Volatility Spikes: 3 Low Beta Stocks To Buy

Image Source: Unsplash

Beta is a measure of a stock's systematic risk or volatility in comparison to the overall market. The S&P 500 is often used as the benchmark, with a beta of 1.0 representing the market average.

A beta greater than 1.0 indicates that a stock is more volatile than the market, while a beta less than 1.0 suggests the opposite. Essentially, low-beta stocks provide a higher level of ‘defense,’ whereas high-beta stocks are known for their higher returns, or ‘offense.’

By adding low-beta stocks to a portfolio, investors can help balance out their risk profile, helping during intense volatility spikes like the market has recently witnessed.

Over recent months, several low-beta stocks – Northrop Grumman (NOC - Free Report), Pfizer (PFE - Free Report), and Kimberly-Clark (KMB - Free Report) – have enjoyed positive earnings estimate revisions, landing them into favorable Zacks Ranks.

For those looking for a higher level of defense, let’s take a closer look at each.

Pfizer Bounces Back Big

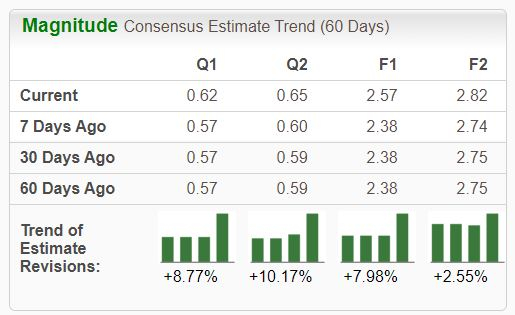

Pfizer shares have been quietly strong off their 2024 lows in late April, gaining more than 20% since. Analysts have taken their expectations higher across the board, landing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The stock has been shoved to the side in the post-COVID world, with weakening quarterly results regularly causing post-earnings pressure. Still, the trend has seemingly shifted over recent releases, with the stock catching a nice boost post-earnings following both of its last two prints.

Regarding the latest release, non-COVID products saw a nice 11% year-over-year boost in operating revenue. The company also raised its adjusted EPS outlook for the year while maintaining all previous guidance.

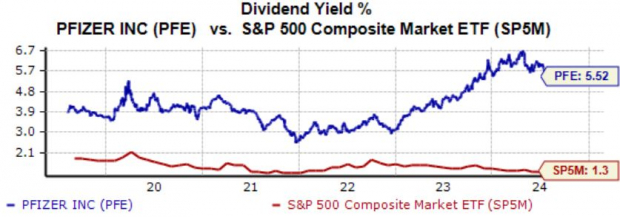

In addition, the stock could attract income-focused investors, with shares currently yielding a solid 5.5% annually. Pfizer paid out $2.4 billion in dividends throughout its latest period, with the company’s 3% five-year annualized dividend growth rate further reinforcing a shareholder-friendly nature.

Image Source: Zacks Investment Research

Northrop Grumman Raises Outlook

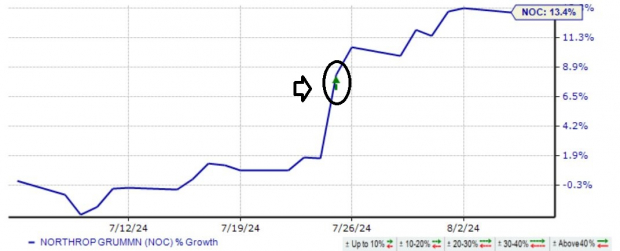

Similar to PFE, Northrop Grumman saw its shares make a strong positive move following the release of its latest quarterly results, up nearly 15% just over the last month. The stock presently sports a Zacks Rank #2 (Buy), with earnings expectations moving higher following a guidance upgrade in the mentioned release.

Image Source: Zacks Investment Research

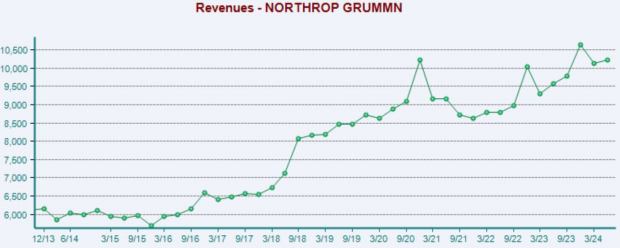

The company maintains a bright internal outlook, with CEO Kathy Gordon stating, “We are laser focused on performance and continue to expand profitability through the deliberate actions we are taking. With strong support for our programs, growing global orders for our products, and solid execution in our business, we are increasing our revenue and EPS guidance for the year.”

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Kimberly-Clark Sees Profitability Boost

KMB shares have delivered a strong performance year-to-date, gaining more than 15%. The company carries a defensive nature thanks to its placement in the consumer staples sector, as these companies’ products have an advantageous ability to generate consistent demand in the face of many economic situations.

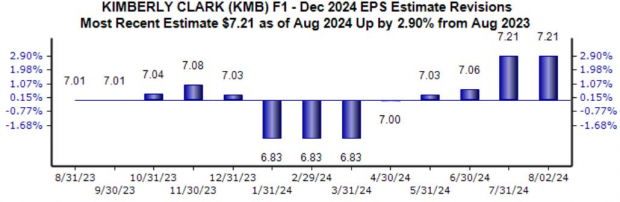

The stock sports a Zacks Rank #2 (Buy), with earnings expectations for its current fiscal year drifting notably higher over the last month following a guidance upgrade.

Image Source: Zacks Investment Research

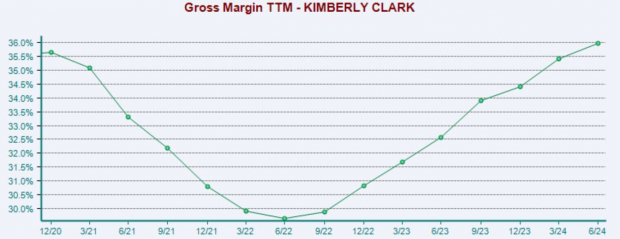

Cost management practices have aided the company’s profitability in a big way, with adjusted EPS of $1.96 throughout its latest quarter seeing a 20% climb year-over-year. Margin expansion has also kept investors happy, as we can see illustrated below.

Please keep in mind that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

During periods of heightened volatility, low-beta stocks can provide a valuable layer of defense and a more balanced risk profile.

And over recent months, several low-beta stocks – Northrop Grumman, Pfizer, and Kimberly-Clark – have enjoyed positive earnings estimate revisions, landing them into favorable Zacks Ranks.

More By This Author:

Can The Paris Olympics Reignite This Beaten Down Stock?Earnings Season: 3 Key Quarterly Reports To Watch

Bull Of The Day: Servicenow