Warren Buffett Stocks: Bank Of America

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway (BRK-B) has an equity investment portfolio worth more than $360 billion as of the end of the 2022 first quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can ‘cheat’ from Warren Buffett stocks to find picks for your portfolio. That’s because Buffett (and other institutional investors) are required to periodically show their holdings in a 13F Filing.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned just over 1.01 billion shares of Bank of America (BAC) for a market value exceeding $32.6 billion. Bank of America currently constitutes over 10.8% of Berkshire Hathaway’s investment portfolio.

This article will analyze this diversified bank in greater detail.

Business Overview

Bank of America is one of the largest financial institutions in the United States, with more than $3.2 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing business lines includes its branch and deposit-gathering operations, home mortgage lending, vehicle lending, credit and debit cards, and small-business services. The company also has operations in several countries.

The company was founded in 1904, trades with a market capitalization of $260.6 billion, and should produce about $95 billion in revenue this year.

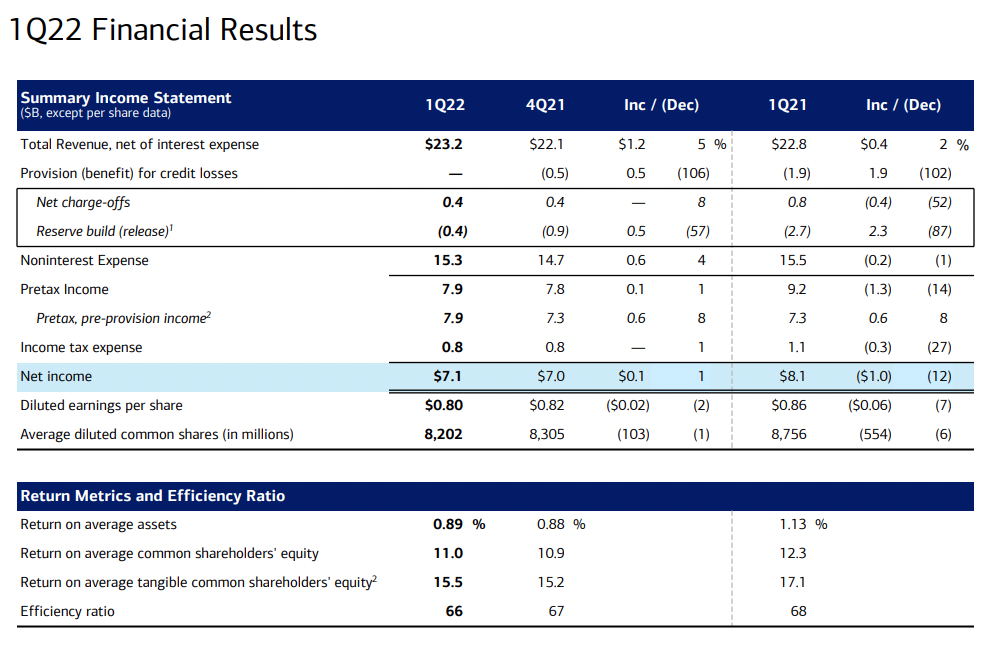

On March 31, 2022, the company reported first-quarter results for 2022. Reported results were better than what analysts expected in both revenue and earnings. Earnings-per-share (EPS) came to $0.80, five cents ahead of estimates. However, this was down 7% compared to the first quarter of 2021. Revenue grew 1.7% to $23.2 billion, which was $110 million better than expected.

Pretax income declined 14% to $7.9 billion, reflecting a minor reserve release than 1Q2021. Overall, net income came in at $7.1 billion, down 12% compared to the first quarter of 2021. Average loan and lease balances were up $70 billion, or 8%,

to $978 billion, led by strong commercial loan growth and higher consumer balances. Loans grew by $89 billion, excluding the Paycheck Protection Program (PPP).

The company recorded a record deposit balance, which is up 14% to more than $1 trillion. Also, record deposit balances for small businesses were up 21% to $172 billion for the first quarter.

Source: Investor Presentation

Growth Prospects

Bank of America has one of the best retail branch networks and overall retail franchises in the United States. The company is one of the top four U.S. credit card issuers, and the bank is a top-three U.S. acquirer.

Over the past ten years, the company has been growing earnings at an incredible pace of 27% compounded annually. However, we expect a 4% earnings growth for the next five years.

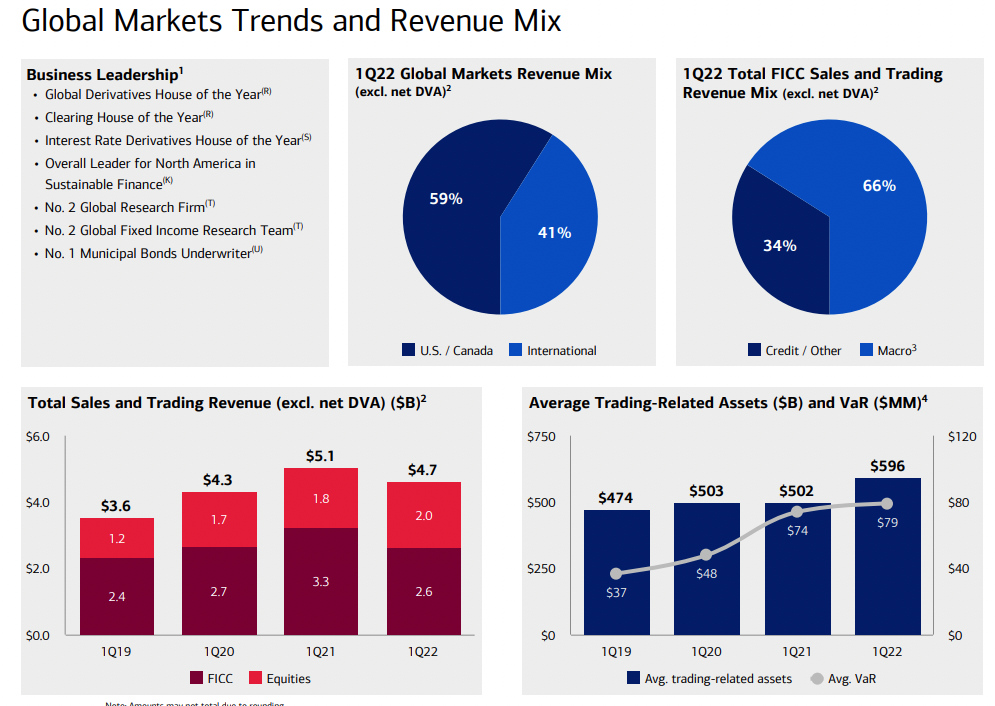

Other areas that can help the company grow earnings would be increasing its international exposure. As you can see, the global market only makes up 41% of the company’s 1Q22 revenues.

Source: Investor Presentation

Competitive Advantages & Recession Performance

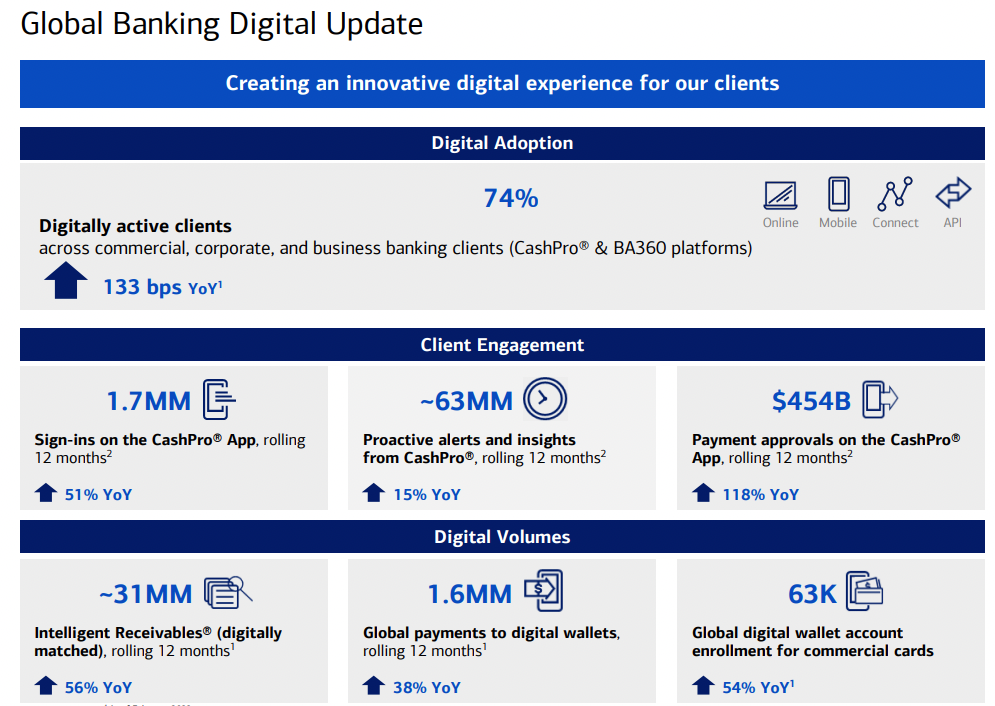

Bank of America competes with the largest banks in the U.S. The company is a leader in online banking, with tens of millions of active digital banking users and strong growth rates across its digital payments solutions. It also has advantages of scale given its massive branch footprint, digital presence, and balance sheet that puts it among the largest banks in the world.

During the last financial crisis, Bank of America was hit hard, but significant financial crises such as 2009 are not common occurrences. During a normal recession, Bank of America should perform better than its 2007-2009 history would suggest. The impacts of the 2020 COVID-19 are a thing of the past, and the bank is moving forward with growth plans.

Source: Investor Presentation

Valuation & Expected Returns

We expect that the company will earn $3.35 per share in 2022. This will decrease by 6.2% compared to the $3.57 per share that the company made in 2021. However, at the current price of $31.13, this gives us a PE ratio of 9.3X earnings.

We think a PE ratio of 11X earnings is fair for this company. Thus this will provide a tailwind multiple expansion of about 18%. This, with the current dividend yield of 2.6%, makes Bank of America attractive at this level.

Overall, we expect the company to earn a little over 10% over the next five years at the current price. However, the market can go lower, bringing this company down with it. COVID-19 lows in 2020 were $17.95. We do not see this going to that level again. However, $25 per share is possible if the market continues to head lower.

Final Thoughts

Bank of America is in a strong position despite the issues like inflating, supply chain issues, etc. The company’s long-term earnings power is intact, its dividend shows a strong growth rate, and its balance sheet looks exceptionally healthy. Shares are undervalued, in our view. We expect a total return outlook of 10% annually at the current price. However, as mentioned above, the stock price can go lower if the overall market continues to decrease.