West Is Headed North

Summary

- 100% technical buy signals.

- 17 new highs and up 16.74% in the last month.

- 62.00% gain in the last year.

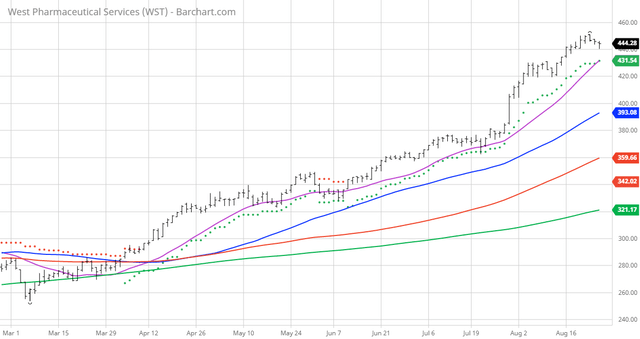

The Barchart Chart of the Day belongs to the healthcare company West Pharmaceutical Services (NYSE: WST). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 6/10 the stock gained 29.31%.

West Pharmaceutical Services, Inc. designs and produces containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Proprietary Products and Contract-Manufactured Products. The Proprietary Products segment offers stoppers and seals for injectable packaging systems; syringe and cartridge components, including custom solutions for the needs of injectable drug applications, as well as administration systems that enhance the safe delivery of drugs through advanced reconstitution, mixing, and transfer technologies; and films, coatings, washing, and vision inspection and sterilization processes and services to enhance the quality of packaging components. It also provides drug containment solutions, including Crystal Zenith, a cyclic olefin polymer in the form of vials, syringes, and cartridges; and self-injection devices, as well as a range of integrated solutions, including analytical lab services, pre-approval primary packaging support, and engineering development, regulatory expertise, and after-sales technical support. This segment serves biologic, generic, and pharmaceutical drug companies. The Contract-Manufactured Products segment is involved in the design, manufacture, and automated assembly of devices used in surgical, diagnostic, ophthalmic, injectable, and other drug delivery systems, as well as consumer products. It serves pharmaceutical, diagnostic, and medical device companies. The company distributes its products through its sales force and distribution network, as well as contract sales agents and regional distributors. West Pharmaceutical Services, Inc. was incorporated in 1923 and is headquartered in Exton, Pennsylvania.

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- 77.61+ Weighted Alpha

- 62.00% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 16.74% in the last month

- Relative Strength Index 77.18

- Technical support level at 443.74

- Recently traded at 440.40 with a 50 day moving average of 393.09

Fundamental factors:

- Market Cap $32.99 billion

- P/E 63.80

- Dividend yield .15%

- Revenue expected to grow 30.40% this year and another 8.00% next year

- Earnings estimated to increase 72.50% this year, an additional 7.20% next year and continue to compound at an annual rate of 25.80% for the next 5 years

- Wall Street analysts issued 3 strong buy, 1 buy, 2 hold and 1 underperform recommendation on the stock

- The individual investors following the stock on Motley Fool voted 81 to 7 for the stock to beat the market with the more experienced investors voting 22 to 4 for the same result

- 4,830 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more