Vodafone Share Price Is Ripe For A Breakout, But Risks Remain

Vodafone (VOD) share price has risen gradually this year as investors flocked back to UK telecom companies. It has risen by 11.7% this year, beating the FTSE 100 index, which has risen by 7.50% this year. Also, the stock has jumped by over 24% from its lowest point in February.

Vodafone’s turnaround is ongoing

Vodafone, one of the biggest telecommunication companies in the world, has gone through a difficult phase in the past few years.

Its revenue growth has slowed while its debt load has been a big burden. At the same time, it has been forced to spend more money to upgrade its network while competition has continued rising in the past few years.

As a result, while its stock has risen by over 24% from its lowest point this year, it remains over 50% below its highest level in 2018. In other words, those who invested £10,000 in the stock at its 2016 highs now have about £4,932, excluding its dividend

Therefore, Vodafone’s management has embarked on a turnaround strategy that it hopes will leave it as a lean and highly profitable company.

For example, the company sold Vodafone New Zealand in 2019 for $2.2 billion and then exited its operations in Egypt, Malta, and Hungary.

Most recently, Vodafone has exited its Spanish and Italian businesses. It sold its Spanish business to Zegona in a $5.4 billion deal and its Italian business to Swisscom for 8 billion euros.

Additionally, the company separated its tower business into a separate publicly-traded company known as Vantage Towers.

Vodafone has reduced its debt

All these disposals have helped the company to reduce its debt over the years. Its total long-term debt stood at over $63 billion in March 2020 and has dropped to over $45 billion in the last financial report. The management hopes to continue lowering its debt figures in the next few years.

In addition to exiting some key markets, Vodafone has also focused on growing its market share in its existing markets. The best example of this is in the UK, which accounts for about 19% of its total revenue. It is aiming to consolidate its business there by merging with Three UK. After the deal closes, Vodafone will own 51% of the combined company.

Vodafone also announced a plan to share network with Virgin 02, a deal that gave its customers a better deal.

Still, Vodafone faces challenges across all its business lines. In Germany, which accounts for 39% of total sales, growth has been sluggish. Just last year, the company’s broadband customers fell by 55,000 in the first quarter after its price increases.

It also expects to lose about 50% of its 8.5 million TV customers because of the MDU transition. Vodafone’s top-performing markets were in Portugal, Turkey, and Africa.

Analysts expect that Vodafone’s business will experience slow growth in the coming years. For FY 25, analysts expect that the group revenue will be €37.22 billion followed by €37.7 billion in FY 26. Its net income is expected to rise to €2.5 billion this year and €2.6 billion next year. The net debt is expected to be €27 billion followed by €23.9 billion.

Good company with risks

Therefore, a case for investing in Vodafone can be made. It is a large company that has gone through a long turnaround strategy. As part of its turnaround, it has shed over 11,000 jobs in the past few years and reduced its debt.

At the same time, it has continued to repurchase its stock using the proceeds of its disposal. Just recently, the company sold another tranche of its Vantage Towers business for €1.3 billion and used the funds to pay debt.

However, the company also has some risks ahead. First, the company is not cheap, with its twelve-month P/E ratio of about 19, higher than its historical range of about 15. Second, its business is not growing in key markets like Germany and the UK.

Third, despite the disposals, the company announced that it would slash its dividend to 4.50p to fund its network.

Vodafone share price analysis

(Click on image to enlarge)

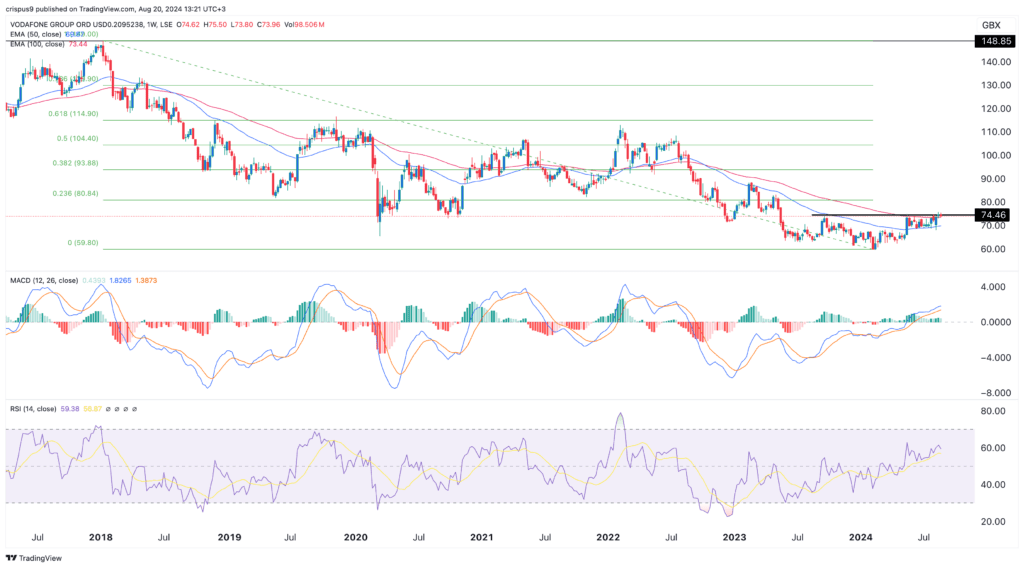

The weekly chart shows that the VOD stock price bottomed at 59.80p earlier this year and has bounced back to 74.45p. It is now attempting to move above the 50-week and 100-week moving averages.

The stock is nearing the 23.6% Fibonacci Retracement point while the Relative Strength Index (RSI) and the MACD indicators have pointed upwards. There are signs that it has formed an inverse head and shoulders pattern.

Therefore, the stock will likely continue rising as buyers target the key resistance point at 93.8p, the 38.2% Fibonacci Retracement point. On the flip side, failure to cross the resistance at 75p will lead to more downside.

More By This Author:

Inflation Eases In The UK, But Is The Economy Truly Recovering?Asia-pacific Markets Edge Up As China Maintains Loan Prime Rates

Rio Tinto, BHP Shares Are At Risk As Iron Ore, Copper Prices Sink

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more