Warren Buffett Stocks: The Bank Of New York Mellon Corporation

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth over $360 billion, as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned just over 72 million shares of the Bank of New York Mellon Corporation (BK) for a market value of nearly $3.6 billion. BNY Mellon represents about 1% of Berkshire Hathaway’s investment portfolio. This makes it the 13th largest public stock position in the portfolio, out of 49 stocks.

This article will analyze the financial services company in greater detail.

Business Overview

The Bank of New York Mellon Corporation is a global financial services institution that specializes in asset management, custodial services, and wealth management.

As of March 31st, 2022, BNY Mellon had $4.5 trillion in assets under custody and administration and $2.3 trillion in assets under management.

The company generates nearly $17 billion in annual revenue. The bank is present in 35 countries around the world and acts as more of an investment manager than a traditional bank. BNY Mellon’s revenue is mostly derived from fees, not traditional interest income.

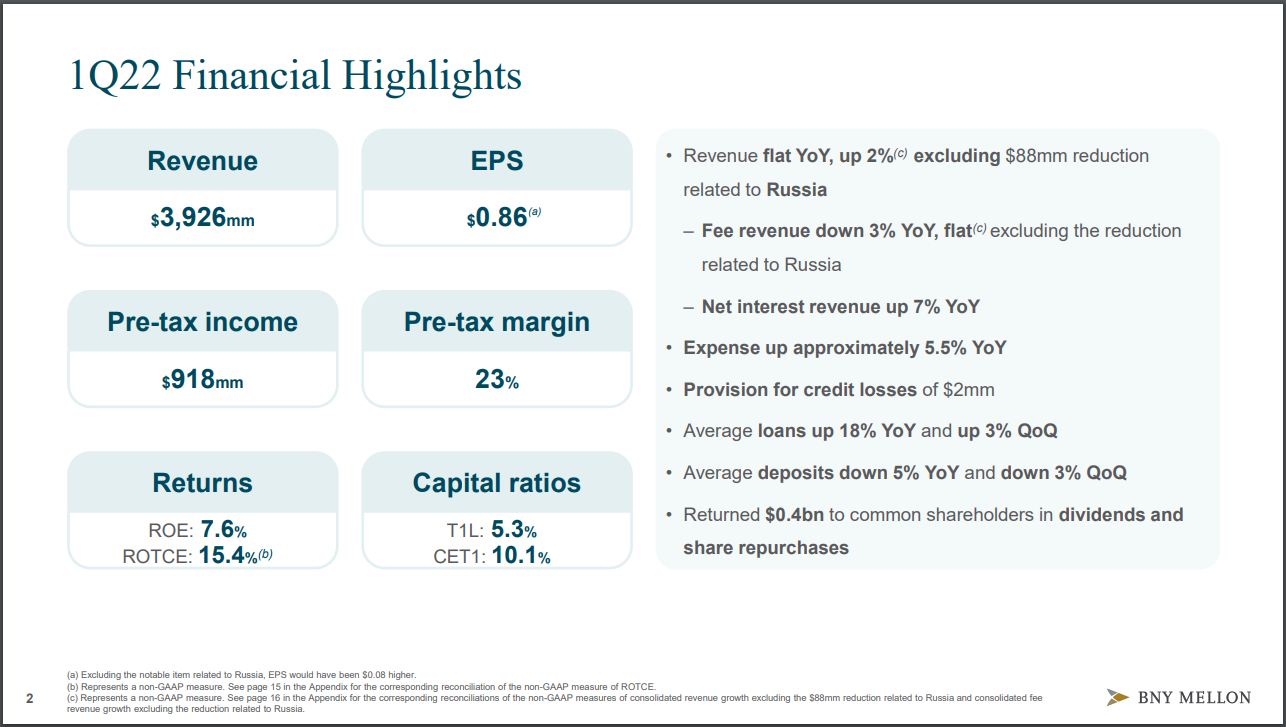

BNY Mellon reported first-quarter results on April 18th, 2022. Earnings-per-share came to $0.86 cents, a penny higher than estimates. Revenue was up 2% year-over-year (when excluding a reduction related to Russia) to $3.93 billion. In the quarter, fee revenue made up 80% of total revenue.

Source: Investor Presentation

Average assets under custody grew by 9% year-over-year to $45.5 trillion, and assets under management rose 2% to $2.3 trillion. The bank also posted a $2 million provision for credit losses, which was a steep decline from the net benefit of $83 million in the year-ago period. Large COVID-related provisions were being unwound in Q1 2021, so this year’s Q1 is more indicative of a normalized result.

BNY Mellon continues to be well-capitalized, as evidenced by its common equity tier 1 ratio of 10.1%, and a tier 1 leverage ratio of 5.3%.

Growth Prospects

Since 2013, BNY Mellon has improved its efficiency, leading to stronger margins which will allow them to capitalize on revenue increases. We are forecasting 4% earnings-per-share growth annually moving forward.

BNY Mellon can realize earnings growth in various ways. Revenue should continue to grow over time under normalized conditions. Its assets under custody and administration should continue to grow as well, especially during strong equity markets, which is a main driver of fee income.

Its lending business is small but growing and continues to add to top line growth as well, 2020 withstanding. We note that issues with assets under management and lending margins tend to move in cycles, so BNY Mellon should catch a break from its headwinds over time.

We also see the bank continuing its share repurchases over time, resulting in a meaningful tailwind for earnings-per-share outside of revenue and company-wide earnings growth.

Competitive Advantages & Recession Performance

BNY Mellon’s competitive advantage is in its lack of reliance upon lending for revenue. This permits it to perform relatively well during recessions while other banks are likely struggling.

While the company is not immune to downturns, its fee model is more resilient to such conditions than a bank that makes the bulk of its revenue from interest income. When many banks suffered in 2020, BNY Mellon saw essentially flat earnings year-over-year.

As of the most recent report, the company held $6.1 billion in cash and due from banks, and $473.8 billion in total assets against $431.7 billion in total liabilities. Long-term debt stood at $25.2 billion as of March 31st, 2022.

BNY Mellon is forecasted to pay out only 30% of its earnings in fiscal 2022. This payout is considered to be very safe, and we expect it to continue growing in the mid-single digits annually in the years to come. So far, the company has increased the dividend for eleven consecutive years.

Valuation & Expected Returns

In the 2012 through 2021 stretch, shares of The Bank of New York Mellon Corp. traded with an average price-to-earnings multiple between 9- and 17-times earnings. Shares are now trading at the lower end of their historical average range, at 9.2 times earnings. As a result, we believe there is a potential for a valuation tailwind in the intermediate-term.

Our fair value estimate for BNY Mellon stock is 12.0 times earnings. If the stock inches up to meet this P/E multiple, it would increase annual returns by 5.4% per year through 2027.

Shares of BNY Mellon currently yield 3.2%, which is high compared to the average yield over the last ten years of sub-3.0%. On both a price-to-earnings and dividend yield basis, BNY Mellon appears to be undervalued.

Additionally, we expect 4% annual EPS growth over the next five years. Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 12.1% per year over the next five years. This makes The Bank of New York Mellon Corp a buy.

Final Thoughts

The Bank of New York Mellon Corp appears to be a fairly undervalued stock today, both on a price-to-earnings and a dividend yield basis. Additionally, we expect moderate earnings growth in the years ahead. The company’s dividend yield is also elevated historically at 3.2% today and is double what the broad market S&P 500 index is offering.

Given all this, BNY Mellon offers good total return prospects in the intermediate-term. Of note, Berkshire Hathaway has not added to their BK position since 2018, and they last reduced their position in mid-2020.