Volatility Is A Reliable And Convenient Proxy For Downside Risk

Image source: Pixabay

Javier Estrada, author of the June 2025 study “Volatility: A Dead Ringer for Downside Risk” tackled a longstanding debate in finance: Is volatility (the standard deviation of returns) a good measure of the risk that investors actually care about? While volatility is the most widely used risk metric in investing, it is also heavily criticized, especially by those who argue that investors are primarily concerned with downside risk—the risk of losses—rather than the mere variability of returns.

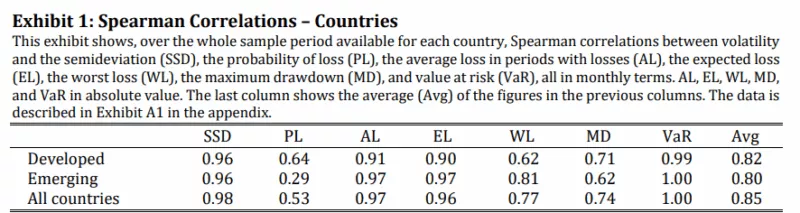

Estrada investigated whether volatility, despite its limitations, serves as an effective stand-in for downside risk by comparing how assets were ranked using volatility versus alternative downside risk metrics: semi-deviation (SSD), probability of loss (PL), average loss (AL), expected loss (EL), worst loss (WL), maximum drawdown (MD), and Value at Risk (VaR). His data sample consisted of the MSCI database of 47 countries (23 developed and 24 emerging) each considered from its inception in the database through December 2024.

Key Findings

Estrada’s central finding was that volatility and downside risk metrics are highly correlated in practice. Specifically, when assets are ranked by volatility, the resulting order is very similar to the rankings produced by more direct downside risk measures. This strong correlation is supported by statistical evidence, such as high Spearman correlation coefficients (indicating how strongly two sets of ranks are correlated) between volatility and the other risk metrics.

- The ranking made by volatility was most similar to those made by SSD, AL, EL, and VaR, with correlations 0.90 or higher.

- The rankings were less similar to those made by PL, WL, and MD, although their correlations were still fairly high, in the 0.62-0.71 range.

- The average correlation across all the downside risk metrics considered was 0.82.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

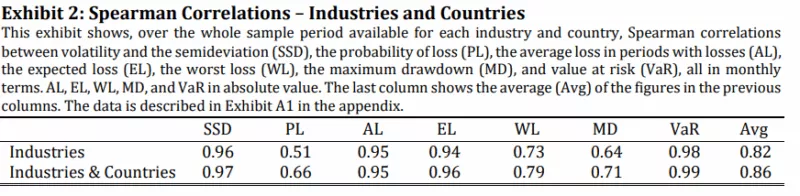

Estrada found very similar results when he repeated the analysis for industries and then for countries and industries pooled.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Estrada found that volatility remains pervasive in finance for two mutually reinforcing reasons:

- It is extremely well known and easy to calculate.

- It is a reliable proxy for the downside risk that investors dislike, as shown by the close correlation in asset rankings.

Key Takeaways for Investors

- Volatility Is Not Perfect—But It’s Practical: While volatility does not distinguish between upside and downside moves, it remains a useful and accessible summary of risk for most investors, especially when comparing assets or building diversified portfolios.

- Downside Risk Measures Often Add Little Value: For many practical purposes, using more complex downside risk metrics may not significantly change investment decisions, as they tend to rank assets similarly to volatility.

- Simplicity Has Its Merits: The widespread use of volatility is justified not only by tradition but also by its empirical effectiveness as a stand-in for the risks investors care about most—potential losses.

- Know When to Dig Deeper: In specialized cases (such as portfolios with asymmetric return distributions or those exposed to extreme tail risks), more nuanced risk metrics may still be warranted. But for most mainstream portfolios, volatility remains a robust and efficient tool.

Estrada’s findings led him to conclude: “A ranking of assets by volatility is very highly correlated with rankings made by different metrics that directly assess downside risk.”

Summarizing, Estrada’s paper reassures investors and practitioners that, despite its critics, volatility is a solid and convenient proxy (a reliable summary) for downside risk. Thus, most investors can continue to use volatility as a primary risk metric with confidence, knowing it closely tracks the downside risks they seek to avoid.

More By This Author:

Insider Trading Increases Market Efficiency

Enhancing Momentum Strategies

Profitability Retrospective: Key Takeaways For Investors