Wall Street Looks To Wrap Up 2nd Quarter, 1st Half Of Year With Gains

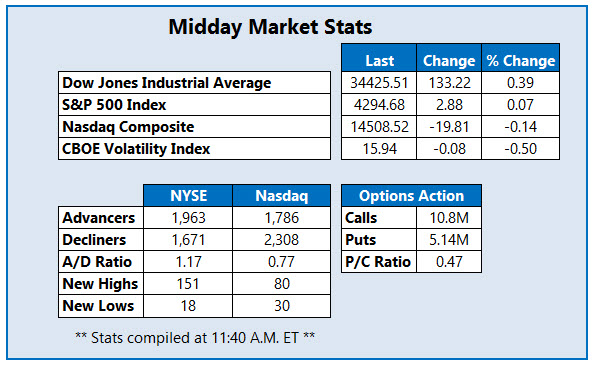

Stocks are trading near record highs this afternoon, as Wall Street looks to wrap up the second quarter and first half of 2021 with substantial wins. The Dow Jones Industrial Average (DJI) has added 101 points at midday, following a better-than-expected ADP employment report. Meanwhile, the tech-heavy Nasdaq Composite (IXIC) is eyeing modest losses for the day, and the S&P 500 Index (SPX) is flat, though the latter looks ready to eke out its fifth-straight closing high, and nab its fifth monthly win in a row.

Elsewhere, the Mortgage Bankers Association said pending home sales in May surged to their highest level since 2005. Still, high prices and low supply may be forcing some buyers out, given last week's drop in mortgage demand. Investors are also keeping an eye on Big Tech, after reports that the Biden administration may issue an executive order that would increase scrutiny over certain industries where only a few businesses dominate the sector.

One stock seeing an unusual amount of activity in its options pits today is Bed Bath & Beyond Inc. (Nasdaq: BBBY), up 22.1% at $36.53 at last check, after beating fourth-quarter earnings estimates and raising its full-year revenue outlook as the back-to-school season approaches. So far, 134,000 calls and 43,000 puts have crossed the tape, which is nine times the intraday average. Most popular is the 7/2 40-strike call, followed by the 35-strike call in the same weekly series, with new positions being opened at both. This indicates premium buyers are expecting more upside for BBBY by the end of the week when contracts expire. The security is now bucking a trend of negative post-earnings moves while bouncing off support at the 50-day moving average. Year-over-year, BBBY has added 247.5%.

The top percentage gainer on the Nasdaq today Cuentas Inc (Nasdaq: CUEN), last seen up 201.6% to trade at $8.39, as social media traders blast mobile banking stocks. The bank, which serves the Hispanic and Latino population, rose to the top 10 trending stocks on trading-focused website Stocktwits after it said it signed a contract to roll out WaveMax's WiFi (SharedFi) in 170 test locations. The shares are now trading at their highest level since August 2020, while also pacing for their seventh-straight daily win. Shares had been trending lower since January, but have since overcome overhead pressure at the 100-day moving average. Month-to-date, CUEN has risen 259.9%.

Meanwhile, Altimmune Inc (Nasdaq: ALT) is towards the bottom of the Nasdaq today. The shares are down 35.8% at $10.22 this afternoon, after the company decided to shelve its Covid-19 nasal vaccine, as it shifts its focus and resources to obesity and liver programs. In response, at least four brokerage firms doled out price-target cuts, including Jefferies to $14 from $24. Today's drop has shares trading at their lowest level since November 2020, while slipping below recent support at the 10-day moving average.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more