Warren Buffett Stocks: Moody’s Corporation

Image Source: Unsplash

Berkshire Hathaway (BRK-B) has grown by leaps and bounds over the decades since famous investor Warren Buffett took it over. The company has grown to one of the largest investors in the world that invests its own capital, and as of the end of the first quarter of 2022, it boasted an equity investment portfolio worth more than $360 billion.

Berkshire Hathaway’s portfolio is filled with high-quality stocks, as one might imagine given it’s run by one of the best investors of all time. The good news is that investors can follow along with great investors like Warren Buffett because of a required filing called a 13F. This details the company’s equity positions as of the end of each quarter, so investors can learn what holdings investors have been bought or sold.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31st, 2022, Buffett’s Berkshire Hathaway owned about 25 million shares of Moody’s Corporation (MCO), for a market value approaching $7 billion. That comprises about 2% of Berkshire’s equity investments but is more than 13% of the total float for Moody’s, so it is sizable to say the least.

In this article, we’ll take a look at Moody’s in detail.

Business Overview

Moody’s is an integrated risk assessment firm that operates globally. The company has two primary segments, called Moody’s Investor Service, or MIS, and Moody’s Analytics, or MA. MIS publishes credit ratings and provides assessment services on debt obligations. These can include corporations, financial institutions, governments, and more, and operates in 140 countries.

Through this segment, Moody’s has rated thousands of borrowers for investors to be able to assess risk. MA provides a range of products and services that support the risk management activities of institutional investors, offering various research and data tools on a subscription basis.

Moody’s was founded in 1900, generates about $6 billion in annual revenue, and trades with a market cap of $51 billion.

Moody’s reported its first-quarter earnings on May 2nd, 2022, and results were largely in line with the prior-year period. Revenue was down 5% to $1.52 billion, and adjusted earnings-per-share came to $2.89, flat year-over-year. Moody’s did, however, cut guidance for the year from $11.00 in earnings-per-share to a midpoint just above $10.

Moody’s noted reduced debt issuances globally given sharply rising interest rates, which reduces fees earned for Moody’s. Revenue in analytics soared 23% to $695 million, however, helping to diversify away from debt issuance fees. We expect $10.10 in earnings-per-share for this year following the guidance cut.

Growth Prospects

Moody’s has been a strong and consistent grower for many years. In fact, in the past decade, Moody’s has grown earnings-per-share at almost 13% annually, on average. There aren’t many companies that can rival that sort of growth, and we see 10% earnings-per-share growth over the medium term.

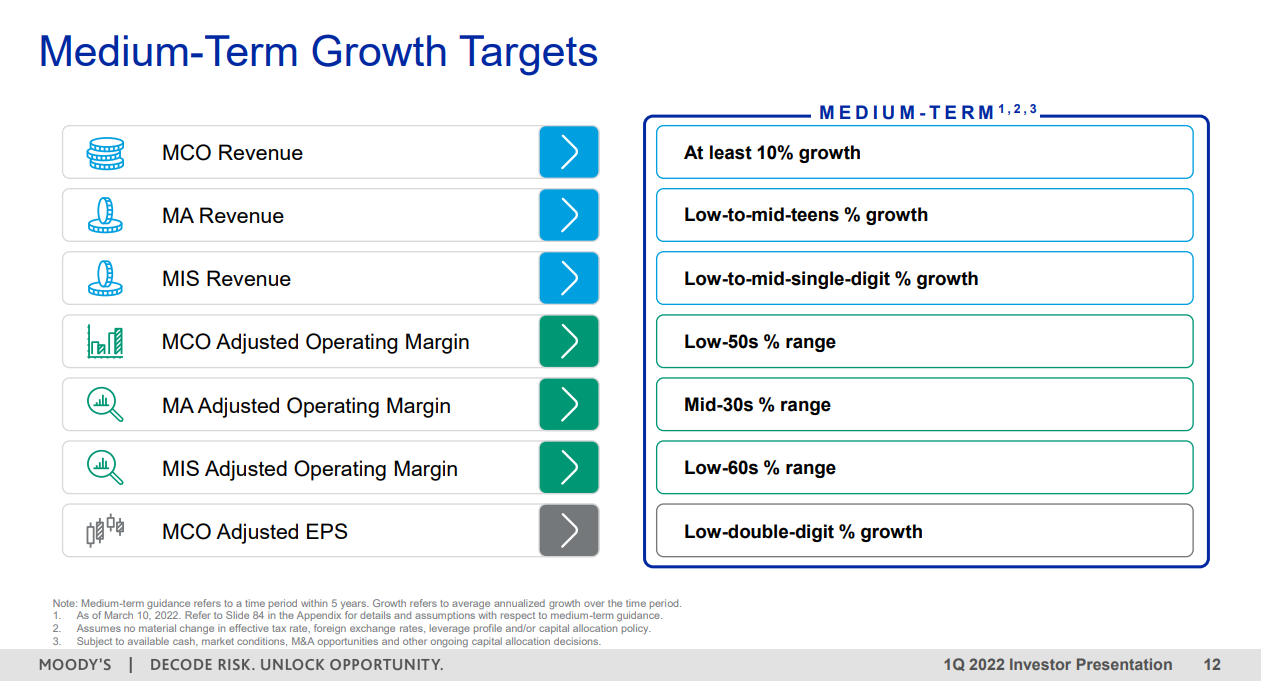

Source: Investor presentation, page 12

Moody’s provides medium-term growth targets, which we can see above. The company expects revenue to grow in the double-digits, with MA leading the way. That is the smaller of the two segments and has essentially no leverage to debt cycles, so we agree this will be the growth driver going forward. Adjusted operating margin is much higher, however, in the MIS segment, so consolidated operating margins are expected to rise to the low-50% area from the high-40s today.

The company’s low double-digit earnings-per-share growth target looks reasonable to us, as we note that not only does Moody’s have revenue and margin levers for growth, but it buys back shares as well. We see 10% growth as a base case with some potential upside, particularly if rates fall again and debt issuances pick up.

Competitive Advantages & Recession Performance

Moody’s has the distinction in its industry of having essentially created institutional analytics more than 100 years ago. That gives it tremendous brand recognition and it has a strong reputation globally for not only debt and credit ratings but analytics services as well.

Moody’s recognized years ago that data was the way forward for institutional investors and has spent billions of dollars developing products to meet that need. We believe this provides a sustainable advantage moving forward.

Recessions tend to damage earnings slightly for Moody’s because debt and credit rating demand tends to fall during those periods. That hasn’t changed, but as MA takes more share of total revenue, the reliance upon these ratings should diminish, and that should simultaneously reduce Moody’s recession vulnerability.

Valuation & Expected Returns

Moody’s has traded with some substantial earnings multiples in years past, mainly because it derives revenue from high-margin subscription services, and it has posted very strong revenue growth. This combination has led to the double-digit earnings growth annually we mentioned above, and it is why we think Moody’s will continue to receive a premium valuation.

We see fair value at 24 times forward earnings, but shares are somewhat overvalued today at 27.5 times earnings. This is partially to do with what we see as temporarily reduced earnings based on two factors. First, the base of earnings from last year was a record, and by a wide margin, making it difficult to replicate.

Second, lower debt issuances due to the surge in interest rates in 2022 should moderate going forward. Given this, we see a nearly-3% headwind to total returns from the valuation in the years to come.

The dividend yield is just 1%, so it isn’t a big source of potential returns. When we combine the yield, the headwind from the valuation, and the strong growth rate estimate of 10%, we see total returns annually of about 8% in the coming years.

Final Thoughts

Moody’s is an outstanding business that has a very bright future in front of it. The reduction in earnings for this year has caused the valuation to move higher, but we see long-term growth intact. In addition, we believe Moody’s will continue to raise its dividend by double-digit rates for the foreseeable future. While Moody’s doesn’t quite hit the total return mark for a buy rating, we see it as a very strong business at a reasonable price today and rate it a hold.