US Stock Market Weekly Review May 18- May 22, 2020

The US stock market closed on Friday, May 22, 2020, with weekly gains for all major stock indexes of more than 3%. The focus is now on the reopening of the economy and developments about the coronavirus vaccine trials.

Some mixed economic reports were released the previous week about the US economy. The NAHB/Wells Fargo Housing Market Index, a monthly survey of home builders that tracks sales of single-family homes and sales expectations for the next six months came in at 37, better than the forecast figure of 35 and an improvement over the previous reading of 30. The housing market can provide important trends and signals about the strength of the US economy. Still the monthly Housing Starts and Building Permits fell significantly, the figures were -30.2% and -20.8% respectively.

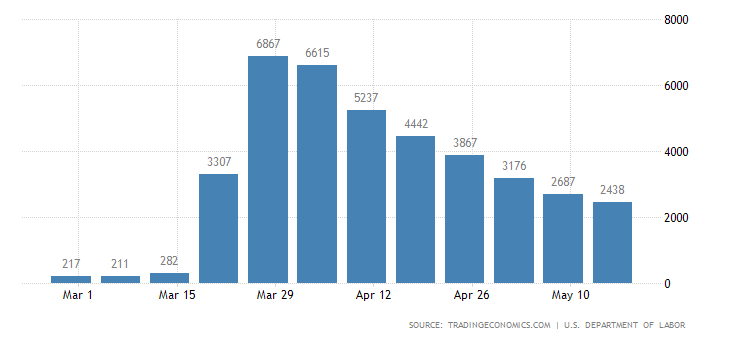

The labor market continues to show weakness. The weekly number for the Continuing Jobless Claims came in at 25073K, worse than the forecast figure of 24765K. The weekly number for the Initial Jobless Claims was also worse than expected. The actual figure was 2438K compared to the forecast figure of 2400K.

The United States Initial Jobless Claims

“The number of Americans filing for unemployment benefits eased to 2.438 million in the week ended May 16th, the lowest level since the coronavirus crisis began more than two months ago. Still, filings came in slightly above market expectations of 2.4 million and lifted the total reported from March 21st to 38.6 million. On a non seasonally adjusted basis, the biggest increases in jobless claims were reported in California, New York, Florida, Georgia, Washington, and Texas. The 4-week moving average, which removes week-to-week volatility, eased for a fourth straight week to 3.042 million, while continuing jobless claims hit a new record of 25 million in the week ended May 9th.”

Source: Trading Economics

There is a declining trend for the Initial Jobless Claims, but the recent numbers are still too high compared to the figures during March 2020. On the positive side, the Markit Manufacturing PMI Flash figure came in at 39.8, better than the forecast figure of 38 and an improvement over the previous reading of 36.1.

For the week of May 18– May 22, 2020, the major US stock market indexes closed as follows on Friday, May 22, 2020:

• Dow Jones Industrial Average: Close 24465.16, +3.29% for the week, -14.27% Year-to-date

• S&P 500 Index: Close 2955.45, +3.20% for the week, -8.52% Year-to-date

• NASDAQ: Close 9324.59, +3.44% for the week, +3.92%, Year-to-date

• Russell 2000: Close 1355.53, +7.84% for the week, -10.47% Year-to-date

Weekly Stocks Gainers

These are the top 2 gainers, stocks with 5 days of consecutive price advances:

1. Celsion Corp (NASDAQ: CLSN) Close 3.03, 5-day change +126.12%

2. Marine Petroleum U (NASDAQ: MARPS), Close 2.19, 5-day change +96.30%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Timber Pharmaceuticals Inc. (NYSE: TMBR), Close 2.91, 5-day change -56.97%

2. Kingsoft Cloud Holdings Limited American Deposit (NASDAQ: KC), Close 17.18, 5-day change -25.63% (IPO was May 8)

3. Volitionrx Ltd (NYSE: VNRX), Close 3.00, 5-day change -17.81%

Economic events for the week May 25- May 29, 2020:

Important economic data for this week will be the new home sales, the durable goods orders, and the consumer sentiment index.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned