US Stock Market Weekly Update March 30- April 3, 2020

Last week I wrote “US stocks had a rebound this week, and all major US stock indexes closed higher. But it could still be too early to call this the bottom for the US stock market. Could it be that the stock market has already discounted all the negative implications of the coronavirus outbreak, and it reacts positively to any negative financial news? Like the record weekly US initial jobs claims surpassing the reading of 3 million posted this week. I am not so sure about that.”

For the week ending on Friday, April 3, 2020, the US stock market declined and all major stock indexes had losses. We had a very negative figure for the US non-far payrolls and the weekly US jobless claims, both of them show the coronavirus negative impact on the US economy. We have to wait for the official figures for the GDP to know if we will have and to what extent a possible recession. Still, significant market moves exist in the financial markets and offer trading opportunities like the rally for oil prices and news that there could be a global oil cut production to support the falling oil prices.

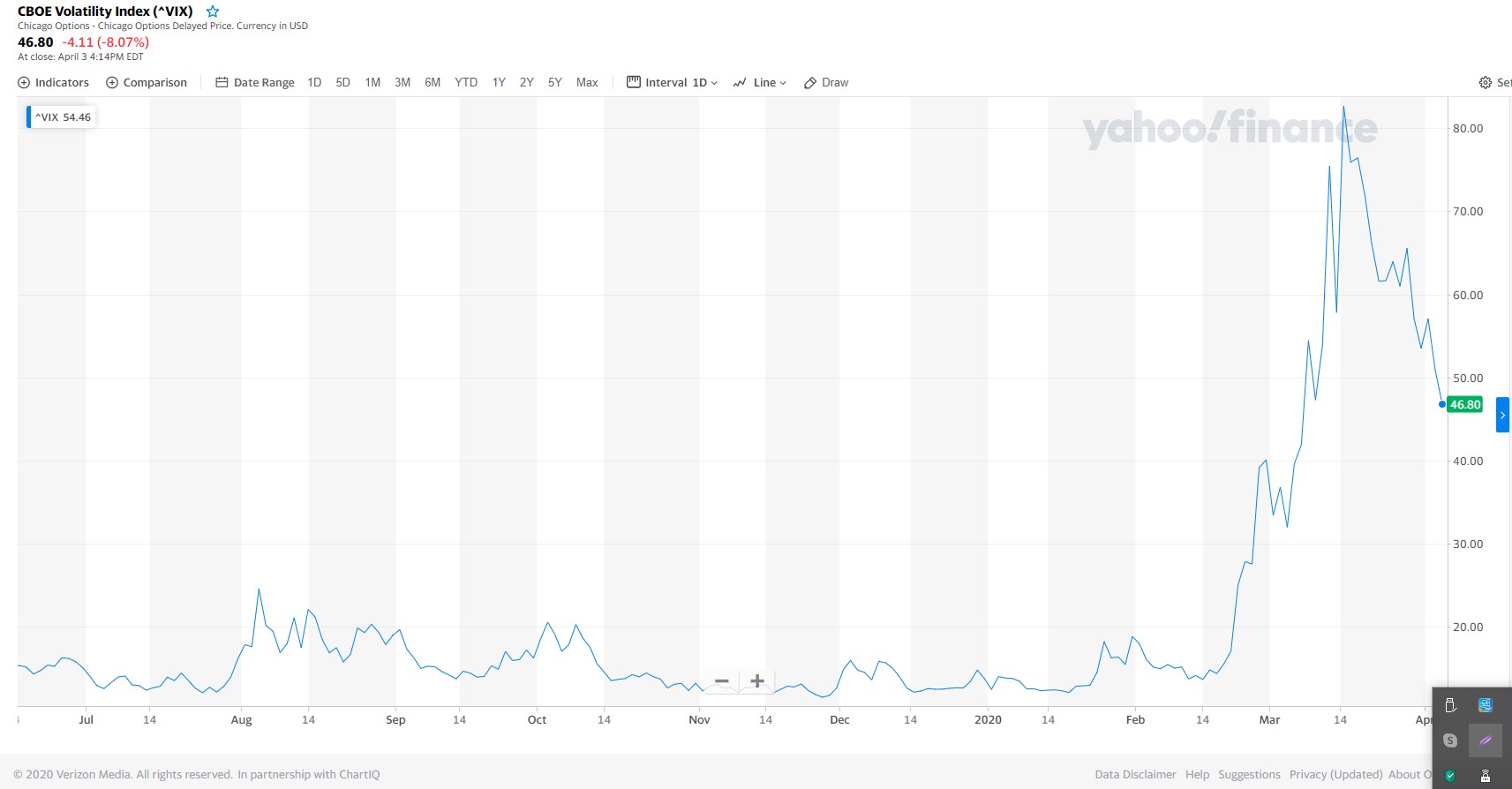

CBOE Volatility Index

An important index to monitor for the US stock market is the CBOE Volatility Index (VIX). It is worth mentioning that on Friday, April 3, 2020, the volatility index fell below the 50.0 level and as of March 16, 2020, and the high price of 82.69, it has declined by about 44%. On Friday, April 3, the VIX index closed at 46.80. A regression of the volatility to the usual lower levels is essential to make the US stock market more investable than in the past few weeks.

VIX index

Source: Yahoo Finance

United States Non-Farm Payrolls

“The US economy lost 701,000 jobs in March, much worse than market expectations of a 100K cut, reflecting the effects of the coronavirus and efforts to contain it. It is the first decline in payrolls since September of 2010 but the figures were not as bad as those seen in 2008 as the number excludes the last two weeks of March when unemployment claims surged by nearly 10 million. About two-thirds of job losses occurred in leisure and hospitality, mainly in food services and drinking places. Employment also declined in health care and social assistance, professional and business services, retail trade, and construction.”

Source: Trading Economics

For the week of March 30– April 3, 2020, the major US stock market indexes closed as follows on Friday, April 3, 2020:

• Dow Jones Industrial Average: Close 21052.53, -2.70% for the week, -26.23% Year-to-date

• S&P 500 Index: Close 2488.65, -2.08% for the week, -22.97% Year-to-date

• NASDAQ: Close 7373.08, -1.72% for the week, - 17.83%, Year-to-date

• Russell 2000: Close 1052.05, -7.06% for the week, -36.95% Year-to-date

Weekly Stock Gainers

These are the top three gainers, stocks with five days of consecutive price advances:

1. Merrimack Pharmaceuticals Inc (NASDAQ: MACK) Close 2.70, 5-day change +29.19%

2. EQT Corp (NYSE: EQT), Close 8.77, 5-day change +27.10%

3. Houlihan Lokey (NYSE: HLI), Close 58.06, 5-day change +25.32%

Weekly Stocks Losers

These are the top three losers, stocks with five days of consecutive price declines:

1. Cedar Fair LP (NYSE: FUN), Close 16.28, 5-day change -28.16%

2. Fidus Investment Cor (NASDAQ: FDUS), Close 5.36, 5-day change -28.15%

3. Pennymac Financial Services IN (NYSE: PFSI), Close 17.25, 5-day change -28.15%

Economic events for the week April 6- April 10, 2020:

Important economic data for this week will be the consumer sentiment, the Fed minutes on monetary policy and consumer inflation.

Stock market commentary

Has the stock market bottomed? I do not think so, the economic news is not well, and as the coronavirus death toll increases the sentiment is biased towards risk-off investing mode. The very large outliers for the numbers of US non-farm payrolls and US weekly jobs claims still have not shown what will the actual economic damage. With the earnings season to start later in April a conservative mode is suggested, still favoring defensive sectors.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.dailyfx.com/economic-calendar

https://stockcharts.com/

Disclosure: I have no position in any stock mentioned