Were Nike's Q4 Results Good Enough To Rebound Its Stock?

Image Source: Unsplash

Nike (NKE - Free Report) shares were up roughly +3% on Thursday ahead of results for its fiscal fourth quarter, which it released after the closing bell.

Despite the pre-earnings spike, NKE is down 17% in 2025 and has now fallen a grizzly 44% over the last three years to widely trail the benchmark S&P 500’s gains of more than +50% and its archrival Adidas (ADDYY - Free Report), whose stock is up +24% during this period.

That said, let’s see if Nike’s Q4 report was enough to get the ball rolling in regard to a potential rebound for the iconic apparel retailer's stock.

Image Source: Zacks Investment Research

Nike’s Q4 Report & Full Year Results

Reporting Q4 sales of $11.1 billion, Nike was able to exceed the Zacks Consensus of $10.71 billion, although this was a 12% decline from $12.6 billion in the comparative quarter. On the bottom line, Nike’s net income came in at $211 million or $0.14 per share, which topped EPS expectations of $0.12 but fell 86% from $1.01 a share in the prior year quarter.

Dealing with what has been an ongoing need to revamp its product line, Nike CEO Elliott Hill stated the company is leaning into a new “sport offense” strategy to reignite growth by focusing on core products, product innovation, and a storytelling marketing strategy. Overall, Nike’s total sales fell 10% during its fiscal 2025 to $46.3 billion, while EPS dropped 45% to $2.16 from $3.95 in FY24.

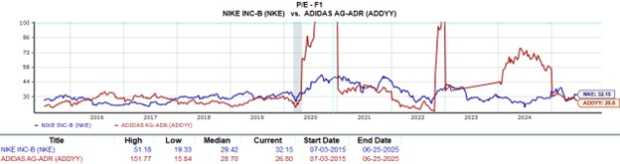

Monitoring Nike’s P/E Valuation

Amid the decline in Nike’s earnings, it has become more evident that monitoring the retail apparel giant’s P/E valuation is very necessary.

While Nike’s Q4 report was somewhat underwhelming, at around $62 a share, NKE does trade at a reasonable 32.1X forward earnings multiple. This is near Nike’s decade-long median of 29.4X forward earnings and a 37% discount to its decade high of 51.1X. Still, Nike trades at a premium to the benchmark’s 23.5X forward earnings multiple and Adidas at 26.8X.

Image Source: Zacks Investment Research

Bottom Line

Nike stock currently lands a Zacks Rank #3 (Hold), but its Q4 report did not give enough to justify a meaningful rebound. Losing market share to rival Adidas and up-and-coming players like Under Armour (UAA - Free Report), Nike’s turnaround strategy is much needed and could eventually cause a sharp rally in NKE, just not right now.

More By This Author:

Nvidia Regains Its Lost Glory - Should You Buy On The Dip And Hold?

FedEx Vs UPS: Which Delivery Services Stock Is The Better Buy The Dip Target?

Is Coinbase Stock Poised For Higher Highs?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more