Verizon Communications Inc: Is It A Buy?

Image Source: Pexels

As part of an ongoing series, we will take a closer look at one of the stocks from our stock screeners and briefly review why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our screens is Verizon.

Verizon Communications Inc. (VZ)

Wireless services account for about 70% of Verizon Communications’ total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier.

Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers’ networks.

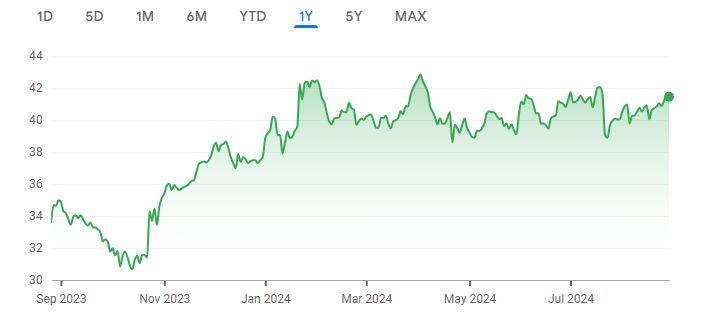

A quick look at the share price history (below) over the past twelve months shows that the price has moved up around 23.55%. Here’s a brief look at why the company is undervalued.

Source: Google Finance

Key Stats

- Market cap: $173.22 billion

- Enterprise value: $345.05 billion

Operating Earnings

- Operating earnings: $29.47 billion

Acquirer’s Multiple

- Acquirer’s multiple: 11.70

Free Cash Flow (TTM)

- Free cash flow: $13.93 billion

FCF/MC Yield Percentage

- FCF/MC yield percentage: 7.98

Shareholder Yield Percentage

- Shareholder yield: 6.40

Other Indicators

- Piotroski F score: 5.00

- Dividend yield percentage: 6.59

- ROA (five-year average percentage): 8

More By This Author:

Walmart Inc. Valuation: Is The Stock Undervalued?

Large-Cap Stocks In Trouble - Sunday, Sept. 1

Home Depot Inc: Is It A Buy?

Disclosure: None.