Vertiv - All Time High

Image Source: Pexels

- Investors look for ten baggers, stocks that grow tenfold over time.

- Vertiv has a 100% technical buy signal

- 187.40+ Weighted Alpha

Many investors look for a ten-bagger. Ten baggers are mostly used to describe stocks that grow tenfold within a given time frame. For an investor to benefit from a 10-bagger, they usually must stick with the investment for a long time. Experienced investors realize that a ten-bagger doesn't become one overnight. It becomes one by hitting new all-time highs week after week, month after month, and year after year. I look for potential ten baggers by using Barchart's powerful screener function to find stocks hitting new all-time highs plus having a very high Weighted Alpha. Vertiv Holdings (VRT) the digital infrastructure technologies company may be one of those stocks.

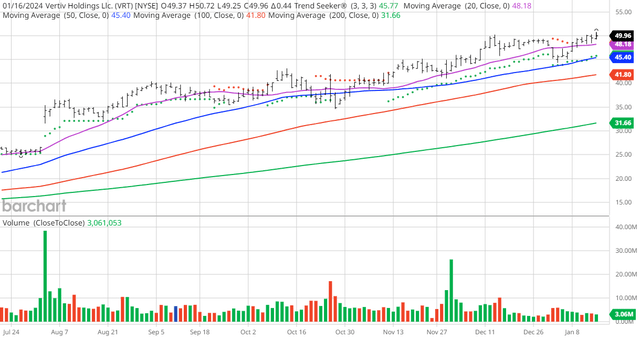

VRT Price vs Daily Moving Averages (Barchart)

Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. It offers AC and DC power management products, switchgear and busbar products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure that are integral to the technologies used for various services, including e-commerce, online banking, file sharing, video-on-demand, energy storage, wireless communications, Internet of Things, and online gaming. The company also provides lifecycle management services, predictive analytics, and professional services for deploying, maintaining, and optimizing its products and their related systems; and preventative maintenance, acceptance testing, engineering and consulting, performance assessments, remote monitoring, training, spare parts, and digital critical infrastructure software services. It offers its products primarily under the Vertiv, Liebert, NetSure, Geist, E&I, Powerbar, and Avocent brands. The company serves social media, financial services, healthcare, transportation, retail, education, and government industries through a network of direct sales professionals, independent sales representatives, channel partners, and original equipment manufacturers. Vertiv Holdings Co is headquartered in Westerville, Ohio.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 187.40+ Weighted Alpha

- 233.73% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 7 new highs and up 4.67% in the last month

- Relative Strength Index 57.63%

- Technical support level at $49.23

- Recently traded at $49.40 with a 50-day moving average of $45.58

Fundamental Factors:

- Market Cap $19 billion

- P/E 33.01

- Dividend yield .05%

- Wall Street projects Revenue will grow 20.70% this year and another 9.30% next year

- Earnings are estimated to increase 228.30% this year, an additional 27.60% next year, and then continue to compound at an annual rate of 73.06% for the next 5 years

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 8 strong buy, 3 buy, and 1 hold recommendations on the stock

- Analysts price targets are $45 to $60 with a consensus of 54 - that's about a 9% gain over today's price

- Value Line gives the stock its highest rating of 1

- CFRAs MarketScope has a buy rating

- 6,550 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Cencora - Name Changed To Protect The Innocent?

Chart Of The Day: Natural Resources - Old King Coal

MicroMarvel: Mereo BioPharma - Analysts Favorite

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are ...

more