Waste Management: An All-Weather Stock For This Resilient Market

Image Source: Pexels

Stocks have been impressively resilient. The market handled the recent Iran news like a trooper. Meanwhile, Waste Management Inc. (WM) is a “garbage king” that’s been delivering as advertised so far, notes Tom Hutchinson, editor of Cabot Dividend Investor.

It seems like the default position of investors is optimism. Stocks seem to want to go higher. The market made up the tariff panic in short order. Rates have remained stubbornly high. The news from the Middle East is wild. Yet stocks have been within bad-breath distance of all-time highs.

I believe these issues will turn out alright and the market will be higher than it is now by the end of the year. But it’s hard to see how stocks generate lasting upside traction until there is more clarity on the current issues. And that could take many months.

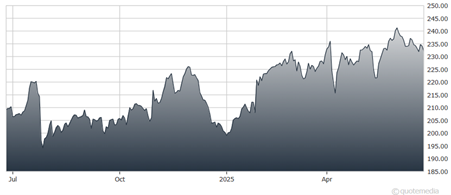

Waste Management Inc. (WM) Chart

Meanwhile, Waste Management faced a huge defensive test shortly after being added to the portfolio -- and it passed. Waste Management fell sharply but then gained back all the losses.

The stock was later under some pressure while many other stocks soared amid the improved tariff news and the “risk-on” mood. But Waste Management regained its footing and recently made a new high before pulling back somewhat in June. The stock should continue to be solid in just about any kind of market.

My recommended action would be to consider purchasing shares of Waste Management.

About the Author

Tom Hutchinson is a Wall Street veteran with experience in stock trading, mortgage banking, and commodity trading. Specializing in income investing, he has served in a financial advisory capacity for several of the nation's largest investment banks.

For more than a decade, Mr. Hutchinson created and actively managed investment portfolios for private investors, corporate clients, pension plans, and 401(k)s. He has a long track record of successfully building wealth and producing a high income for clients, while maintaining and growing principal.

More By This Author:

SPX: Why A Big Move May Be Setting Up – And Which Key Sector To Watch

Microsoft: Yes, Its AI Investments Will Pay Off... Handsomely

ALB: A Screaming Bargain In The Lithium Space

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more