US Stock Market Weekly Update May 4 - May 8, 2020

The US stock market closed on Friday, May 8, 2020, with weekly gains for all major stock indexes. The Nasdaq has now gained on a year-to-date basis. But we believe that the stock market and many of its stocks are currently disconnected from the fundamentals and the severity of the negative economic impact the coronavirus crisis is having on the economy.

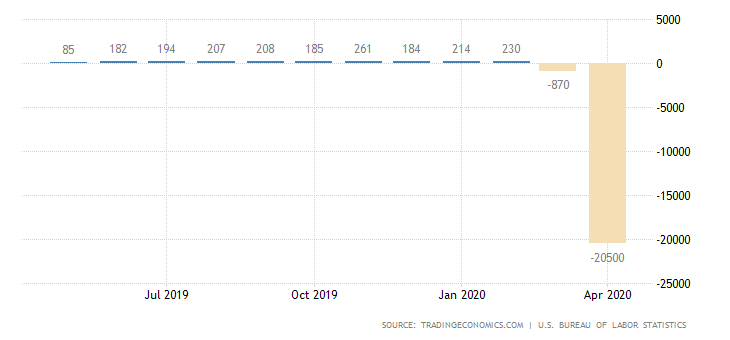

In a week during which the April monthly jobs report revealed that more than 20 million jobs were lost in one month, and the US unemployment rate spiked to 14.7%, the highest level in almost 80 years, the stock market completely ignored this bad news and rallied on Friday, May 8, 2020, the day of the jobs report release. It seems that the FOMO effect (fear of missing out) in trading and investing in stocks is dominating over logic, valuations and fundamentals for now. The stock market reacted positively to the very negative jobs report on hopes that about 80% of the job losses were reported to be temporary layoffs, meaning that with the gradual reopening of the economy these jobs will be added back to the economy and contribute to the total consumer spending. It remains for now to see the validity and truth of this estimate.

United States Non-Farm Payrolls

“The US economy lost 20.5 million jobs in April, less than market expectations of a 22 million cut, and after declining by 870K in March. It is the largest drop ever, bringing total employment to 131 million, the lowest level since February 2011, and owing to the coronavirus pandemic and consequent restrictive lockdown restrictions and business closures. Job losses were widespread, with the largest (7.7 million) decline occurring in leisure and hospitality. Almost three-quarters of the decrease occurred in food services and drinking establishments (5.5 million). Employment also fell in the arts, entertainment, and recreation industry (1.3 million) and in the accommodation industry (839,000). The change in total nonfarm payroll employment for February was revised down by 45,000 to +230,000, and the change for March was revised down by 169,000 to -870,000. With these revisions, employment changes in February and March combined were 214,000 lower than previously reported.”

Source: Trading Economics

For the week of May 4– May 8, 2020, the major US stock market indexes closed as follows on Friday, May 8, 2020:

• Dow Jones Industrial Average: Close 24331.32, +2.56% for the week, -14.74% Year-to-date

• S&P 500 Index: Close 2929.80, +3.50% for the week, -9.32% Year-to-date

• NASDAQ: Close 9121.32, +6.00% for the week, +1.66%, Year-to-date

• Russell 2000: Close 1329.64, +5.49% for the week, -20.31% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Lightbridge Corp (LTBR) Close 8.15, 5-day change +135.20%

2. Camping World Holdings Inc (CWH), Close 14.00, 5-day change +70.11%

3. Twilio (TWLO), Close 179.69, 5-day change +66.41%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Medley Llc (MDLX), Close 2.96, 5-day change -55.00%

2. Medley Llc 7.25% Notes Due 2024 (MDLQ), Close 3.45, 5-day change -54.43%

3. Neurometrix Inc (NURO), Close 2.04, 5-day change -23.31%

Economic events for the week May 11- May 15, 2020:

Important economic data for this week will be inflation, consumer sentiment, and retail sales. The focus will be on retail sales, as an increase in consumer spending is considered positive for the economic growth, and the higher the growth of the retail sales the faster should we expect the economic recovery.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned

Heading up to $12-$13... then on to $24-$30