Using Top-Down Analysis For JNJ Trade Setup

Image Source: Pixabay

When we look at the stock market, it is easy to get lost in the noise of individual stock movements. A top-down trading strategy helps bring clarity. This approach involves starting with the big picture, the overall market, then narrowing down to a specific sector, and finally selecting a promising stock within that sector or industry. This method helps confirm that the broader market and sector trends support your individual stock picks.

Let’s apply this strategy to the healthcare sector. We will start by examining the Health Care Sector (XLV). Then, we will dive into a specific stock within that sector, Johnson & Johnson (JNJ), to see if it presents a solid trading opportunity. This methodical process allows us to make more informed decisions by ensuring market tides are in our favor.

Analyzing the Healthcare Sector with XLV

First, we need to understand what the broader healthcare sector is doing. The XLV exchange traded fund is an excellent tool for this, as it tracks a basket of the largest healthcare companies. A quick look at the chart gives us a sense of the prevailing trend and overall market sentiment for this industry. A strong sector trend can lift all boats, making it easier for individual stocks to perform well.

(Click on image to enlarge)

Looking at the XLV chart, we see a promising trend developing. From August through October, the ETF has been trading within a well defined upward channel. This pattern is characterized by a series of higher highs and higher lows, which is a classic sign of a bullish uptrend. This tells us that, as a whole, money is flowing into the healthcare sector, and investors are optimistic about its prospects.

The price is currently near the upper band of this channel. While this could suggest a short term pullback is possible, the underlying strength of the trend is undeniable. The consistent upward momentum in XLV provides a supportive backdrop for looking at individual stocks within the sector. A rising sector tide makes it more likely that a good stock setup will follow through. With this positive outlook on the healthcare sector, we can now drill down to a specific company.

A Closer Look at Johnson & Johnson (JNJ)

Now that we have established that the healthcare sector is in a healthy uptrend, we can look for individual stocks that might offer a good entry point. Johnson & Johnson is a major component of the XLV and often serves as a bellwether for the sector. Analyzing its chart will tell us if it is confirming the sector’s strength or showing signs of weakness.

(Click on image to enlarge)

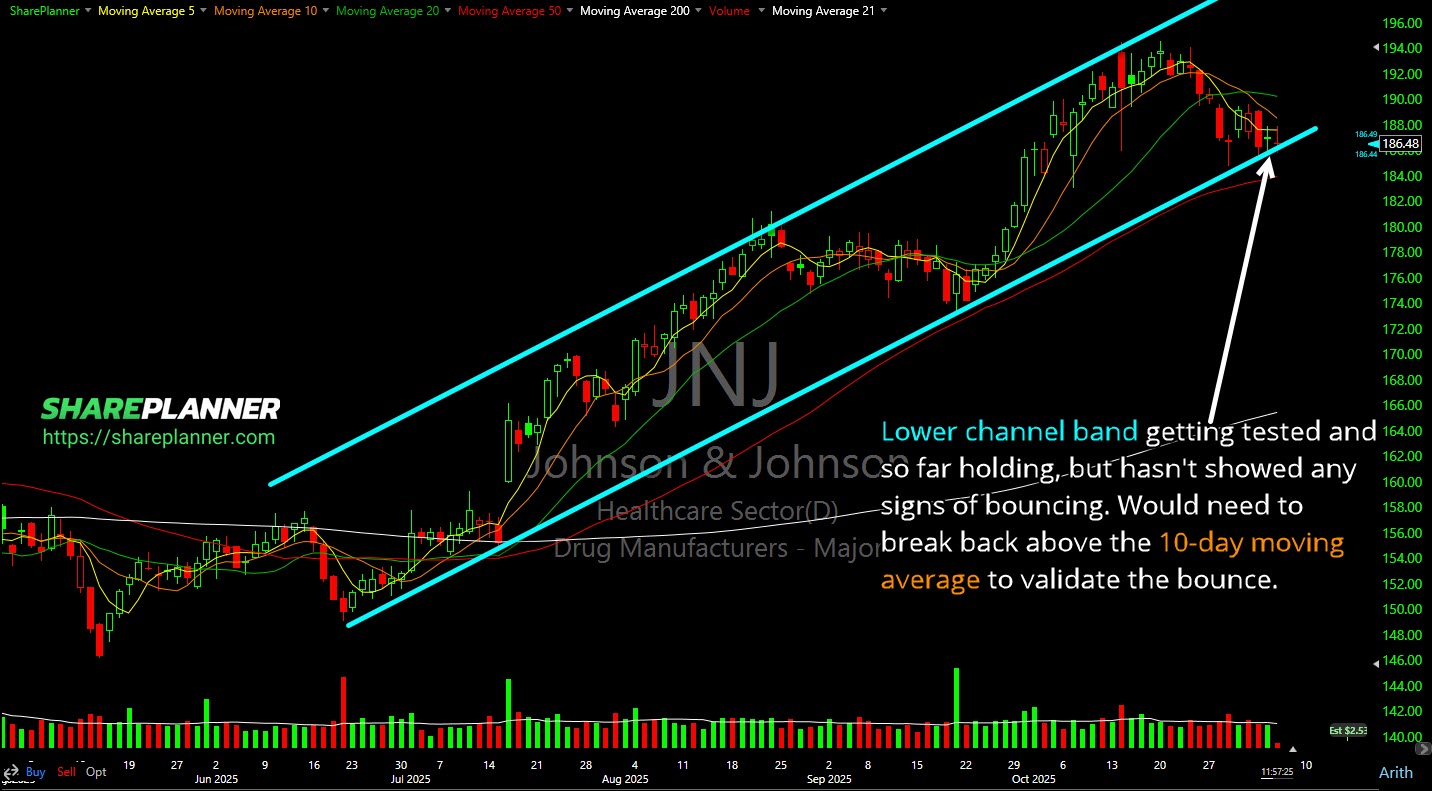

The chart for JNJ reveals a similar upward channel, mirroring the trend we saw in the broader XLV. This is a great confirmation. It shows that JNJ has been a strong participant in the sector-wide rally. However, the current price action for JNJ tells a slightly different story than the overall sector ETF.

Right now, JNJ is testing the lower support band of its channel. The price has held at this level so far, which is a positive sign. But it has not yet shown any convincing signs of a bounce. For a true confirmation that the stock is ready to move higher again, we would need to see it break back above its 10 day moving average. A move above this short term average would signal that buyers are stepping back in and that the stock is likely to resume its upward path within the channel.

This is a critical moment for JNJ. The stock is at a potential support level within a strong uptrend, backed by a bullish sector. However, the lack of an immediate bounce suggests caution. We are at a decision point where the stock needs to prove itself. If it fails to hold this lower channel and breaks down, it could signal a period of weakness not just for JNJ, but potentially for the broader healthcare sector as well.

Putting It All Together for a Trading Plan

Using a top-down approach gives us a more complete picture. We started with the XLV and confirmed the healthcare sector is in a solid uptrend. This gives us the confidence to look for long positions within the sector. Then, we examined JNJ and found that while it shares the same bullish long term structure, its short term position requires patience.

The analysis provides a clear, actionable plan. The sector (XLV) is strong, but the individual stock (JNJ) is at a critical support level that needs to hold. A trader could watch for JNJ to bounce off the lower channel and reclaim its 10 day moving average as a potential entry signal. This strategy aligns the trade with the broader sector trend while waiting for a specific confirmation from the stock itself.

This method prevents us from jumping into a trade based on one chart alone. By confirming the sector trend first, we increase our odds of success. If JNJ does confirm a bounce, the supportive trend in XLV suggests there could be significant room for it to run. If it fails, we know to stay on the sidelines and look for other opportunities, protected by our disciplined, top-down approach. Trading is about managing risk, and this strategy provides a logical framework to do just that.

More By This Author:

PLTR Back To Breakout SupportNVDA Stock Analysis – Monster Rally: Buy, Sell Or Hold?

UBER & NVDA

Click here to download my Allocation Spreadsheet. Get all of my trades ...

more