Value In T & PM

(Click on image to enlarge)

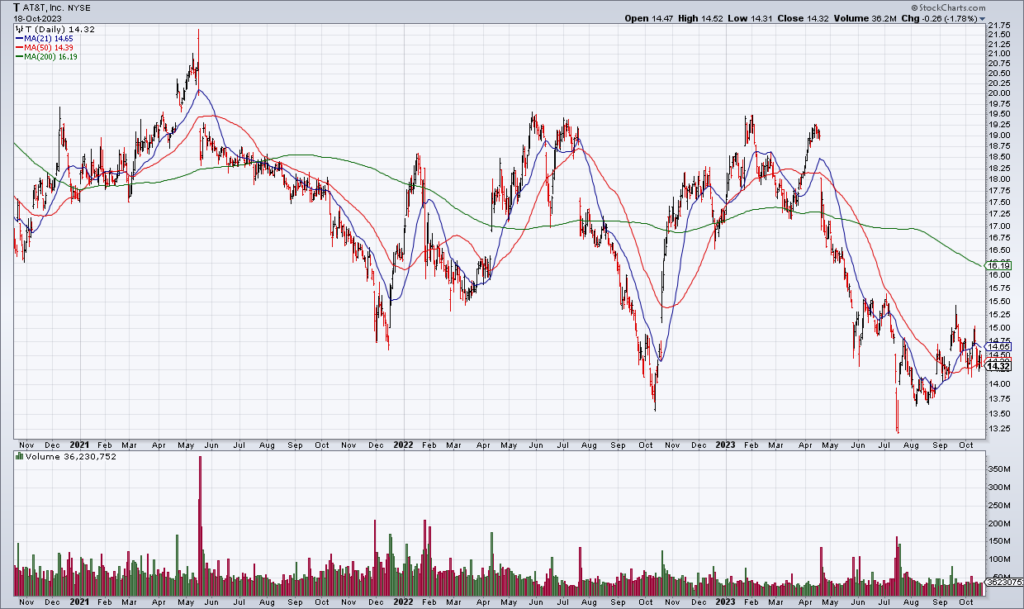

While the focus for Thursday’s trading session with be Tesla (TSLA) and Netflix (NFLX) after their respective 3Q23 earnings reports on Wednesday afternoon, I’ll also be watching AT&T (T) and Philip Morris International (PM) after both report their 3Q23 earnings this morning. Both are unloved value stocks with some upside IMO.

T has had a lot of problems obviously but it’s one of the two leading wireless carriers and I don’t think it’s going anywhere. 3Q23 revenue was +1% and adjusted EPS 64 cents. T also pays a 27.75 cent quarter dividend which works out to a 7.75% rate. While the dividend may get cut, it would still be high. T is a cheap stock that plays an important role in the economy and I’ll hold my 1% position. Shares are currently +4% in the premarket.

(Click on image to enlarge)

PM is another cheap, unloved stock that I like. While smoking is under political pressure, many people still smoke and will continue to do so. PM’s cigarette volumes were down only 0.5% from a year ago. PM is guiding 2023 EPS to $6.05-$6.08 which gives it a PE just north of 15 on current year earnings. It also pays a fat 5.45% dividend. I’ll continue holding my 1% position. PM shares are off marginally in the premarket.

More By This Author:

TSLA And NFLX Earnings

Defense Stocks Are A Buy, Technical Weakness

Interest Rates & The Fed, 3Q Earnings, Israel-Palestine

Disclosure: Top Gun is long shares of T and PM.