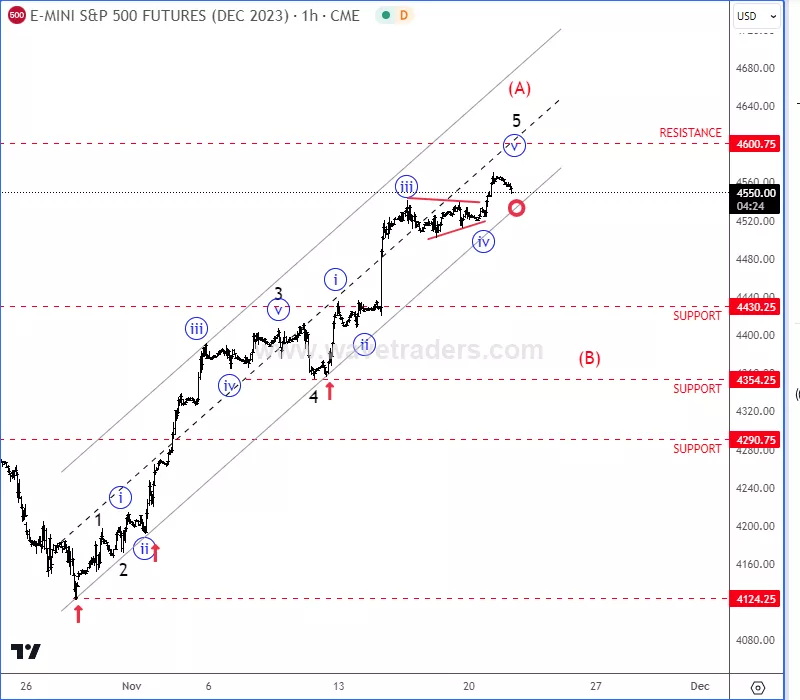

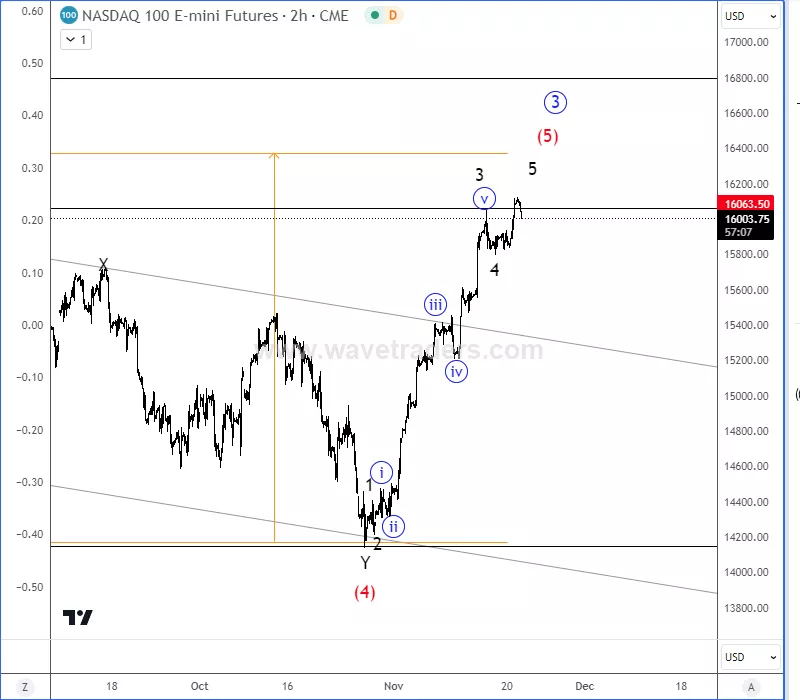

US Stocks Can Be Nearing Temporary Resistance Ahead Of FOMC

Photo by Nicholas Cappello on Unsplash

US stocks are in massive and impulsive recovery in November, but we can see them approaching an interesting area from a technical point of view and by Elliott wave theory.

SP500 came nicely higher for wave »v« of 5, but we should be now aware of a higher degree corrective slow down, especially if breaks EW channel support line. If SP500 will keep grinding higher after the FOMC meeting later today, then wave »v« of 5 of (A) can be still in progress towards 4600 area before we will see a higher degree correction within wave (B).

Now that the Nasdaq 100 is back to July highs and 16k area, there's a chance it's finishing wave 5 of (5) of a higher degree wave 3, so be aware of a higher degree wave 4 correction soon.

More By This Author:

KuCoin Is Back To Bullish Trend

Fantom Is In A Bullish Resumption As Expected

Silver Remains In Uptrend, As 10Y US Treasury Notes Can Be Bottoming

You can check our different Elliott wave market updates with Black Friday sales. Explore them at https://wavetraders.com/

For more analysis visit us at www.wavetraders.com and ...

more