Walmart (WMT) Solidifies Supply Chain Via New Baytown Facility

Photo by Caique Morais on Unsplash

Walmart Inc. (WMT) has been focused on strengthening its supply-chain network. To this end, the omnichannel retailer unveiled plans to expand its supply-chain campus in Baytown, TX through a new distribution center spanning more than 1,000,000 square feet. This will mark the company’s fourth facility in Baytown, TX, which is slated to open in Fall 2022.

The new distribution center will create another 300 full-time job opportunities alongside solidifying the company’s supply-chain network in Texas. Walmart operates 19 distribution centers and 593 retail stores in Texas, employing more than 185,000 workers in the state.

In connection with fortifying the supply chain, WMT also unveiled plans of opening a 1.8M plus-square-foot fulfillment center in southern Pennsylvania earlier this week. The facility, which is expected to begin operations in Spring 2022, will contribute to Walmart’s growing supply-chain network and e-commerce capabilities. This Shippensburg facility is likely to create up to 600 full-time, permanent job positions across the region. Currently, Walmart operates seven distribution centers and 160 retail outlets and employs 60,000+ associates in Pennsylvania.

Fulfillment centers are a critical part of Walmart’s supply-chain network and e-commerce business. These fulfillment centers store various items that are picked, packed and shipped directly to customers. The centers allow increased access and quick shipping of everyday low-priced products to customers.

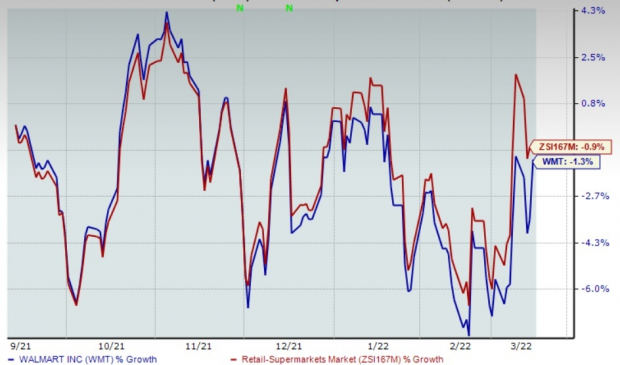

Image Source: Zacks Investment Research

E-Commerce Business Growth

Walmart’s e-commerce business and omnichannel penetration have been increasing all the more amid the pandemic. From fiscal 2021 beginning to fiscal 2022 end, WMT’s digital sales as a percentage of sales increased from 6% to 13%. Walmart’s U.S. e-commerce sales rose 1% in the fourth quarter of fiscal 2022 and soared 70% on a two-year stack basis. The company is witnessing rapid growth in advertising income. At Sam’s Club, e-commerce sales jumped 21% due to a robust direct-to-home show and a solid curbside performance. In the International segment, e-commerce sales advanced 21% on a constant-currency basis.

The company has been taking several e-commerce initiatives, including buyouts, alliances and improved delivery and payment systems. The company is innovating the supply chain and adding capacity and building businesses, such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services.

All said, the abovementioned expansion in Baytown, is likely to solidify this Zacks Rank #3 (Hold) company’s operations and fuel growth. Shares of Walmart have decreased 1.3% in the past six months compared with the industry’s drop of 0.9%.

3 Retail Stocks to Bet on

Here are three better-ranked stocks, including The Kroger Co. (KR) , Target Corporation (TGT) and Dillard's (DDS).

Kroger sports a Zacks Rank #1 (Strong Buy). Kroger has a trailing four-quarter earnings surprise of 22.1%, on average. Shares of KR have surged 33.1% in the past six months.

The Zacks Consensus Estimate for Kroger’s current financial-year sales suggests growth of 2.4% from the year-ago period’s level.

Target, a general merchandise retailer, carries a Zacks Rank #2 (Buy). Shares of Target have decreased 11.7% in the past six months.

The Zacks Consensus Estimate for Target’s current financial-year sales and earnings per share suggests growth of 3.5% and 6.7%, respectively, from the year-ago period. TGT has a trailing four-quarter earnings surprise of 21.3%, on average.

Dillard's, a retail department stores operator, currently has a Zacks Rank #2. Dillard's has a trailing four-quarter earnings surprise of 8.8%, on average.

The Zacks Consensus Estimate for Dillard's current financial-year sales suggests growth of 4.7% from the year-ago period’s tally. Shares of DDS have rallied 36.5% in the past six months.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more