US Stock Market Weekly Review July 27- 31

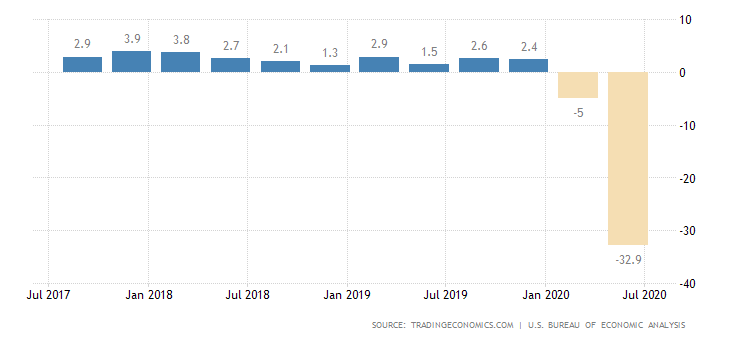

If we want to summarize the US stock market performance with a few words for the previous week, then seven words are enough. These words are “The US economy is officially in recession”. The US GDP growth reported for the second quarter of 2020 showed a 9.5% decline in GDP which is equivalent to a 32% annualized decline.

The good news is that this decline was better than expected compared to the estimate of -34.1% annualized decline. But the bond market is signaling signs of alarm with a rally for bond prices and decline for bond yields. The 10-yr bond yield at close on Friday, July 31, was 0.5360-0.0050 (-0.92%), which is near to the year-to-date lows seen earlier in March when there was an intense selloff for stocks. The stock market reaction to the recession news was muted, and the bond market does not support the economic theory that in a strong economy risk-on mood for investing should send bond yields to lower levels. Bonds are considered safer investments compared to stocks and this is not fully reflected now if all worst economic impacts of the coronavirus are discounted.

Tech stocks continued to move higher, as three stocks beating earnings estimates contributed to the Nasdaq outperforming this week. Apple, Amazon, and Facebook all reported better than expected earnings.

Economic news

The Federal Reserve kept the key interest funds rate unchanged as expected in a low-high range of 0%- 0.25% respectively and stated in its latest press release that “The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals. The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

The Durable Goods Orders came in at 7.3%, better than the forecast of 7%. The CB Consumer Confidence index missed the estimate of 94.5 with a figure of 92.6, and the housing market showed strength with the Pending Home Sales rising more than expected, with a figure of 16.6% higher than the estimate of 15%. The labor market was mixed with Continuing Jobless Claims rising at 17018K, higher than the forecast of 16200K, and the Initial Jobless Claims coming at 1434K, less than the forecast of 1450K. The Core Personal Consumption Expenditure Price Index figure reported was 0.9% year-over-year well below the target of 2% that the central bank has set. Finally, the Michigan Consumer Sentiment Final reading was a slight miss at 72.5 lower than the forecast of 73.

United States GDP Growth Rate

“The US economy shrank by an annualized 32.9 percent in the second quarter of 2020, compared to forecasts of a 34.1 percent plunge, the advance estimate showed. It is the biggest contraction ever, pushing the economy into a recession as the coronavirus pandemic forced many businesses including restaurants, cafes, stores, and factories to close and people to stay at home, hurting consumer and business spending. Decreases were seen in personal consumption, exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending while federal government spending jumped. The recovery will depend on the capacity of the country to control the pandemic and avoid more waves of infections. Still, the number of new cases continues to increase, making several states to scale back or pause the reopening of their economies. Fed officials see the US economy shrinking 6.5 percent in 2020.”

Source: Trading Economics

The major US stock market indexes closed as follows on Friday, July 31. The S&P 500 turned positive for the year.

- Dow Jones Industrial Average: Close 26428.32, -0.16% for the week, -7.39% Year-to-date

- S&P 500 Index: Close 3271.12 , +1.73% for the week, +1.25% Year-to-date

- NASDAQ: Close 10745.27, +3.69% for the week, +19.76%, Year-to-date

- Russell 2000: Close 1480.43, +0.88% for the week, -11.27% Year-to-date

Weekly Stock Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Sohu.Com Inc (Nasdaq:SOHU) , Close 22.97, 5-day change +106.75%

2. Jumia Technologies Ag ADR ( NYSE:JMIA), Close 15.56, 5-day change +63.96%

3. Purple Innovation Inc WT (Nasdaq:PRPLW) , Close 6.52, 5-day change +49.89%

Weekly Stock Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Ashford Inc (NYSE:AINC), Close 4.96, 5-day change -34.63%

2. Capital Product Part (Nasdaq:CPLP), Close 5.65, 5-day change -31.43%

3. Jaws Acquisition Corp WT (NYSE:JWS-WT), Close 2.22, 5-day change -29.53%

Economic events for the week August 3- August 7:

Important economic data for the week will be the Markit Manufacturing PMI Final, the ISM Non-Manufacturing PMI, the weekly Jobless Claims, and the Unemployment Rate and Non-far Payrolls.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Source: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200729a.htm

Disclosure: I have no position in any stock mentioned

Interesting but no surprises. These are bad times. Not horrible times, but certainly bad times.

And the future is still uncertain, except that we know that the recovery will not be instant. Nor even quick.