Wall Street Mixed As Tech Stocks Fall, Fed Meeting Begins

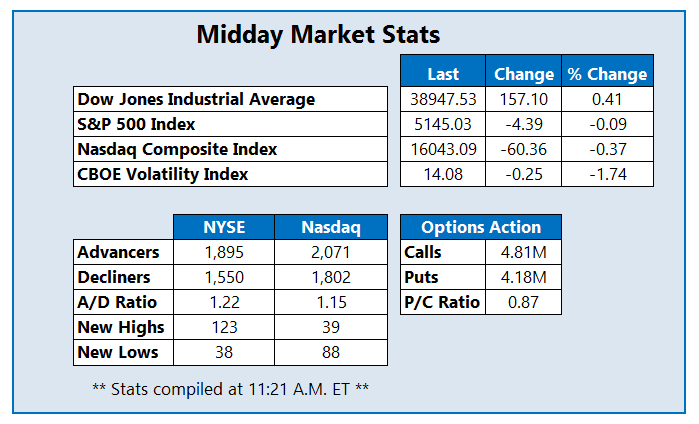

Stocks are scattered midday Tuesday, as investors digest the semiconductor sector's pullback that's being led by the shares of Nvidia (NVDA). In addition, the Fed's two-day policy meeting is getting underway, and investors are almost 100% certain the central bank will leave interest rates untouched. At last glance, the Nasdaq Composite (IXIC) is in the red, the S&P 500 Index (SPX) is just below breakeven, and the Dow Jones Industrial Average (DJI) is up 157 points.

U.S.-listed shares of China-based electric vehicle (EV) company Xpeng Inc (NYSE: XPEV) are 3.3% lower at $9.50 at last check, pulling back from a surge above the $10.50 mark that followed a better-than-expected earnings report for the fourth quarter. What's more, the company announced the termination of its agreement with Taobao China but said it will continue to collaborate with certain areas of Alibaba's (BABA) business. In response, 11,000 puts have crossed the tape, which is double the average intraday volume. The most popular is the weekly 3/22 9-strike put, followed by the 10-strike call from the same weekly series. Despite today's early morning lift, XPEV is down 35% year to date.

Shares of Enliven Therapeutics Inc (Nasdaq: ELVN) are near the top of the Nasdaq after the company announced a $90 million private placement financing alongside updates on its pipeline. Last seen 25.1% higher at $15.81, ELVN is now 15.6% higher in 2024.

Crypto stocks are falling across the board after Bitcoin (BTC) fell in overnight trading, and MicroStrategy Inc (Nasdaq: MSTR) is suffering as one of the worst stocks on the Nasdaq. The equity was last seen 17.2% lower at $1,245 this afternoon, as it continues to pull back from a record high. MSTR also just breached its recently supportive 10-day moving average.

More By This Author:

Nasdaq, S&P 500 Snap Losing Streaks Amid Tech StrengthRed-Hot Tech Rally Boosts Major Benchmarks

Market Pessimism Ushers Daily, Weekly Losses For Stocks