Warren Buffett Stocks: RH

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion, as of the end of the first quarter of 2022, making it one of the largest investors in the world.

Berkshire Hathaway’s portfolio is filled with high-quality stocks, and generally ones that pay dividends. However, in recent years, Buffett has proven willing to go outside the typical list of companies for Berkshire to buy. Indeed, the company now owns some hyper-growth names, and ones that aren’t yet profitable.

You can learn from Warren Buffett’s stock picks to find ones for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Berkshire owned almost 2.2 million shares of RH (RH), for a market value exceeding $600 million. That makes Berkshire a sizable owner of RH at almost 9% of the company’s float, although the position is just 0.2% of the company’s total equity investment portfolio.

In this article, we’ll examine the business of RH, as well as its future growth prospects and expected total returns.

Business Overview

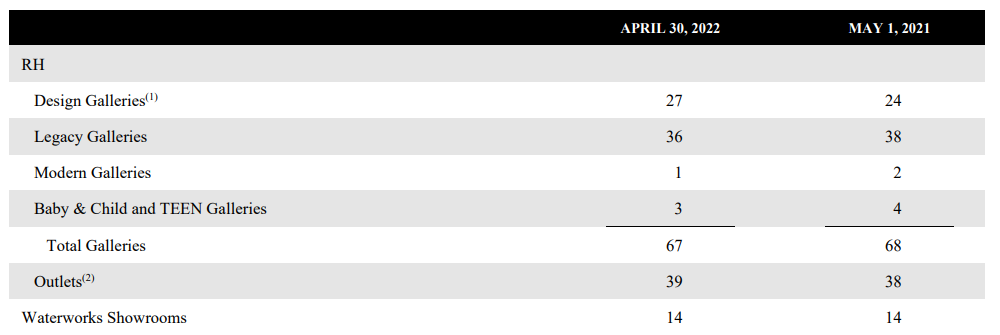

RH is a retailer in the home furnishings sector, that operates primarily in the US. The company sells furniture, lighting, rugs, bathware, home décor, outdoor and garden, and more through its retail stores, Source Books, and its digital properties. The company has 67 Galleries, which are large-format stores, 39 outlet stores, which are smaller-format, and 14 Waterworks showrooms, which are bath and kitchen stores. RH’s stores can be found in the US, Canada, and the UK.

Source: Q1 earnings release

RH was founded in 2011, generates about $3.6 billion in annual revenue, and trades today with a market cap of $6.9 billion. RH has never paid a dividend to shareholders.

RH reported first quarter earnings on June 2nd, 2022, and while the company beat expectations on both revenue and profit by wide margins, shares fell on guidance. Total revenue was up 11% year-over-year to $957 million, while adjusted earnings-per-share soared 59% to $7.78. Revenue was $33 million ahead of estimates, while earnings were a staggering $2.42 ahead of expectations.

Adjusted gross margins were up 480 basis points year-over-year to 52.1%, providing much of the fuel for the earnings beat. Product margins were up 390 basis points, as the company resisted the need to promote to move product. The company noted that while its competitors are promoting and it could lose share as a result, given its status as a luxury brand, RH is willing to cede share temporarily to preserve the brand and long-term pricing power.

Adjusted operating margin rose 210 basis points to 24.7% of revenue. On a dollar basis, adjusted earnings were up 50% to $213 million, with the difference to the per-share gain of 59% being share repurchases.

RH noted first quarter revenue was a record for the company, and up 98% against the same period in 2020.

RH also noted that SG&A costs are temporarily higher for the first three quarters of this year, as it returns to mailing Source Books after a hiatus, and as its newer stores are opened and begin generating revenue. The company noted elevated SG&A costs in Q1, and forecasts for the same for quarters two and three. This hurts profit margins, but the company said it should pass.

Free cash flow in Q1 was $107 million, and the company ended the quarter with $166 million in net debt, with $2.24 billion in cash on the balance sheet. During the quarter, RH spent $481 million to repurchase $180 million in outstanding convertible notes, terminate all of the 3.4 million outstanding warrants, and unwind remaining bond hedges. RH has $101 million in convertible notes outstanding now as it seeks to reduce potential dilution of shareholders down the road.

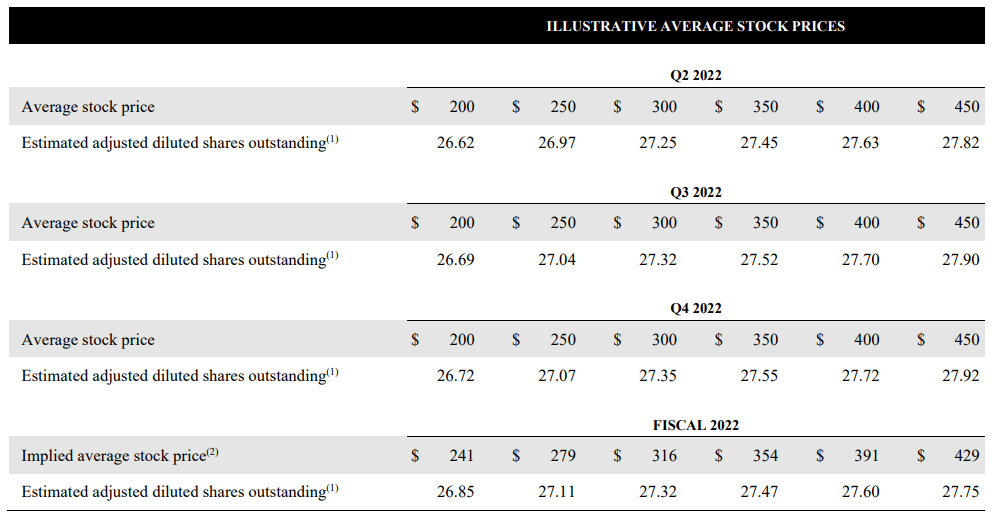

Source: Q1 earnings release

This table shows the potential impact to the share count should the company not repurchase remaining outstanding convertible notes and warrants. As the share price rises, RH is liable for converting debt and warrants to common shares outstanding, which would dilute shareholders. This is why it’s using cash to eliminate these before they are exercised.

Subsequent to Q1 results, the company fairly quickly reduced guidance for this year. It now expects to see revenue growth of 0% to 2% this year, and adjusted operating margin of 23% to 24%. However, management also said these headwinds should be temporary as demand resets from a blockbuster run in the past two years.

We expect to see $23.25 in earnings-per-share for this fiscal year after the guidance update.

Growth Prospects

RH’s growth in the past has been nothing short of exemplary, but also extremely volatile. The company posted its first profit as a publicly-traded company in 2014, with a gain of 45 cents per share. However, earnings deteriorated into an annual loss by 2018, before soaring to $22.13 in fiscal 2022, and expectations for a similar value this year. Obviously, this sort of growth is unsustainable, but we do see a bright future for RH nonetheless.

We see earnings growth as muted this year given the guidance update, and the challenges around the fact that earnings more than doubled from 2020 to 2021. However, going forward we estimate 6% annual earnings-per-share growth.

We believe revenue can sustainably grow in the low- to mid-single digits annually. In addition, the company continues to make profitability improvements by trimming unprofitable product lines and maintaining its pricing power.

We also see the company’s enormous share repurchase program as fueling gains to earnings-per-share via a lower float. The company had $2.45 billion in share repurchases authorized at the end of the fiscal first quarter, against a current market cap of under $7 billion. Should those repurchases come to fruition, it would be a huge tailwind to earnings-per-share in the years to come.

Competitive Advantages & Recession Performance

RH’s competitive advantage is certainly in its brand name recognition as a luxury retailer, driven by its outstanding leading edge design team. RH has made a name for itself in the past decade as a premiere luxury home furnishings provider, and it shows with its world-beating profit margins. RH’s model is designed around its stores that are intended to be immersive shopping experiences, unlike warehouse-style furniture stores.

However, given RH is – at the end of the day – a furniture and home goods retailer, it is highly susceptible to recessions. RH serves high-end consumers so it is marginally insulated from consumer spending declines, but it’s still quite vulnerable to economic slowdowns, and potential buyers of the stock should be aware of this risk.

Valuation & Expected Returns

Shares trade for just over 12 times this year’s earnings estimate, which is extremely cheap by RH’s own historical standards, and indeed, for furniture retailers in general. RH has averaged 19 times earnings-per-share in the past five years, and we assess fair value at 17 times earnings. This conservative estimate is given the current uncertainty around whether the slowdown in consumer spending will persist.

Even so, the valuation could drive a 6.5% tailwind to total returns in the coming years. RH does not pay a dividend, so the balance of returns would come from 6% projected annual earnings growth. All told we see 12%+ total annual returns, and therefore rate the stock a speculative buy.

Final Thoughts

While RH has its own set of challenges given its products are highly discretionary, we see the company as a strong grower that is very reasonably priced. RH has the potential to buy back an enormous percentage of the float in the years to come, and its advantage as a luxury goods provider means its profit margins are best-in-class. While it is susceptible to consumer spending slowdowns, the stock is priced such that we expect double-digit returns in the years to come.

More By This Author:

Blue Chip Stocks In Focus: Sonoco Products Co.Blue Chip Stocks In Focus: Williams-Sonoma, Inc.

Blue Chip Stocks In Focus: Walgreens Boots Alliance