War And Markets: Understanding The Impact Of Geopolitical Shocks

Image source: Pixabay

The conflict in the Middle East has generated a global reaction of shock, disdain, and compassion. Secondarily, investors have wondered how this regional conflagration might affect the global economy in general and stocks in particular, says Sam Stovall, chief investment strategist at CFRA Research.

Since WWII, selected military shocks resulted in average declines for the S&P 500 one, seven, and 30 days after the event as a result of the initial surprise and uncertainly. Stocks then recovered 60 days and beyond, after realizing that the fallout from most events would be localized.

However, there have been several instances that triggered or exacerbated US recessions and bear markets, such as the Yom Kippur War in 1973 and Iraq’s invasion of Kuwait in 1990. Add to this the concern from recent inflation reports and the Q3 2023 EPS reporting period, and one can understand why investors may think stock price gains could stall.

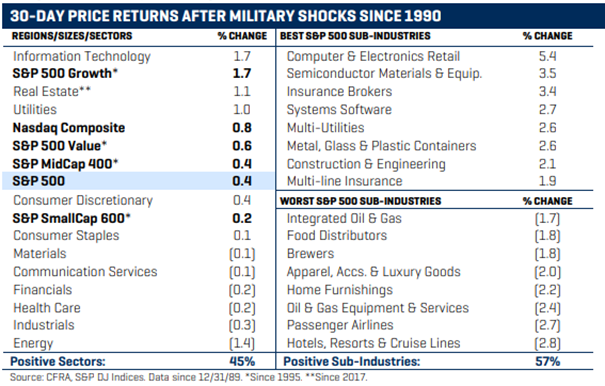

However, in the week through Oct. 12, the S&P 500 was still up 1.0%, along with all sizes, styles, eight of 11 sectors, and 61% of the 153 subindustries in the S&P 1500. Since 1990, the S&P 500 treaded water during the first 30 days following 12 selected shocks, gaining an average of 0.4%, and accompanied by gains for all sizes, styles, and five of 11 sectors.

Not surprisingly, the energy sector posted the weakest average 30-day performance due to the potential disruption of global oil supplies. Conversely, technology held up best, possibly reflecting companies’ and countries’ ongoing desire to improve their preparedness.

On a sub-industry level, a slight majority of groups went on to post advances, with a cross section of areas being embraced, while airlines, hotels, and oil were shunned.

About the Author

As chief investment strategist, Sam Stovall serves as analyst, publisher, and communicator of CFRA's outlooks for the economy, market, and sectors. He focuses on market history and valuations, as well as industry momentum strategies.

Mr. Stovall is the author of The Seven Rules of Wall Street and writes weekly Sector Watch and Investment Policy Committee meeting notes on CFRA's MarketScope Advisor platform. His work is also found in CFRA's flagship weekly newsletter The Outlook.

More By This Author:

Gold Surges On War Fears. Here's Why The Rally Could StickEQT Corp: A Solid Energy Company Poised To Benefit From Rising NGL Demand

McCormick: A Leading Spice And Seasoning Maker With A Solid Dividend

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.