US Stock Market At A Tactical Decision Point

The benchmark S&P 500 (SPX) finished Friday’s session at 3895, up 56 points or 1.5% for the week after declining by 927 points or 19.4% in 2022. SPX remains in the midst of a year-long major downtrend.

Chart 1 below shows that SPX will begin next week just below primary Tactical resistance at 3904 to 3907. This is an important Tactical decision point for the market from which the current 2022 major decline should resume — IF it’s still valid.

Chart 1

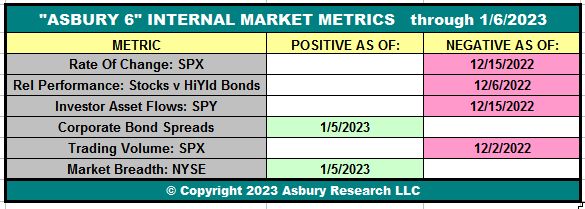

Table 1 below shows that the Asbury 6, our daily risk management model, is currently negative or bearish and has been since December 15th as four of its six constituent metrics are red or negative.

As long as the “A6” model remains on a Negative status next week, we will expect overhead resistance near 3900 to contain the S&P 500 on the upside and for a new leg lower to begin from it. A bullish shift in the Asbury 6, however, would be an early indication of a new major bullish trend change in the US broad market index.

Table 1: The Asbury 6

More By This Author:

The 3 Keys To A Year-End Rally

Get Ready For A Great Buying Opportunity

It Could Be A Great 3rd Quarter

Disclaimer: All Contents © Copyright 2005-2023 Asbury Research LLC. The contents of all material available on this Internet site are copyrighted by Asbury Research LLC. unless ...

more