Warren Buffett Would Like A Word With You

Warren Buffett is arguably the greatest investor of all time.

Unlike many of the super wealthy that existed before him (Rockefeller, Morgan, Vanderbilt, Dupont) Buffett wasn’t an entrepreneur who built an oil, steel, banking, or railroad empire. Instead, Buffett was an investor, who allocated capital in such a way that his holding company Berkshire Hathaway, grew to be one of the 10 largest companies on the S&P 500.

Buffett himself grew to be worth over $100 billion in the process.

Put simply, this is a man who got unbelievably rich from the markets. So when Warren Buffet speaks on the subject of stocks, it’s a good idea to listen.

One of Buffett’s best-known quotes concerning the markets is that “trannies don’t lie,” meaning that the Dow Jones Transportation Index, which is comprised of companies associated with transportation in the real economy is one of the most accurate economic bellwethers out there.

Put simply, whatever the Dow Jones Transportation Index does, is a solid indicator of what’s happening in the economy.

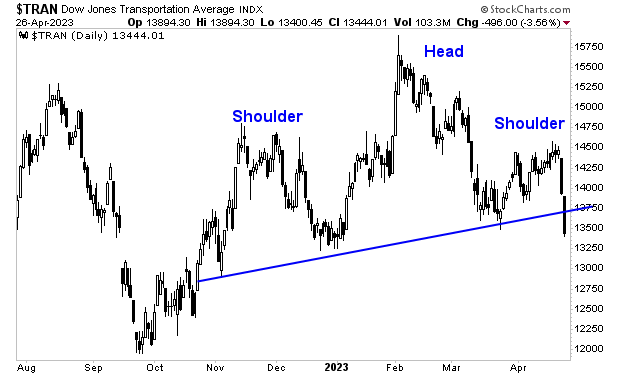

I mention this because the Transportation index has just broken down from a clear Head and Shoulders topping pattern. This suggests the economy is rolling over in a significant manner.

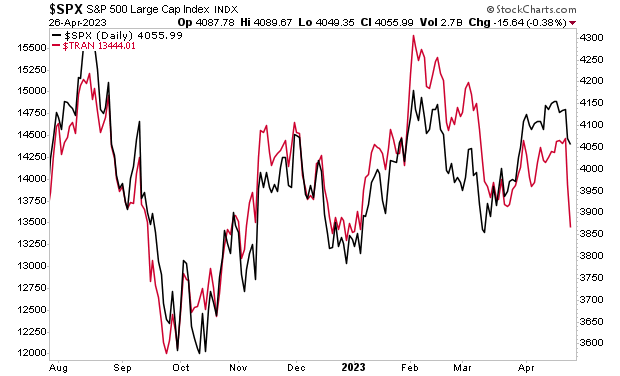

Now take a look at the Transportation index (red line) overlaid with the broader market as represented by the S&P 500 (black line) in the chart below. The implication concerning the economy is clear. But the S&P 500 has yet to “get it.”

Indeed, in the Big Picture, my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008, and today.

More By This Author:

The Clock Is Ticking On This $20 Trillion Debt BombWhy Stocks Are On Borrowed Time

The Bond Market Fears Something Worse Than Inflation Is Coming