Welcome To The “Pre-Taper” Tantrum

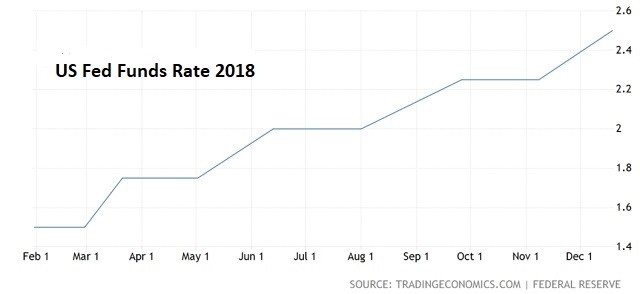

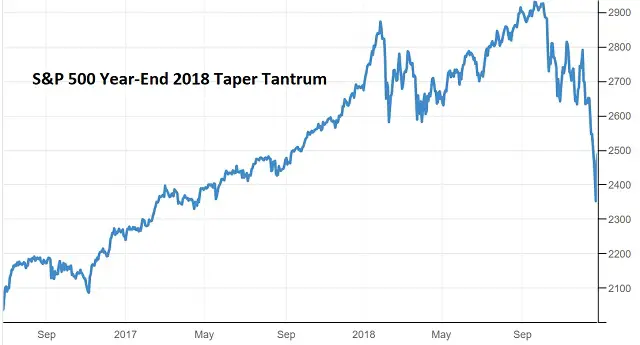

Back in 2018, the Fed tried to moderate its post-Great Recession emergency policy of low-interest rates and torrential money printing. It reduced (or tapered) its asset purchases and, in a series of tiny steps, boosted short-term interest rates by about one percentage point.

And the financial markets, by then addicted to easy money, threw what came to be known as a taper tantrum.

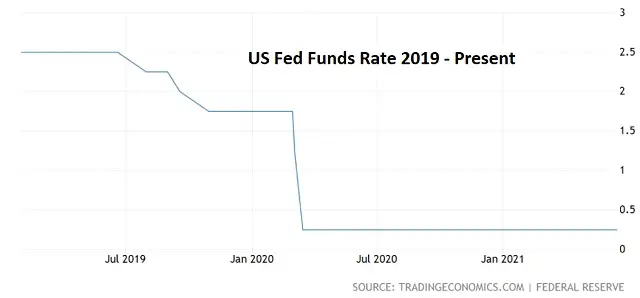

The Fed immediately backed off and started lowering rates, culminating with a plunge to zero when the pandemic hit.

But those simpler times — when the Fed actually had to raise rates to elicit a backlash from the financial markets — are apparently over. Today, all it takes to panic “investors” is a few sentences about maybe possibly tightening just a smidge at some indeterminate date in the future.

Last week, for instance, the Fed directed its trail balloon specialist, James Bullard, to find out what the markets think of slightly less money printing in late 2022. Here’s how MarketWatch covered his comments:

Bullard says he expects first rate hike late next year

St. Louis Federal Reserve President James Bullard said Friday he expects the central bank to raise its benchmark interest rate in 2022 given his forecast for above-target inflation.

In an interview on CNBC, Bullard said it was “natural” for the Fed to tilt hawkish at its meeting earlier this week given recent strong inflation readings.

Bullard said the Fed was surprised how strong the economy has been this year. Last December, the central bankers forecast a 4% GDP growth rate this year. Earlier this week, they raised their estimate to 7%. They upped their core PCE inflation forecast to 3% from 1.8% in December.

“We were expecting a good year, but this is a bigger year than we were expecting, more inflation than we were expecting. And I think it’s natural that we’ve tilted a little bit more hawkish here to contain inflationary pressures,” Bullard said.

The Fed is buying $80 billion of Treasurys and $40 billion of mortgage-backed securities, along with keeping interest rates close to zero, to support the economy.

Bullard said he expected “in-depth discussions” of slowing the asset purchases would start now that Fed Chairman Jerome Powell had opened the door for the debate. It may take “several meetings” for the Fed to “get organized,” he added. The Fed meets every six weeks. The next meeting is in late July.

Bullard said he was “leaning” toward supporting an end to the purchases of mortgage backed securities given the “booming housing market” and talk about a bubble in the sector.

“I would be a little concerned about feeding into the housing froth that seems to be developing,” Bullard said.

“I’m leaning a little bit toward the idea that maybe we don’t need to be in mortgage-backed securities,” he said.

The Fed holdings of mortgage-backed securities have risen almost $1 trillion since last March, according to economists at Jefferies.

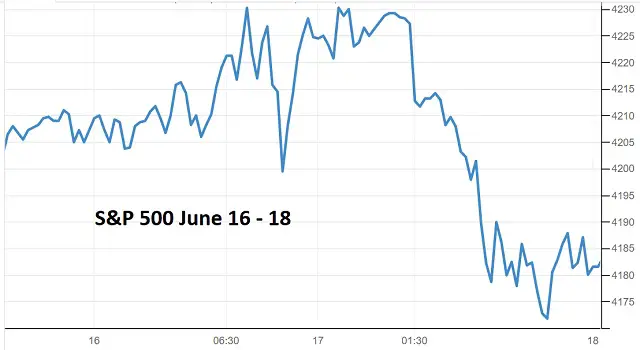

To summarize, the Fed might stop buying mortgage-backed securities twelve or so months hence – in the face of 7% growth and 5% inflation in the here-and-now. To which stocks responded with what can only be described as a pre-taper tantrum.

The Fed got the message and immediately walked back Bullard’s speculations, promising instead to — get this — demand something more than just high inflation before it starts tightening.

And so we’ve arrived at that long-awaited monetary policy endpoint where it becomes clear that the government will never be able to tighten monetary or fiscal policy. Never ever. The plane is now officially on autopilot, heading straight for an inflationary mountain with no ability to steer over or around it.

Let’s finish with Peter Schiff’s explanation of how the markets “called Bullard’s bluff” – and how ridiculous it is for the Fed to claim to know what will happen a hear hence: