VIX Futures Hit New Record Short: Is A Historic Volatility Squeeze Coming?

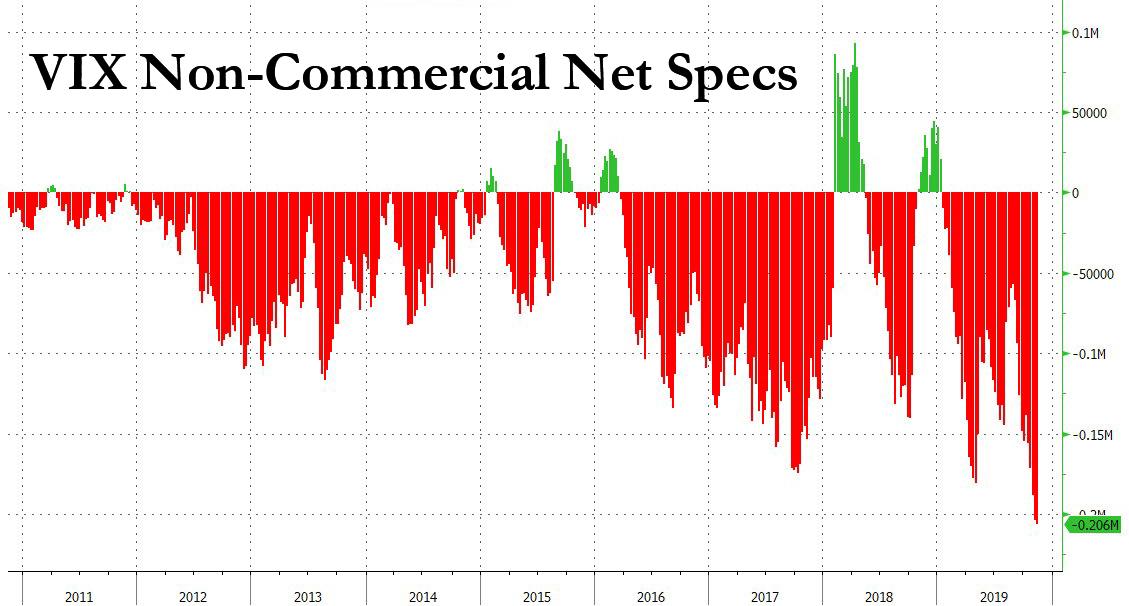

For the past 5 weeks, net futures for VIX non-commercial spec positions have hit consecutive record shorts, with the latest print of -206,157 the highest on record.

(Click on image to enlarge)

So besides a reflexive trade in which record market highs prompt carry-seeking traders to short even more VIX, which in turn results in even higher highs, even more short VIX carry and even more VIX shorting, does this unprecedented shorting activity in spot VIX imply anything else, besides the risk of an unprecedented VIX short squeeze of course?

One answer comes courtesy of Goldman's derivatives strategist, Rocky Fishman, who this week writes that to get a full picture of vol positioning, one has to look not only at VIX futures but also VIX ETPs, which have become increasingly popular as hedges (perhaps not so much in February 2018 but we digress).

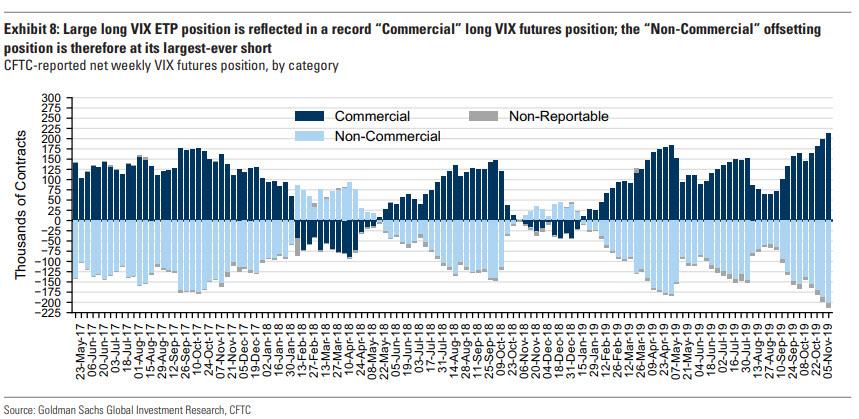

According to Fishman, the net vega position in VIX ETPs is now above $300mm vega, or roughly the equivalent of 300k VIX futures: "This reflects conservative investor positioning, since long VIX products can be used as a hedge."

And since derivative markets are zero-sum, the byproduct of long VIX ETP position (and corresponding long VIX futures position from the “Commercial” group that likely includes ETP issuers) is a large short VIX futures position from the “Non-Commercial" group shown in the chart above, which Goldman sees as likely holding these shorts as part of relative value strategies. And while the Goldman derivatives strategist may be correct that much of the futures space is used to hedge the ETP space, we disagree that VIX ETPs are using derivatives to hedge exposure, as would be the case in the zero-sum world shown in the chart below.

(Click on image to enlarge)

What are the implications? According to Fishman, with the majority of VIX ETP assets in unlevered long strategies and very little activity in short ETPs, daily rebalancing of ETPs is not likely to materially exacerbate moves in volatility. "However, the constant shifting of exposure from the first VIX future to the second (currently from November to December) has the potential to be adding to VIX curve’s steepness."

(Click on image to enlarge)

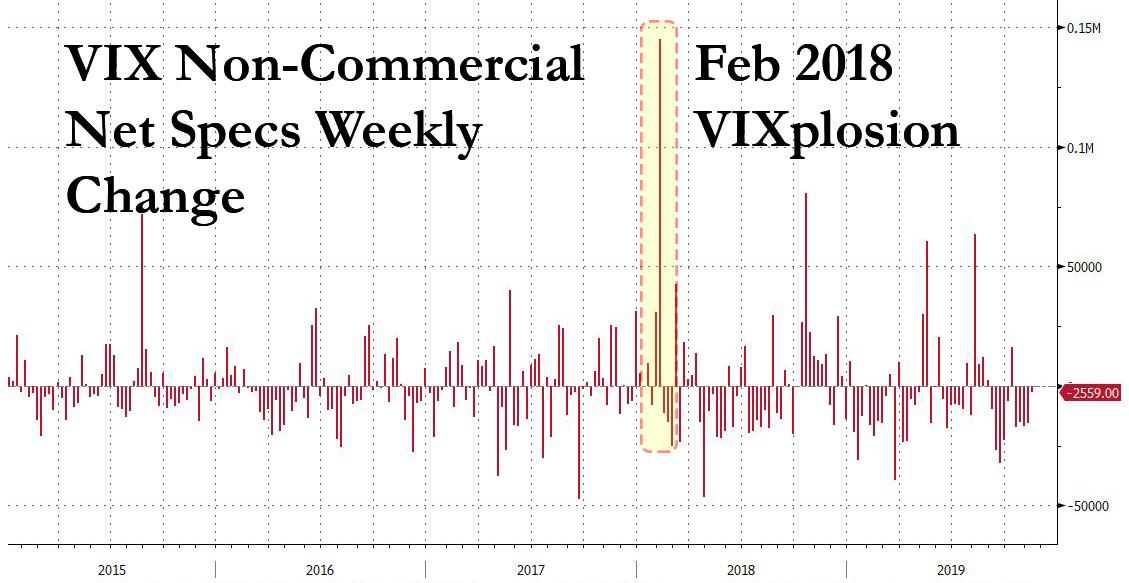

If Fishman is correct, there is never point in worrying about record VIX net spec exposure ever, as every position merely represents an offset to an equally matched long position somewhere else. We know that's incorrect however, because the biggest one week surge on record in non-commercial specs took place during the February 2018 VIXplosion week, which confirms that not only were ETPs not perfectly hedged, but there was an epic VIX short squeeze which as many recall sent spot VIX into the 50s.

(Click on image to enlarge)

So for all those who hope to mitigate the importance of a record VIX net short in futures, not only do we disagree that this position is "perfectly" hedge with commercial longs, but since non-commercial actors are more likely to reverse positions, catching commercial longs offside and unwilling to part with their longs, it is our belief that the potential for a historic VIX short squeeze is now far greater than it was during the Feb 2018 VIXplosion which ended up wiping out all those who were long inverse VIX ETNs. We, for one, can't wait to find out just what "collecting pennies in front of a steamroller" trade will be wiped out during the next epic VIX squeeze.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more