Warren Buffett Stocks: StoneCo Ltd.

Berkshire Hathaway (BRK-B) has an equity investment portfolio that was valued at more than $360 billion as of the end of March 2022. That makes Warren Buffett’s company one of the larger asset managers in the world, and in particular, out of managers that invest their own capital. Given this, as well as Buffett’s legendary investing success, the moves the company makes with its portfolio are closely watched by investors.

Berkshire Hathaway’s portfolio is filled with quality stocks that the company holds for the very long-term, typically. Investors can see the moves the company has made each quarter as Berkshire is required to file a 13F. That is a form where a company must list the size of its positions in each stock it owns. Investors, therefore, can see what Berkshire is buying or selling in near real-time.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Berkshire owned almost 11 million shares of StoneCo. (STNE), for a market value of about $88 million. This is a very small position for a massive investor like Berkshire, and indeed, it comprises less than one tenth of one percent of the company’s total equity portfolio. However, it does amount to a more than 3% stake in the software company.

In this article, we’ll take a look at StoneCo’s business in detail, analyzing its prospects as an investment.

Business Overview

StoneCo is a financial technology company that helps customers conduct their businesses in-store, online, and on mobile channels in Brazil. The company’s primary product is Stone Hubs, which offers local sales and services, as well as technology and solutions to digital merchants. The company has about 1.9 million customers in its payments business. StoneCo was founded in 2000, produces about $1.7 billion in annual revenue, and trades for a market cap of $2.8 billion.

StoneCo’s Q1 earnings showed massive improvements in revenue and profitability, as the company has become accustomed to in recent years. Revenue was up 134% year-over-year in Q1, and adjusted EBITDA soared by 117%. EBITDA margin rose on efficiency gains from the cost of services and administrative expenses, which were leveraged down with the sharply higher top line.

Total payment volume was down slightly from Q4, but year-over-year, was up 63%. Net additions of small and medium businesses was 160,100 in Q1, down from 377,700 in Q4, but up from 134,800 in the year-ago period.

Management also provided bullish guidance for the second quarter, with revenue, payment volume, and adjusted earnings before taxes up from Q1 levels. Revenue is forecast to be $450 million to $460 million in Q2, up ~150% year-over-year.

Growth Prospects

We see growth prospects as outstanding for StoneCo in the coming years. The company has averaged 50% annual revenue growth since 2017, and while that growth has been somewhat lumpy, its sheer ability to move revenue higher has been extraordinary.

As the company continues to add new merchants, its ecosystem of products and revenue streams become more and more lucrative. Earnings are down for this year, but we see earnings power of 60 cents per share annually, as opposed to estimates of just 30 cents for 2022. On that base of 60 cents in earnings power, we believe 5% earnings growth is achievable.

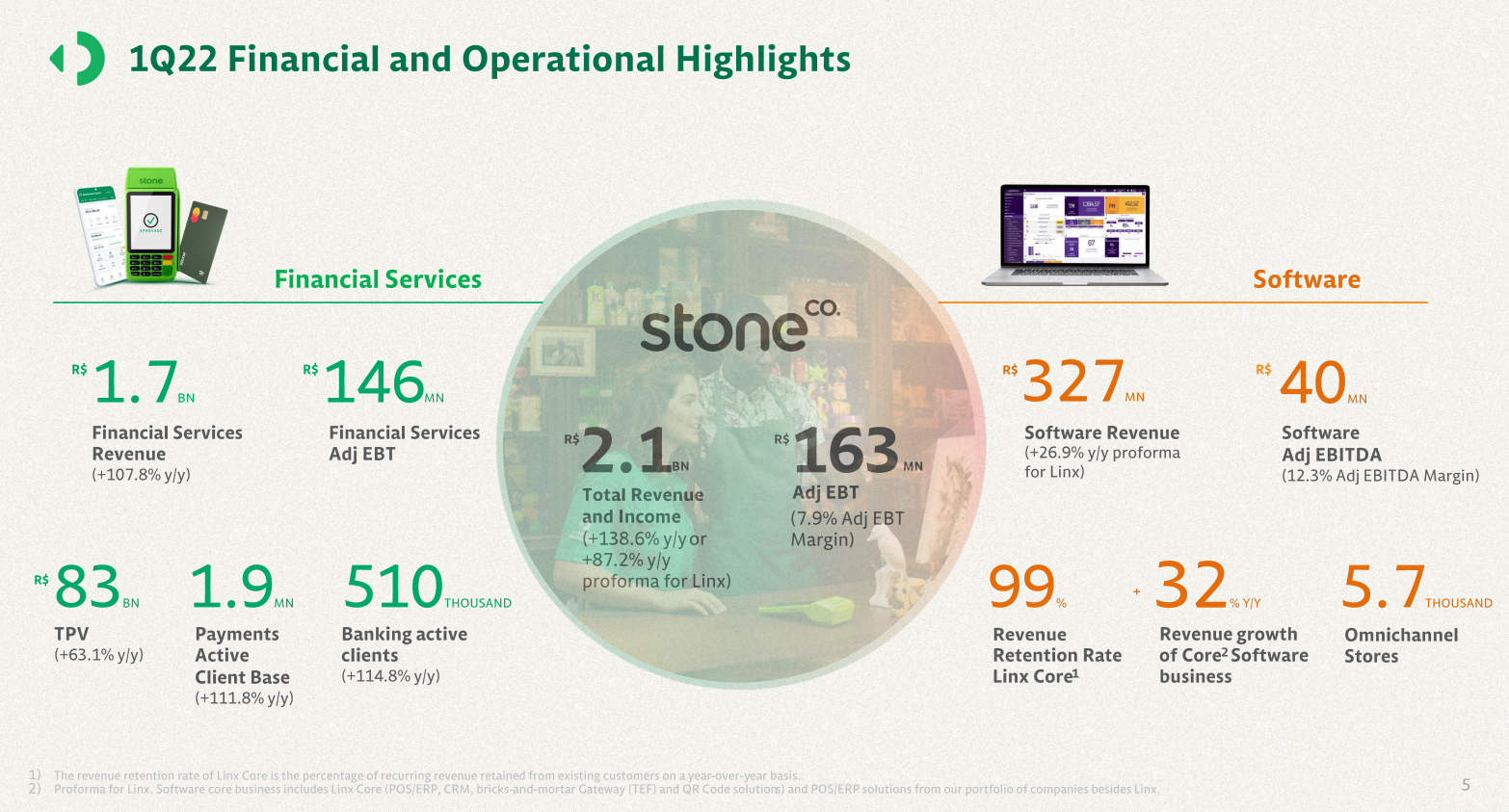

Source: Investor presentation, page 5

This slide highlights some of the ways StoneCo has been growing, and will continue to grow in the years to come. The company has several levers is can pull for revenue and earnings expansion, including growing its payments customer base, its banking customer base, and its software customers. StoneCo is positioning itself as a fintech leader in Brazil, particularly for small merchants and medium-sized businesses, and we think the future is bright.

We do note that volatility in earnings and revenue is likely to be high given StoneCo’s relatively small size, as well as its reliance upon Brazil, which is a large but somewhat undeveloped economy. Currency rates tend to fluctuate rapidly in Brazil, and economic cycles tend to be much sharper than in the US, for instance. Still, we see StoneCo’s ability to grow as very strong despite these factors.

Competitive Advantages & Recession Performance

StoneCo’s competitive advantage is in its focus on the unique needs of Brazilian merchants; the company has found a niche it can exploit to the fullest with great products and services. It does face competitive threats and always will, given there will always been heavy need for fintech services among small businesses, and that there will always be numerous entrants to take share in this lucrative market. However, StoneCo has proven in recent years to be able to grow at rapid rates even with these factors, which we think will abate somewhat as StoneCo continues to grow.

Recession resistance, unfortunately, is likely to be poor. StoneCo will suffer with declining revenue and earnings during a recession given it is extremely leveraged to economic growth through its customers. In addition, Brazil’s economic growth and contraction tends to be quick and sharp, so recessions are likely to be tougher than in more developed countries that aren’t as reliant upon commodities. We see this as one potential detractor from the bull case for StoneCo and something we believe investors should carefully consider.

Valuation & Expected Returns

Valuing the stock is somewhat tricky given we believe earnings are in a trough this year. We’ll use earnings power of 60 cents per share to value the stock. Shares trade for just 13 times that value today, which is a fraction of its historical valuations. The stock has traded for between 20 times and 100 times forward earnings, with the average just below 50 times. We are conservatively assessing fair value at 22 times earnings, and even so, expect to see a low-double digit tailwind to total returns from the valuation in the years to come.

StoneCo doesn’t pay a dividend, so when we combine expected earnings growth and the valuation tailwind, we expect 20% total annual returns in the years to come.

Final Thoughts

StoneCo is not a stock for everyone, given it is quite volatile, has direct exposure to a developing economy with a volatile currency, and is vulnerable to recessions. However, the stock is priced quite cheaply against its historical norms, and we see StoneCo’s ability to continue to grow revenue by leaps and bounds as fueling the share price in the years to come. The stock does not pay a dividend, so income investors should look elsewhere, but for those seeking capital gains, StoneCo is a speculative buy.

I have debunked this "let's get Warren on the bus with us" crap a few times but I will do it on more time:

About 4 years ago, WB and CM sat in still one more bi-weekly meeting with their 2 firebrands. The agenda was always the same. What in the hell are we going with this $100 billion or so of idle cash? Almost Hollywood, the pitch on an outlier. So the old dudes heard it and said, hell, throw $300 or $400 million at it. What's next?

So they bought about 15 mlllion shares at roughly $25. They sold about 4 million shares in the hood of $50 and got $100 million back. The 11 million or so shares left are pocket lint to the Brk portfolio.