Vertiv Vs. Applied Digital: Which Data Center Infrastructure Stock Has More Upside?

Image: Bigstock

Key Takeaways

- Vertiv's orders rose 21% with a 1.4 book-to-bill ratio, while its backlog climbed 30% year-over-year to $9.5 billion.

- Vertiv's $1 billion Purge Rite deal and NVIDIA tie-up boost its AI-focused thermal and power solutions.

- Applied Digital's $11 billion CoreWeave deal and faster build times drive its AI data center expansion.

Vertiv (VRT - Free Report) and Applied Digital (APLD - Free Report) are major players in the data center infrastructure market. While Vertiv offers advanced thermal and power management systems tailored for large-scale data centers, Applied Digital builds and operates high-performance data centers optimized for AI and high computing workloads (HPC).

Per a Grand View Research report, the data center infrastructure management market was valued at around $3.06 billion in 2024 and is expected to register a CAGR of 17.3% from 2025 to 2030. Both Vertiv and Applied Digital are likely to gain from the massive growth opportunity.

So, Vertiv or Applied Digital — Which of these Data-Center Infrastructure stocks has the greater upside potential? Let’s find out.

The Case for Vertiv Stock

Vertiv’s extensive product portfolio spans thermal systems, liquid cooling, UPS, switchgear, busbars, and modular solutions.

In the trailing 12 months, organic orders grew approximately 21%, with a book-to-bill ratio of 1.4 times in the third quarter of 2025, indicating strong prospects. Its backlog grew 12% sequentially and 30% year-over-year to $9.5 billion. This growth is primarily driven by the rapid adoption of AI and the increasing need for data centers to support the digital transformation.

Acquisitions have played an important role in expanding Vertiv’s portfolio. Vertiv recently announced an agreement to acquire Purge Rite Intermediate for approximately $1.0 billion in cash, with up to $250 million in additional earn-out, to enhance its liquid-cooling and thermal-management services for AI and high-performance data centers.

As mentioned, the global increase in AI adoption is driving strong demand for data center infrastructure. Vertiv is capitalizing on this trend, particularly in the Americas, where organic sales increased 43% in the third quarter of 2025, and APAC registered a 21% increase in organic sales.

Vertiv’s partnership with NVIDIA is a plus. It aims to stay one generation ahead of NVIDIA, enabling efficient and scalable power solutions for next-generation AI data centers.

The Case for Applied Digital Stock

Applied Digital is similarly benefiting from robust demand for data center infrastructure. The increasing focus on energy efficiency is a noteworthy development in the data center industry.

Building on this momentum, the company has established itself as a key player by forming long-term partnerships with major hyperscalers like CoreWeave. CoreWeave initially contracted 250 megawatts at Applied Digital’s Polaris Forge 1 campus in North Dakota, representing $7 billion in revenues over 15 years. This agreement was later expanded to cover the full 400 megawatts of capacity under construction, increasing the total contract value to $11 billion.

The CoreWeave partnership supports Applied Digital’s shift from cryptocurrency mining to AI-optimized data center infrastructure. This partnership offers strong revenue visibility and reduces risk in Applied Digital’s business model.

Applied Digital’s ability to deliver scalable and efficient data centers is a key advantage in the market. The company has shortened construction timelines from 24 months to 12-14 months, enabling it to deploy infrastructure to meet the urgent needs of hyperscalers rapidly. This capability has positioned Applied Digital as a trusted partner for hyperscalers, who are projected to invest over $350 billion in AI infrastructure in 2025 alone.

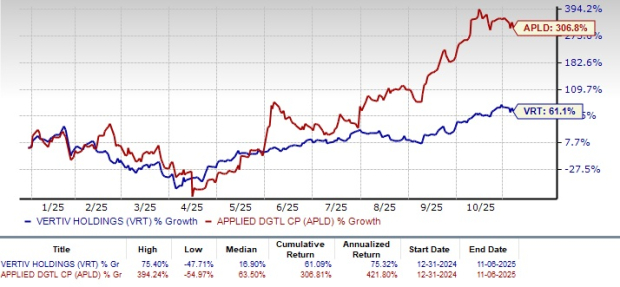

Price Performance and Valuation of Vertiv and Applied Digital

In the year-to-date period, Vertiv’s shares have gained 61.1% and Applied Digital’s shares have surged 306.8%. The outperformance in Applied Digital can be attributed to its robust demand for data center infrastructure and strategic partnerships with hyperscalers.

Despite Vertiv’s expanding portfolio, the challenging macroeconomic environment, including the uncertainty created by higher tariffs, does not bode well for the stock.

Vertiv and Applied Digital Stock Performance

Image Source: Zacks Investment Research

Valuation-wise, Vertiv and Applied Digital’s shares have been overvalued, as suggested by a shared Value Score of F. In terms of trailing 12-month Price/Book, Vertiv shares have been trading at 19.94X, which is higher than Applied Digital’s 8.15X.

Vertiv and Applied Digital Valuation

Image Source: Zacks Investment Research

How Do Earnings Estimates Compare for Vertiv & Applied Digital?

The Zacks Consensus Estimate for Vertiv’s 2025 earnings is pegged at $4.11 per share, which has increased 7.31% over the past 30 days and 44.21% year-over-year.

Vertiv Holdings Co. Price and Consensus

Image Source: Zacks Investment Research | Vertiv Holdings Co. Quote

For 2025, the Zacks Consensus Estimate for Applied Digital’s loss is pegged at 31 cents per share, which has declined 4 cents over the past 30 days. The company reported a loss of 80 cents per share in the year-ago quarter.

Applied Digital Corporation Price and Consensus

Image Source: Zacks Investment Research | Applied Digital Corporation Quote

Vertiv's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, delivering an average surprise of 14.89%. Applied Digital's earnings missed the Zacks Consensus Estimate in two of the trailing four quarters, matching the same on two occasions, with the negative average surprise being 104.22%. The average surprise of Vertiv is higher than that of Applied Digital.

Conclusion

While both Vertiv and Applied Digital stand to benefit from the data center infrastructure boom, Vertiv’s stronger earnings momentum, diversified growth drivers, and consistent performance suggest it may offer greater upside potential in the near-term.

Despite a robust portfolio and partnerships with hyperscalers, Applied Digital's near-term prospects are murky given rising loss estimates. Customer concentration and financing execution for large projects may also temper visibility.

Currently, Vertiv sports a Zacks Rank #1 (Strong Buy) rating, making the stock a stronger pick than Applied Digital, which has a Zacks Rank #3 (Hold) rating.

More By This Author:

Should Investors Bet On Cameco Stock Post The Q3 Earnings Miss?3 DWS Mutual Funds To Buy Now For Sustainable Returns

Should You Buy, Sell Or Hold Caterpillar Stock Post Q3 Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more