Wedge Salad

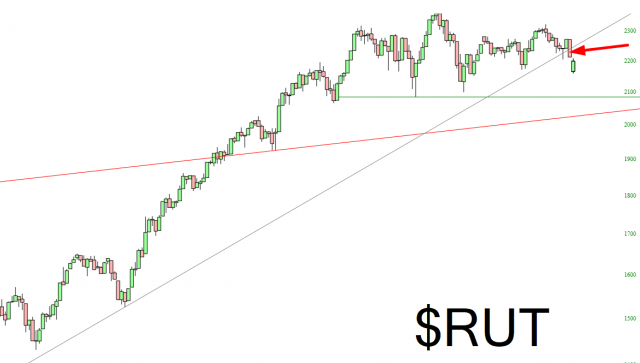

From a charting perspective, the market has become vastly more interesting in just the past few trading days. As I mentioned last week, we finally had a failure of the March 2020 trendline. I think that, in the weeks ahead, the small caps is going to remain the most interesting sector to short.

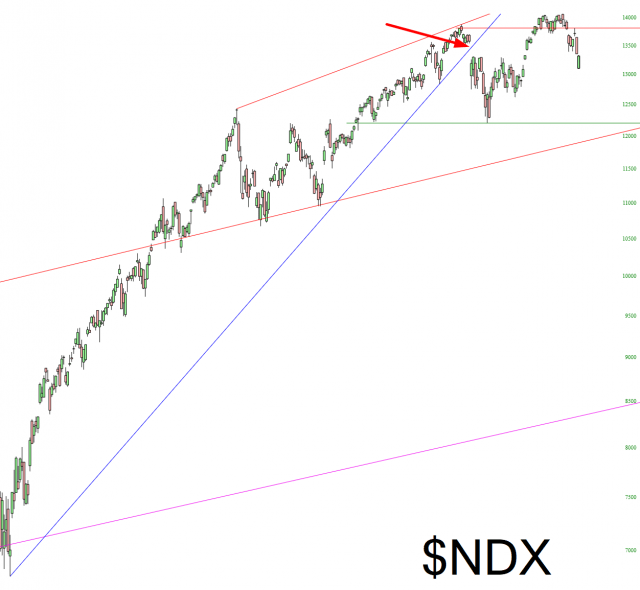

The tech stocks actually broke their March 20202 trendline months ago, and they did a cutesy little fake-out by making new highs earlier this month. Now we’re starting to weaken again, although I don’t think the pattern is nearly as clean as the Russell 2000.

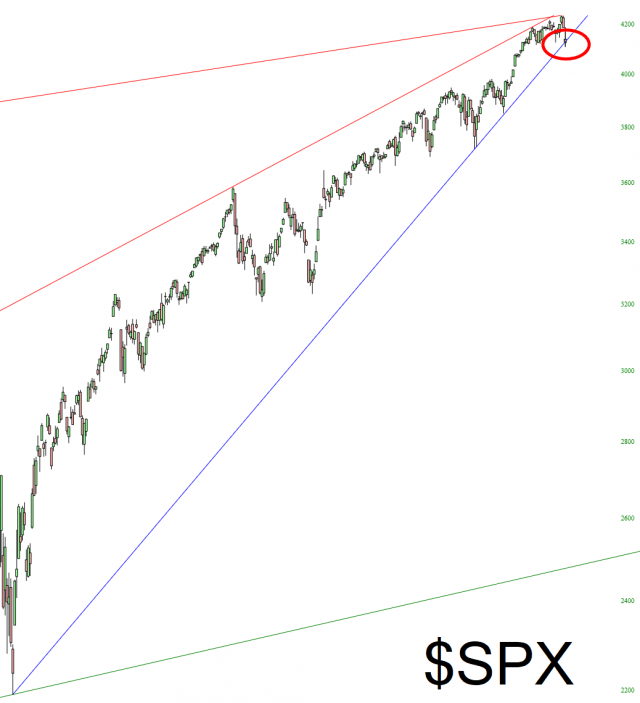

The one the world is watching, however, is the S&P 500, which at this very moment is holding on for dear life. The Federal Reserve is frantically trying to keep propping up this fraud, and we’re on a razor’s edge at this moment. Hopefully Powell will fail and justice will at last prevail. I’m a simple man, and all I really desire is the utter financial collapse of the United States of America. That, plus a hot chai latte.

Nice chart. I enjoy a good salad!