Walmart - Overpriced For Growth?

The coronavirus pandemic had two sets of clear winners within the retail segment, the one which included Walmart, Target, and other chains that continued to operate and witnessed a burgeoning sales as consumers stayed inside their houses and shopping for essential services gained prominence.

While the laggards were the apparel retail and other non-essential chains like Macy's, Kohl's and others which were shut down, scrambling for liquidity put a huge strain on the sector causing several shutdowns, much to the likes of J.C Penney and J. Crew. However, despite increasing consumer traffic and rising sales, Walmart's stock performance fell short of its stupendous topline performance. Since the bottom, Walmart significantly lagged the performance of the S&P by a mile having grown a tepid under 7% compared to S&P's massive 39% rally. In fact, Walmart was one of the two DJIA stocks which bucked the trend amid a big rally on Friday and ended up in the red.

Data by YCharts

Q1 2020 Results Scanner

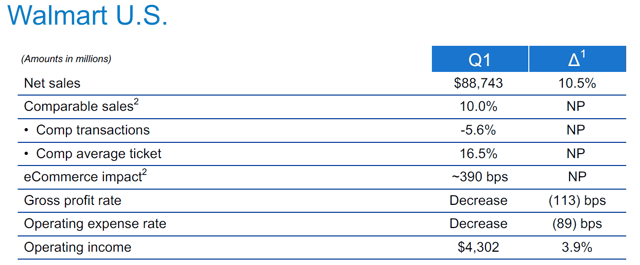

The company reported an exceptionally massive 10% comp sales growth in its US segment driven by higher average ticket sales as customers stockpiled products amid the coronavirus lockdown measures and customers made fewer trips to the stores. E-commerce sales surged as well, growing 74% contributing ~390 bps to the comp sales growth. The strong comp sales growth was driven by strength in food, consumables, and health and wellness partially offset by softness in the discretionary categories. The growth was also impacted somewhat due to the unprecedented demand and stock-outs with the company struggling to recover the in-stock units and meet demand.

Sam's Club reported a comp sales growth of 12.0% with footfall growing 11.9%. While tobacco remained a laggard, meat, deli, frozen foods, canned protein, pasta and coffee/ breakfast segments performed well. Walmart International reported 7.8% cc sales growth with comp sales positive in nine of 10 major markets offset by limited operations of the Flipkart business in India after the government imposed a significant nationwide lockdown.

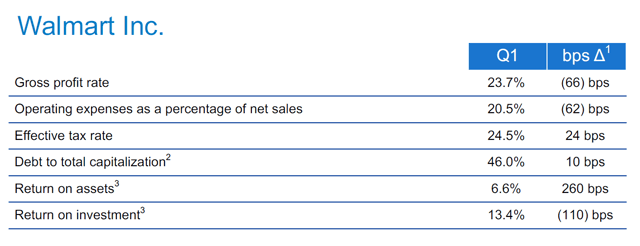

However, despite a huge surge in the topline, the company was unable to improve its bottom line. Gross margin declined 66 bps due to a shift towards lower-margin categories and general markdown in certain franchises with return on investment declining 110 bps at a time when it posted one of the biggest comp sales growth numbers. Operating margins also declined consequently by 62 bps despite some additional COVID-19 costs. The company reported an Adjusted EPS of $1.18 and the company did beat the consensus estimates by $0.09. So what are we fussing about?

Valuation

The company is currently trading at a massive 25x P/E significantly higher than its long-term average. We expect the company's SSS to moderate as the stimulus benefits fade, unemployment persists, and competitors reopen their doors and the subsequent pantry loading benefits wane. While much of the rally was primarily on the hopes that a corona-induced lockdown would benefit the retailer, Walmart is no growth stock. The company's margin concerns are no surprise to investors and even amid a huge sales bump we expect the topline growth to moderate as well which will even have a further effect on the company's earnings. Apart from that, WMT's second round of bonuses will also have an impact in Q2 which would lead to further pressure on margins. We view the current risk-reward tipped on the downside and are negative on the company in the short to medium-term.

Data by YCharts

The tone of constant complaint about the stock prices not rising borders on offensive. Amazingly enough there is actually more to a business than just making profit for the shareholders. I am aware that it sounds like a gross heresy, but some businesses actually exist primarily to serve their customers. It appears that Walmart is one of them.

Really? I think every company puts profit first. What other companies do you believe to be so altruistic? Would love to know that I'm wrong.