Utility Dividend Growth Match-Up: Southern Company Vs. Consolidated Edison

It is no secret that utility stocks are great for income. They arguably enjoy the most defensive, recession-resistant business model one can find.

This makes them ideal for investors interested in high dividend yields, and safe dividend payouts.

Southern Company (SO) and Consolidated Edison (ED) are two of the largest utilities in the U.S.

Southern has raised its dividend for 15 years in a row. It is a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

ConEd has reached an even more exclusive level. It a Dividend Aristocrat, since it has raised its dividend for 43 years in a row.

This article will compare and contrast these two utility stocks, and try to determine which one is the better pick for income investors.

Fundamentals Winner: Consolidated Edison

Southern and ConEd are in the same industry—electricity generation and distribution. They differ in size and regional market served.

Southern serves 9 million electric and gas customers, located primarily in the southeast U.S.

ConEd provides electric service to more than 3 million customers in New York.

(Click on image to enlarge)

Source: 4Q Earnings Presentation, page 4

ConEd performed slightly better than Southern in 2016. ConEd’s earnings-per-share rose 2% to $4.15 last year. Adjusted earnings-per-share increased 13% in the fourth quarter, thanks to favorable weather trends.

For its part, Southern’s earnings-per-share declined 1.2% in 2016, to $2.57. One reason for the decline is because Southern continues to be dragged down by cost over-runs at its major Kemper project.

The Kemper facility is a massive electric power plant that utilizes a new technology for burning coal. It uses lignite, which can be converted to gas at a lower temperature than existing techniques.

According to Southern, this is expected to result in lower costs with less harmful environmental impacts.

The problem for Southern is that costs are coming in much higher than originally anticipated.

Last year, Southern absorbed $428 million in excess losses at the Kemper Integrated gasification combined cycle. This was an increase from $365 million of such losses incurred in 2015.

This issue has weighed on Southern for a few years now. But the project is finally nearing completion. Once Southern can rid itself of these losses, its earnings growth is likely to improve.

Growth Prospects Winner: Southern

The trade-off for the certainty of their business models, is that utilities exhibit fairly low rates of earnings growth.

Rather than companies in other industries that can innovate and develop new products, electricity is an extremely stable business.

Southern and ConEd have regulated operations. This provides them with a modest amount of growth, since utilities regularly receive approval for periodic rate increases.

In a normal climate, they can be expected to grow earnings-per-share a few percentage points above GDP growth.

ConEd’s future growth will benefit from its recently approved three-year rate plans for its electric and gas delivery businesses.

Overall, ConEd expects 2017 adjusted earnings-per-share of $3.95 to $4.15. At the midpoint, ConEd’s earnings-per-share, on an adjusted basis, are set to increase 1.5% this year.

(Click on image to enlarge)

Source: 4Q Earnings Presentation, page 21

Meanwhile, Southern appears to have better growth prospects than ConEd. It has taken a more aggressive approach to M&A activity, such as its $8 billion merger with AGL Resources last year.

The deal expands on Southern’s customer growth initiative.

(Click on image to enlarge)

Source: Fourth Quarter Presentation, page 7

Southern expects earnings-per-share growth of 2.4% in 2017, thanks to customer additions and new energy infrastructure improvements booked under long-term contracts.

Long-term, the company sees the potential for 5% annual earnings-per-share growth. Growth is expected to accelerate, thanks largely to customer growth, as well as the projected completion of the Kemper project in early 2017.

(Click on image to enlarge)

Source: Fourth Quarter Presentation, page 12

For a utility, a 5% annual growth rate of earnings-per-share is an impressive figure. This could lead to stronger dividend growth as well moving forward.

Dividends: Southern Company

Investors have long relied upon utility stocks for dependable dividends. They were once known as “widow-and-orphan” stocks, because they could be passed on to heirs and continued paying reliable dividends.

Since everyone needs to keep the lights on, utility stocks could even be owned by the most risk-averse among us (widows and orphans).

As a result, well-run utilities can provide consistent (if unspectacular) earnings growth and dividend hikes every year.

ConEd’s longer history of annual dividend increases, and its membership in the Dividend Aristocrats, would normally make it the clear winner over a Dividend Achiever.

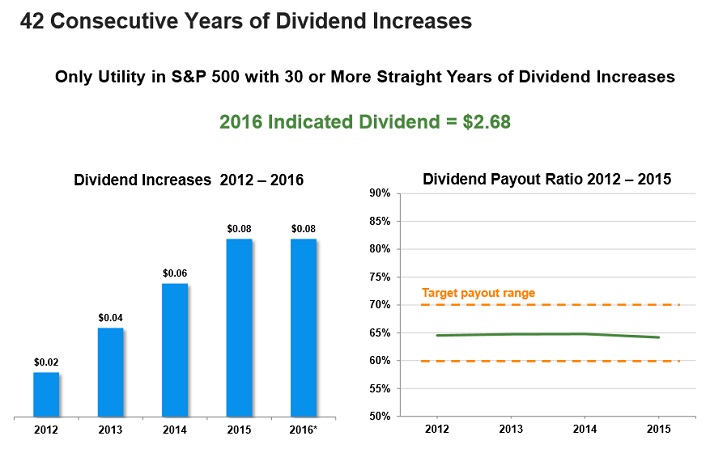

(Click on image to enlarge)

Source: November 2016 Investor Update Presentation, page 20

However, this is an unusual time for utility stocks.

The mad rush for yield over the past few years has resulted in declining dividend yields across the utility sector. In a low-interest environment, investors are scrambling for the high yields that utilities typically provide.

As share prices rose across the utility sector, dividend yields declined. ConEd enjoyed a much stronger rally than Southern in recent years. Over the past three years, ConEd stock increased 38%, compared with a milder 18% rise for Southern.

Of course, this is not surprising, given Southern’s problems at its Kemper facility.

Nevertheless, right now Southern and ConEd have dividend yields of 4.5% and 3.6%, respectively. This is a big difference—Southern yields nearly a full percentage point higher than ConEd.

Put differently, a $10,000 investment in ConEd would generate $360 in annual dividend income. The same investment in Southern would provide $450 in annual income—25% more income than ConEd.

Southern appears willing to pay out more of its earnings in dividends, relative to ConEd. ConEd seeks to maintain a payout ratio of 60%-70% of adjusted earnings-per-share. Southern currently maintains a payout ratio closer to 80%.

There is nothing alarming about Southern’s payout ratio. Even though it is higher, the company still easily covers its dividend with earnings. The benefit is that investors are treated to a significantly higher yield.

Final Thoughts

ConEd stock rose much more than Southern over the past few years. This was great for ConEd shareholders.

But, those interested in buying the stock now have to settle for a relatively low dividend yield for a utility stock.

By contrast, Southern has a much higher dividend yield, and could exhibit stronger earnings and dividend growth moving forward thanks to its M&A and recovery at the Kemper facility.

As a result, while both stocks are strong picks for income, Southern could be the more rewarding income investment. The 8 Rules of Dividend Investing agree with this qualitative assessment. Southern Company outranks Consolidated Edison using The 8 Rules.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more