US Stock Market Weekly Review July 20-24

A week with moderate losses for the US stock market amid important earnings reports and new political tensions between the USA and China. A new federal stimulus is expected while coronavirus cases in Florida and Texas remain a major concern for local lockdowns, and now slim chances for a broader national lockdown. The coronavirus cases should be monitored as they can have a large impact on the speed of the US economic recovery.

Economic News

A series of mixed economic news for the previous week sent tech stocks closing lower as they underperformed compared to the S&P 500 and Dow Jones. On Friday, shares of Intel Corporation (INTC) closed lower more than 16% at 50.59-9.81 (-16.24%) on news that its next-generation manufacturing of chips will be delayed at least for 6 months. Could this be a red flag to monitor for other chip stocks? On the same day shares of Advanced Micro Devices, Inc. (AMD) jumped more than 16%, closing at 69.40+9.83 (+16.50%), as investors saw the delay of Intel as an opportunity for Advanced Micro Devices to gain the advantage of it in terms of market share.

The Chicago Fed National Activity Index came in at 4.11 beating expectations of 3.5 indicating strength in overall economic activity. Existing Home Sales were slightly weaker than expected with a figure of 4.72M compared to the forecast of 4.78M. The weekly Continuing Jobless Claims were better than expected with a figure of 16197K compared to the forecast of 17067K. But there was a lot of disappointment with the number of weekly Initial Jobless Claims reported to be 1416K, worse than the forecast of 1300K. This shows that the labor market recovery is still bumpy ahead. The CB Leading Index missed marginally the forecast, showing some weakness for current economic conditions. The actual figure was 2.0%, less than the forecast of 2.1%. Finally on the economic news, the Markit Manufacturing PMI Flash missed the expectation by a slight margin but with several 51.3 compared to the forecast of 51.5 it was in the expansion area, and that is positive for the manufacturing sector. The New Home Sales jumped to 13.8%, a huge increase compared to the forecast of 4%. This should not be a surprise with the historically low interest rated at this moment.

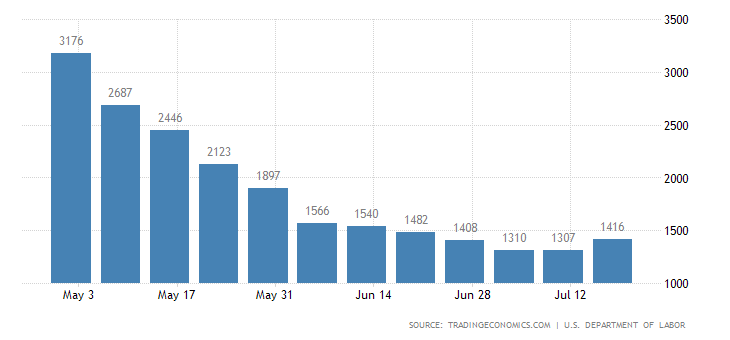

United States Initial Jobless Claims

“The number of Americans filling for unemployment benefits increased 1.42 million in the week ended July 18th, accelerating for the first time in nearly four months and compared to market expectations of 1.30 million, as a resurgence in new COVID-19 cases forced several states to scale back or pause the reopening of their economies. The latest number lifted the total reported since March 21st to 52.7 million. The 4-week moving average, which removes week-to-week volatility, eased to 1.36 million from 1.38 million, while continuing jobless claims decreased to 16.20 million in the week ended July 11th, below market forecasts of 17.07 million.”

Source: Trading Economics

The major US stock market indexes closed as follows on Friday, July 24, 2020:

• Dow Jones Industrial Average: Close 26469.89, -0.76% for the week, -7.25% Year-to-date

• S&P 500 Index: Close 3215.63 , -0.28% for the week, -0.47% Year-to-date

• NASDAQ: Close 10363.18 , -1.33% for the week, +15.50%, Year-to-date

• Russell 2000: Close 1467.55, -0.39% for the week, -12.04% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Genocea Biosciences (NASDAQ:GNCA), Close 4.48, 5-day change +11.32%

2. Rignet Inc (NASDAQ:RNET), Close 3.36, 5-day change +84.62%

3. Platinum Group Metals Ltd (NYSE:PLG), Close 2.12, 5-day change +52.52%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Ashford Hospitality Trust Inc (NYSE:AHT), Close 4.18, 5-day change -39.68%

2. Cyclerion Therapeutics Inc (NASDAQ:CYCN) , Close 3.46, 5-day change -28.36%

3. Relay Therapeutics Inc (NASDAQ:RLAY), Close 33.20, 5-day change -24.51%

Economic events for the week July 27- July 31, 2020:

Important economic data for the week will be the Durable Goods Orders, the CB Consumer Confidence Index, the Pending Home Sales, the Goods Trade Balance, the Fed Interest Rate Decision, the weekly Jobless Claims and last but not least the much anticipated GDP Growth Rate QoQ.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned