US Stock Market Weekly Review: June 15- June 19, 2020

The US stock market for the week ending on June 19, had weekly gains for all major stock indexes. The US retail sales number was the biggest positive economic surprise for the week, beating expectations and signaling improving economic conditions. While the US labor market continues to show signs of weakness with the weekly US job claims figure of 1508K, being worse than the expected figure of 1300K, there have been almost three months now that claims are above 1 million, and to the extent that this trend does not show levels of rapid improvements, it poses severe threats for the degree of economic recovery.

Important economic news has been released that supported the stock market and could add additional support in the coming months. The first news was that the US government is working on a $1 trillion economic stimulus plan targeted to infrastructure sectors. The second news was that the Fed is expanding its bond-buying program adding corporate bonds that will meet is defined criteria, adding more liquidity in the markets.

The increase in coronavirus cases in some states, such as In Florida, New York, California, Texas, Georgia and Arizona is still a negative factor that should be considered as there are fears for the second wave of coronavirus, and partial lockdowns again, which should not be good news for the economy.

U.S. Retail Sales

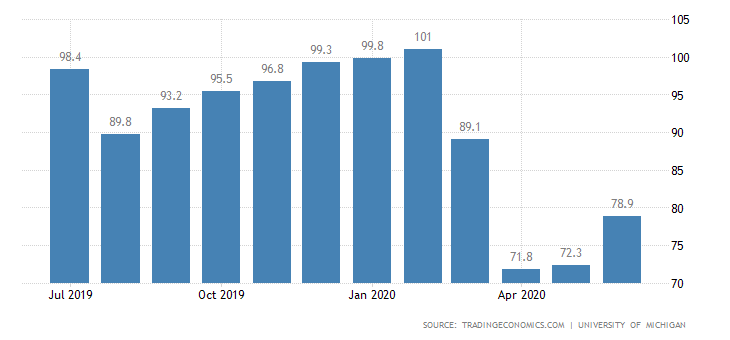

“Retail sales in the US jumped 17.7 percent from a month earlier in May of 2020, recovering from a record 14.7 percent fall in April, and much better than forecasts of an 8 percent increase. It is the biggest rise on record as Americans went back to work and many stores reopened after the coronavirus lockdown. The biggest increases were seen in stores with clothing (188 percent); furniture (89.7 percent); sporting goods, hobby, musical instrument, & book stores (88.2 percent); electronics and appliances (50.5 percent); motor vehicles (44.1 percent); food services and drinking places (29.1 percent); miscellaneous stores (13.6 percent); and gasoline stations (12.8 percent). Still, compared to the same month in 2019, retail sales fell 6.1 percent. Also, sales were 12.7 percent lower in the three months to May than in the 3 months to February before the pandemic started.”

Source: Trading Economics

This big jump in the retail sales is probably unsustainable and a reversion to the mean of previous months should be expected in the next months. But still, it's a huge improvement over the three consecutive declines for February, March, and April 2020, respectively.

For the week of June 15– June 19, 2020, the major US stock market indexes closed as follows on Friday, June 19, 2020:

• Dow Jones Industrial Average: Close 25871.46, +1.04% for the week, -9.35% Year-to-date

• S&P 500 Index: Close 3097.74, +1.86% for the week, -4.12% Year-to-date

• NASDAQ: Close 9946.12, +3.73% for the week, +10.85%, Year-to-date

• Russell 2000: Close 1418.63, +2.23% for the week, -14.97% Year-to-date

Weekly Stock Gainers

These are the top three gainers, stocks with five days of consecutive price advances:

1. Tortoise Acquisition Corp WT (NYSE:SHLL), Close 4.05, 5-day change +355.06%

2. Alpine Immune Sciences Inc (NASDAQ:ALPN), Close 12.10, 5-day change +224.40%

3. Mosaic Acquisition Corp WT (NYSE:VVNT), Close 6.03, 5-day change +103.03%

Weekly Stock Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Chesapeake Energy Corp (NYSE:CHK), Close 12.77, 5-day change -33.59%

2. Forte Biosciences Inc. (Nasdaq:FBRX), Close 14.31, 5-day change -27.18%

3. Panhandle Royalty Company (NYSE:PHX), Close 2.98, 5-day change -21.99%

Economic events for the week June 22- June 26, 2020:

Important economic data for this week will be the existing home sales, the Markit Manufacturing PMI Index (flash reading), personal income, and spending.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned