"We Took Out The June 2007 Highs": Morgan Stanley's Sell Signal Just Hit An All Time High

For the past several months, Morgan Stanley's fundamental analysts have been turning increasingly bearish on stocks, with the pessimistic sentiment plateauing earlier this week when chief equity strategist Michael Wilson said that there is far too much optimism in the market, and that while earnings are slowly rising, forward PE multiples are far too high and are set to slide, with "the de-rating about 75% to go or an approximate 15% decline in P/Es from here." As a result, in Wilson's view - which is rapidly emerging as the most bearish on Wall Street - "earnings revisions will not be able to offset that de-rating, leaving the overall market vulnerable to a 10-15 % correction over the next 6 months."

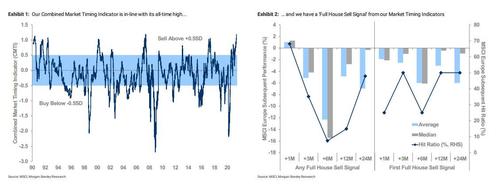

It now appears that Morgan Stanley's fundamental bearishness has spilled over into the bank's technical analyst team and as the bank's chief Euro equity Strategist Matthew Garman writes, for only the fifth time in over 30 years, each of Morgan Stanley's five market timing indicators are giving a sell signal at the same time.

Not only that, but the bank's Combined Market Timing Indicator - which has been in sell territory since March - just hit a new all time high of 1.19, surpassing the previous record high seen in June 2007, right around the time of the first great quant crash and before the market collapsed.

According to Garman, the only time equities have risen after a "Full House" Sell Signal was in February 2017, shortly after the Shanghai Accord kicked in to prevent a global recession. The other previous occasions where there was a "Full House" Sell Signal were March 1990, May 1992, June 2007. According to MS, "in the 6M post the initial Full House Sell Signal, MSCI Europe has fallen on average 6%."

So with every in house risk indicator screaming sell, does that mean that Morgan Stanley will have the guts to tell its clients to sell? Why of course not, because in this market where stuff like the AMC, GameStop and Bed Bath & Beyond squeezes force analysts to admit they no longer have any idea what's going on.

Morgan Stanley is keeping the hope and assuming that the current period will be similar to 2017 - the only other time when a massive sell signal did not result in a market plunge.

Back in 2017, we remained constructive despite the signal given i) strong EPS growth, ii) an early cycle environment, iii) EU inflows, iv) low sentiment and v) a rise in M&A. Sentiment metrics may look more elevated than in 2017, but many of those factors remain in place today. While we see a trickier risk-reward for equities globally, we maintain our view that there is a compelling case for Europe to outperform global peers.

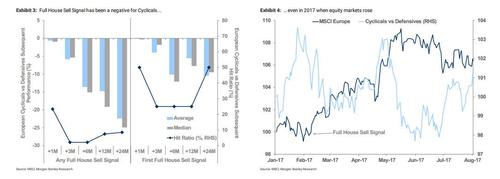

Yet even Morgan Stanley is forced to admit that while Defensives may just scrape by after a record sell signal, cyclicals are about to be hammered. The next chart shows the relative performance of Cyclicals versus Defensives after a Full House Sell Signal on. As MS notes, "perhaps unsurprisingly, given the poor performance at the market level, Cyclicals have struggled. In the 6M post the four initial Full House Sell Signals, Cyclicals have underperformed Defensives on average 12%, and this drops to -15% looking at any day when the MTIs have all said sell at the same time."

This was true even in 2017 when equity markets rose: "we previously cited similarities with the 2017 Full House Sell Signal as reasons to not get overly cautious on equity markets in aggregate at this moment in time. After the February-2017 Full House Sell Signal, MSCI Europe continued to rise pretty consistently through the rest of the year. However, despite strong performance from the market in aggregate, the performance of Cyclicals versus Defensives was much poorer. Between February and June 2017 Cyclicals underperformed Defensives by 6%."

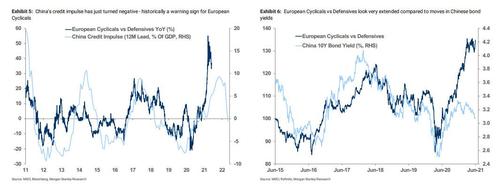

It's not just the bank's sell signal that is prompting concerns about the future returns of cyclicals: Borrowing a page from our own warnings (see "China's Credit Impulse Just Turned Negative, Unleashing Global Deflationary Shockwave"), Morgan Stanley looks at "a number of China data points which are giving warning signs" first and foremost the collapse in China's credit impulse, to wit:

While credit tightening has been front-loaded in 1H21, as outlined here, our economists remain constructive on China's growth recovery. Having said that, a number of Chinese data points do suggest the Cyclical bounce looks overextended. China's credit impulse has just turned negative, and historically this has provided a lead indicator for the year-on-year performance of European Cyclicals (Exhibit 5). Similarly, the relative performance of Cyclicals versus Defensives has closely tracked moves in Chinese 10Y bond yields, which are now at their lowest levels since September 2020, standing in sharp contrast to the performance of Cyclicals.

Putting it all together, readers have to ask themselves if what is coming will be an analog of the one and only episode on history when the market did not plunge after all Morgan Stanley market timing indicators hit a sell (and were at an all time high), or will this case be similar to March 1990, May 1992, and June 2007 when the outcome was anything but a happy ending.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more