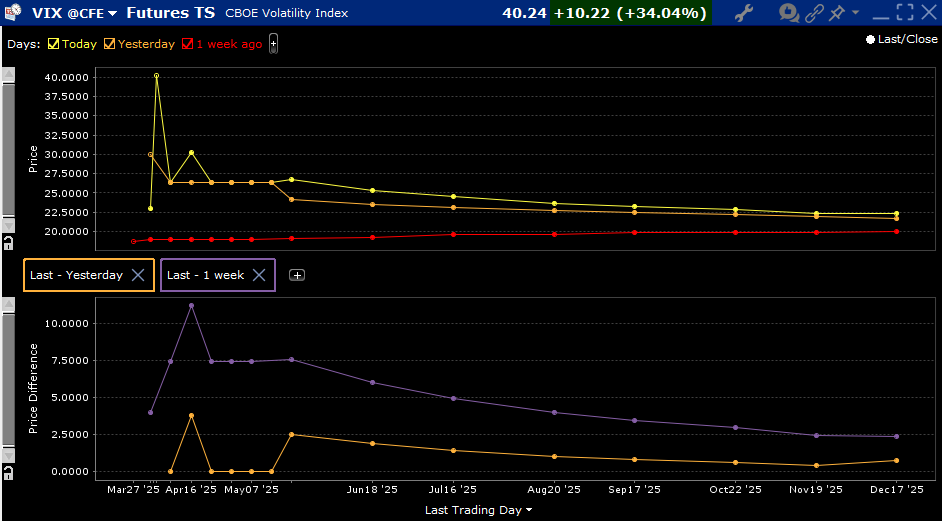

Another “what did you expect them to do?”involves the jump in the Cboe Volatility Index (VIX).Today move to, and at one point, through the 40 level was a big “tell”.We had largely avoided the “get me out!” blast in VIX until today, but now we got that sharp spike in the index and the curve is generally inverted throughout:

VIX Futures Term Structure, Today (yellow, top graph), Yesterday (orange, top), 1-Week Ago (red, top); with Changes: 1-Day (orange, bottom graph) and 1-Week (purple, bottom)

(Click on image to enlarge)

Source: Interactive Brokers

The persistently high levels of VIX futures can be interpreted as the market’s response to the removal of the perceived “Trump Put.”[i]If you thought that the administration would backstop markets, then your need to purchase downside protection was effectively outsourced.Why buy a put if you’re getting one for free?Unfortunately, the President, Treasury Secretary, and Commerce Secretary all have had numerous opportunities to mollify nervous investors, yet none have done so.Therefore, it is reasonable for investors to assume that the market-friendly policies that we came to expect from the first Trump administration are not in evidence this time around.And regarding the “Fed Put”, that might still be in effect, but Powell’s comments make it far from clear that they are willing to exercise it anytime soon.

Have a good and peaceful weekend.Go UConn!

[i] Last week, we questioned whether the put was exercised after some market-friendly comments.It’s now obvious that it wasn’t

More By This Author:

Liberation ConflagrationA Volatile End To A Volatile Quarter

Those Pesky Consumers And Their Miserable Sentiment

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more ...

more