Weekly Portfolio Update - Monday, February 26

Last week the Fed said some hawkish things…and stock prices spiked. Counterintuitive? Indeed.

Something else is clearly going on, and that thing is artificial intelligence. In just the past couple of years, computer systems have begun to do things that seem eerily superhuman, and pretty much every major business is now racing to incorporate those abilities. The processing chips that make AI possible are in unprecedented demand and the companies that produce them are soaring like late-1990s dot-coms, led by the OG of this space, Nvidia, which has added a breathtaking $1 trillion in new market cap in just a few months.

(Click on image to enlarge)

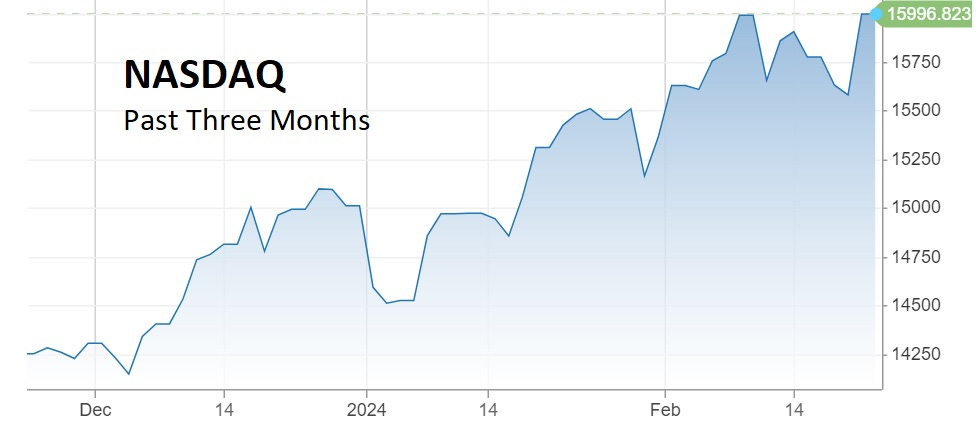

The NASDAQ exchange, where most Big Tech companies trade, is being levitated by Nvidia and a handful of other AI stocks, and is now at an all-time high:

(Click on image to enlarge)

So it’s official. We’re back in a tech stock bubble, with all that that implies for near-term volatility and an eventual crash. Buckle up.

More By This Author:

Inequality In 9 Charts And One Amusing ImageMainstream Money Tiptoes Into Gold Miners

It’s Not About Inflation: We Want To Know If We Can Afford To Live