US Stock Market Weekly Update August 3- August 7, 2020

It was a strong week for the US stock market amid positive economic news and hopes for a new government stimulus. Nasdaq made a new record and a new 52-week high, but small-cap stocks outperformed and strong jobs report in July shows that there is a slow economic recovery in the labor market. Further gains for small-cap stocks are a possibility as Russell 2000 is still negative for the year and the valuation concerns of especially tech stocks will be also a key theme to monitor for the rest of 2020.

Economic News

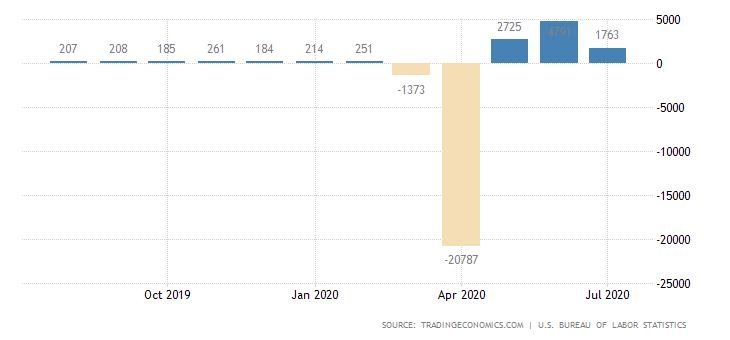

The ISM Manufacturing PMI reported was better than expected with a figure of 54.2, beating the estimate of 53.6, showing expansion in the manufacturing economy. The Factory Orders were also better than expected coming in at 6.2% compared to the forecast of 5%. A notable trend to monitor is the Balance of Trade, which was reported at $-50.7B, worse than the forecast of $-50.1B. The US dollar lately has depreciated against major currencies, such as the Euro and the British Pound, and this in theory should boost the exports and reduce the deficit in the balance of trade. The ISM Non-Manufacturing PMI and ISM Non-Manufacturing Business Activity both beat the estimates and showed expansion for business activity related to the services sector. The main event for the week was the July jobs report, which showed an increase for the Non-Farm Payrolls, a number of 1763K better than the forecast of 1600k and a decline for the unemployment rate at the level of 10.2%, better than the estimate of 10.5%. A continued recovery in the labor market is a key factor for a sustainable US economic recovery.

The United States Non-Farm Payrolls

“The US economy added 1.76 million jobs in July 2020, easing from a record 4.8 million in the previous month,as a resurgence in COVID-19 cases hit the labor market recovery. Still, the reading beat market expectations of a 1.6 million increase with employment in leisure and hospitality increasing by 592 thousand and accounting for about one-third of the gain, and with government employment rising by 301 thousand. Typically, public-sector education employment falls in July, but declines occurred earlier than usual this year due to the pandemic, resulting in unusually large increases in local government education (+215 thousand) and state government education (+30 thousand). Also, a 27 thousand advance in federal government employment reflected the hiring of temporary workers for the 2020 Census. Increases were also seen in retail trade, professional and business services, other services, and health care. Nonfarm employment remained 12.9 million below their pre pandemic-level.” Source: Trading Economics

For the week of August 3– August 7, 2020, the major US stock market indexes closed as follows on Friday, August 7, 2020:

• Dow Jones Industrial Average: Close 27433.48, +3.80% for the week, -3.87% Year-to-date

• S&P 500 Index: Close 3351.28, +2.45% for the week, +3.73% Year-to-date

• NASDAQ: Close 11010.98 , +2.47% for the week, +22.72%, Year-to-date

• Russell 2000: Close 1569.18, +6.0% for the week, -5.95% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Addex Therapeutics Ltd ADR (NASDAQ:ADXN), Close 21.0, 5-day change +132.04%

2. NuZee Inc (NASDAQ:NUZE), Close 39.96, 5-day change +99.90%

3. Cymabay Therapeutics (NASDAQ:CBAY), Close 6.26, 5-day change +76.34%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Leju Holdings Ltd (NYSE:LEJU), Close 2.9, 5-day change -26.63%

2. Occidental Petroleum Corp Wts (NYSE:OXY-WS), Close 4.16, 5-day change -25.71%

3. Blue Apron Holdings Inc (NYSE:APRN), Close 8.90, 5-day change -25.65%

Economic events for the week August 10- August 14, 2020:

Important economic data for the week will be the Inflation Rate, the Weekly Jobless Claims the Retail Sales and the Michigan Consumer Sentiment Index Preliminary.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned

How many of those "new" jobs are actually restored jobs that had vanished as the customer base stayed home? Restoration of loss is certainly welcome but it tends to confuse things more than a little. Certainly the intent to add a positive spin to the data results in a bit of a twist with the numbers.

Quoting percentages of originals would be more truthful but not so very much "sunshine."