US Bank Deposits & Money-Market Funds See Small Outflows As Stock Market Decoupling Hits Record High

Image Source: Unsplash

On a seasonally-adjusted basis, total bank deposits rose a tiny $2.1BN increase last week as money-market funds saw a $22.3BN outflow...

Source: Bloomberg

Notably, the MM fund outflows were dominated by a $30BN decline in institutional funds as Retail funds continued to see inflows (+8BN)...

Source: Bloomberg

On a non-seasonally-adjusted basis, total bank deposits rose by 8BN (the third weekly NSA inflow in a row)...

Source: Bloomberg

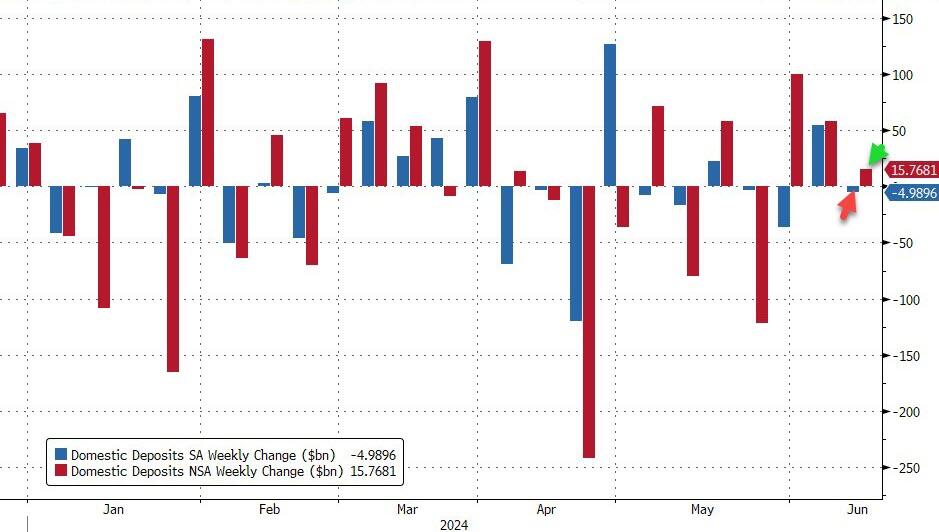

However, excluding foreign deposits, US banks saw a net $5BN SA deposit outflow (large banks -$1.4BN, small banks -$3.6BN) while on an NSA basis, domestic deposits rose by $15.7BN (large banks +$14.6BN, small banks +$1.1BN)...

Source: Bloomberg

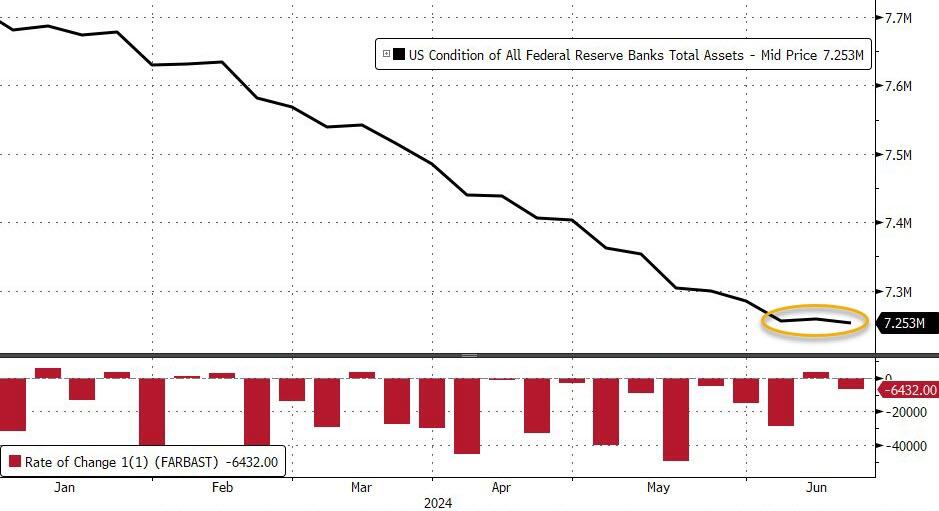

The Fed's balance sheet barely budged for the second week in a row (-$6BN after last week's +$3BN)...

Source: Bloomberg

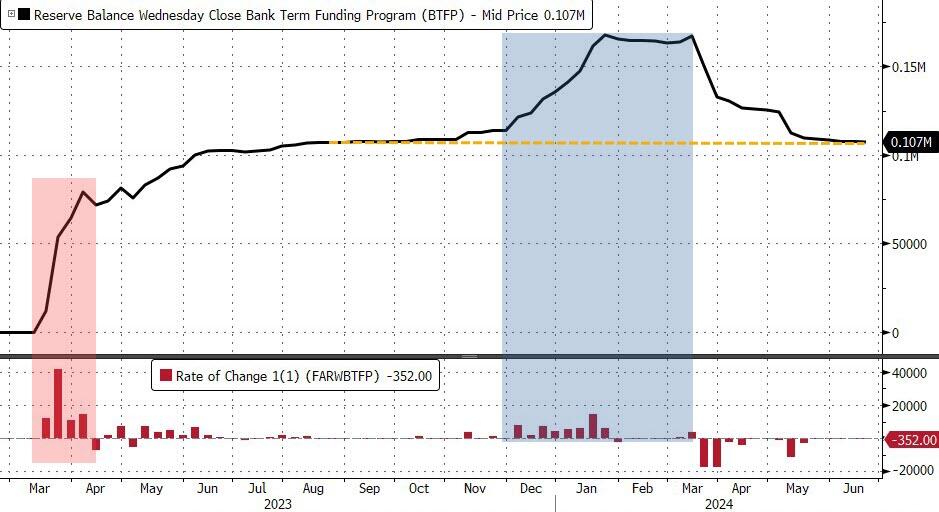

The Fed's now-expired Bank Bailout fund (BTFP) saw a tiny $352 million decrease - erasing all the arb-driven surge in demand for the facility, but leaving a whopping $107BN left out there filling holes in bank balance sheets...

Source: Bloomberg

And finally, with money-market fund and bank deposit outflows, it's not hard to see where that money is flowing... the decoupling between US equity market cap and bank reserves at The Fed is now way beyond record highs...

Source: Bloomberg

Is Powell's acquiescence to a bigger, sooner 'QT taper' (in the face of not-under-control inflation) to soften the blow when this crocodile mouth snaps shut.

More By This Author:

Crude Pops, Gold Drops, Crypto Flops As Nvidia Suffers Worst Week In 2 Months"Everything Is Frozen": Third-Day Of Cyberattack Leaves 15,000 Auto Dealerships Crippled

Futures Fall, Tech Rally Fades Ahead Of Record $5 Trillion OpEx

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more