Visualizing Global Equity Returns So Far In 2025

(Click on image to enlarge)

Key Takeaways

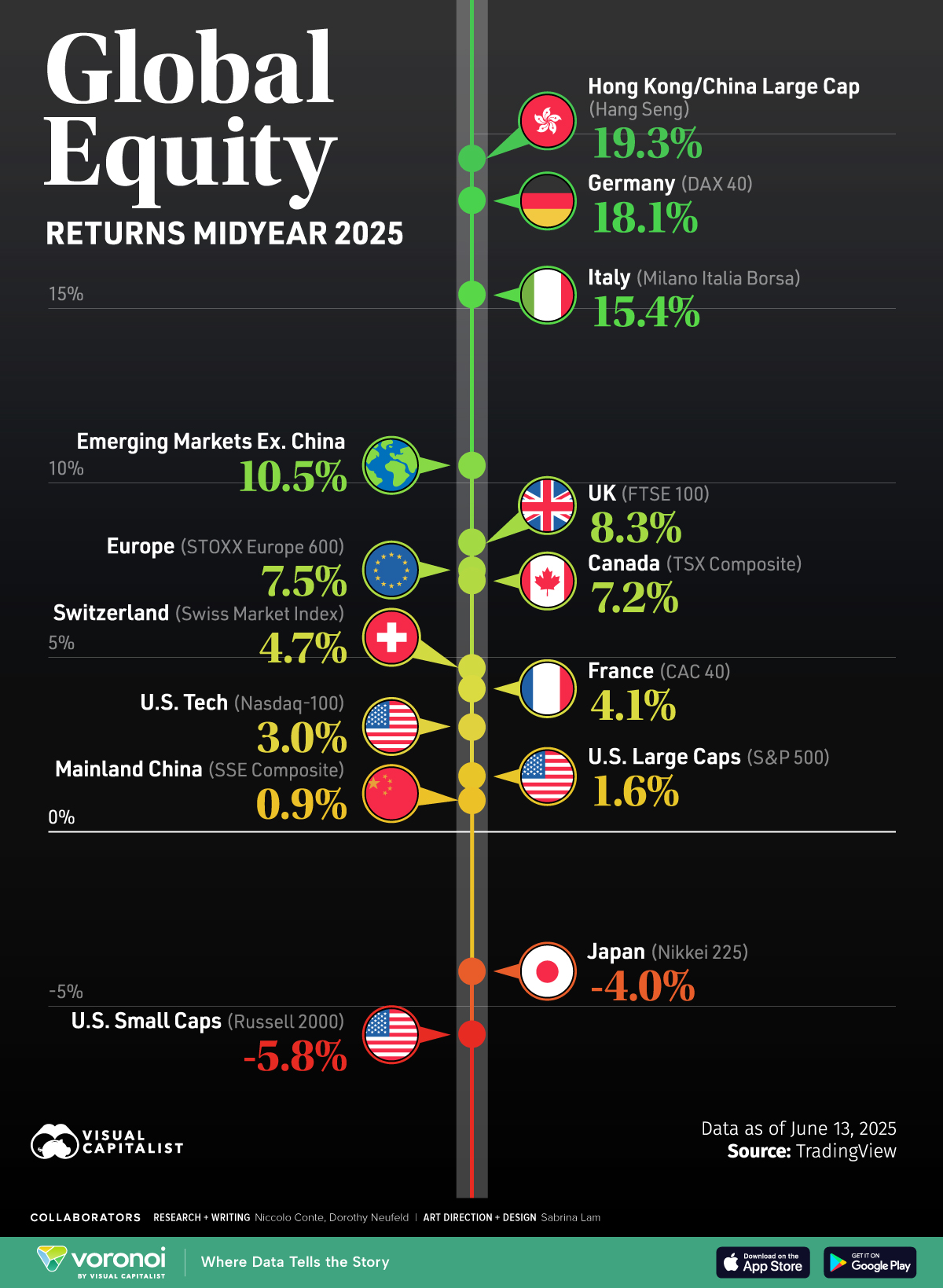

- Hong Kong’s Hang Seng Index has jumped 19.3% year-to-date as of June 13, fueled by a tech rally.

- With 18.1% returns, Germany’s DAX 40 Index is being propelled by armsmakers due to an influx in defense spending.

- By comparison, the S&P 500 has gained just 1.6% given trade uncertainty.

U.S. equities continue to see tepid returns in 2025, weighed down by a weak dollar and trade disruptions.

Instead, several global equity markets—from the Hang Seng Index to European stocks—are booming. While policy support in China is driving returns, massive defense spending is contributing to gains across German and Italian indices.

This graphic shows year-to-date global equity returns, based on data from TradingView.

A Closer Look at Global Equity Performance

As of June 13, 2025 the Hang Seng Index has returned 19.3%—the strongest returns across leading global equity markets.

| Index | Description | YTD Returns as of June 13 2025 |

|---|---|---|

| Hang Seng | Hong Kong / China Large Cap | 19.3% |

| DAX 40 | Germany | 18.1% |

| Milano Italia Borsa | Italy | 15.4% |

| MSCI Emerging Markets Ex.China | Emerging Markets Ex.China | 10.5% |

| FTSE 100 | UK | 8.3% |

| STOXX Europe 600 | Europe | 7.5% |

| TSX Composite | Canada | 7.2% |

| Swiss Market Index | Switzerland | 4.7% |

| CAC 40 | France | 4.1% |

| Nasdaq-100 | U.S. Tech | 3.0% |

| Index | Description | YTD Returns as of June 13 2025 |

|---|---|---|

| S&P 500 | 🇺🇸 U.S. Large Caps | 1.6% |

| SSE Composite | 🇨🇳 Mainland China | 0.9% |

| Nikkei 225 | 🇯🇵 Japan | -4.0% |

| Russell 2000 | 🇺🇸 U.S. Small Caps | -5.8% |

While mainland China’s market remains sluggish, Hong Kong’s Hang Seng Index is surging, driven by investor optimism around DeepSeek.

Additionally, retail giant Shein is reportedly considering shifting its IPO from London, while battery maker CATL raised over $4 billion in an IPO in May. With U.S. markets seeing muted returns, the Hang Seng is positioning itself as the world’s top IPO destination in 2025.

Meanwhile, Germany’s DAX 40 Index is up 18.1%, aided by a 500 billion euro infrastructure fund. Adding to this, falling inflation coupled with a strong euro are providing favorable conditions for interest rate cuts. Like Germany, Italy’s major index has seen strong gains of 15.4%.

With year-to-date returns of 7.1%, Canadian equities remain resilient despite the economy’s vulnerability to global trade tensions. This strength is likely due to its defensive sector mix, attractive valuations, and fear fatigue of tariff tensions.

As we can see, U.S. markets have lagged in 2025—though some standout performers have emerged. Palantir leads the S&P 500 with a remarkable 82% return so far, while NRG Energy and Howmet Aerospace have each surged over 50%, driven by momentum in the AI and defense industries.

More By This Author:

Infographic: How Asia-Pacific Trades With China & The U.S.

Charted: Unemployment Rates In OECD Countries In 2025

Ranked: Largest Communities On Reddit