Visa Inc. Stocks Elliott Wave Technical Analysis - Friday, November 22

V Elliott Wave Analysis Trading Lounge

Visa Inc., (V) Daily Chart

V Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iv} of 5.

DIRECTION: Upside in wave {v} in 5.

DETAILS: Looking for consolidation in wave {iv} as we stand at the beginning of MinorGroup1 at 310$.

(Click on image to enlarge)

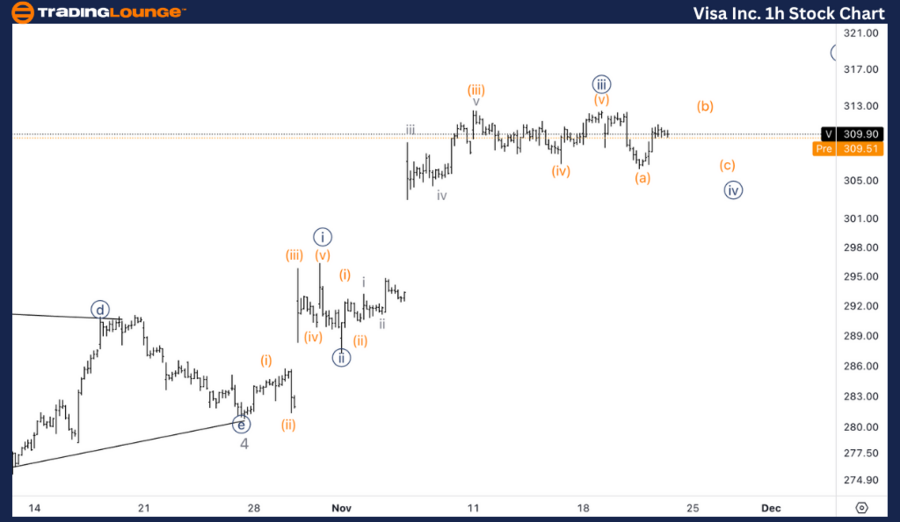

Visa Inc., (V) 1H Chart

V Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (a) of {iv}.

DIRECTION: Completion in wave {iv}.

DETAILS: Looking for a potential pullback into wave (b) to then fall back down into wave (c). There is a probability we have already completed wave {iv} as we stand in the area of the previous (iv), as well as we can identify a three wave move in what is currently labelled as (a).

(Click on image to enlarge)

This analysis of Visa Inc., (V) focuses on both the daily and 1-hour charts, using the Elliott Wave Theory to assess current market trends and forecast future price movements.

* V Elliott Wave Technical Analysis – Daily Chart*

Visa (V) is currently in wave {iv} of 5, with the expectation of further consolidation as the price is hovering around the MinorGroup1 level at 310$. This wave is typically a corrective phase, and once complete, it should lead to an upside move in wave {v} to complete the fifth wave of the larger motive structure. The key to confirming this will be how the price reacts to the ongoing consolidation.

* V Elliott Wave Technical Analysis – 1H Chart*

On the 1-hour chart, Visa seems to have completed wave (a) of the corrective wave {iv}. The structure shows a potential three-wave move in wave (a), suggesting that we may see a pullback in wave (b) before completing wave (c) of {iv}. There is also a possibility that wave {iv} may already be completed, as the price is currently in the area of the previous wave (iv), adding to the probability that wave {v} could start soon.

More By This Author:

Unlocking ASX Trading Success: Wesfarmers Limited

S&P/ASX 200 Index Elliott Wave Technical Analysis

Elliott Wave Technical Analysis: Dogecoin Crypto Price News - Friday, Nov. 22

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.de09a8df1f78ea31842d091928c24326.png)