UPS: A Package Delivery Giant Set To Capitalize On Online Sales Growth

Image Source: Unsplash

Today, United Parcel Service (UPS) is the global leader in package delivery services. Every day, it has more than 1.6 million shipping customers and 11.1 million delivery customers spread across 220 different countries and territories. But it started much smaller back in 1907, explains Nilus Mattive, editor of Safe Money Report.

At the time, two teenagers started delivering packages — six years before the US Postal Service began doing the same. They launched their operation — called the American Messenger Service — from a Seattle basement using $100 in borrowed money.

Within 12 years, they were expanding to Oakland, California, painting their delivery vehicles a distinctive brown color, and trying out a new name, which we know today as UPS. The expansion and growth have continued ever since.

All that shipping activity produces an enormous pile of money. Last year, the company’s revenue came in just over $100 billion. Profits were north of $13 billion, or $13.20 on a per-share basis.

The company returned more than $8 billion of that to shareholders through stock buybacks and dividends. That isn’t surprising. UPS has been paying dividends since it first went public and has been consistently increasing them ever since.

This year marked the 14th consecutive year of a higher dividend, in fact. The current quarterly dividend of $1.62 per share amounts to a very solid 3.75% annual yield at the recent stock price -- roughly the same income you’d get from a 10-year Treasury.

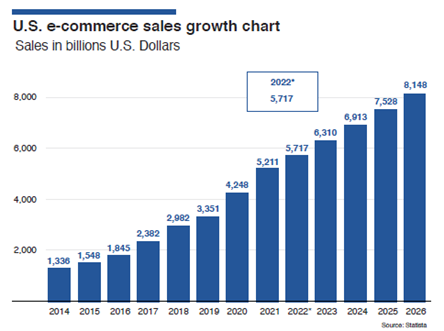

Meanwhile, online shopping still has plenty of room for future growth, which suggests UPS has a ton of runway. In 2014, global e-commerce retail sales totaled about $1.34 trillion. By 2021, they had risen roughly fourfold to $5.21 trillion. And it’s estimated they will increase another 56% by 2026 — less than three years from now.

Over the short-term, UPS is investing quite a lot of money back into its businesses. Capital expenditures were up 13.7% year-over-year in 2022 and are expected to rise again this year.

However, current CEO Carol Tomé has been quite focused on making the company more efficient and reducing costs wherever possible. It’s reasonable to expect that the money being spent today is going to result in larger profits down the road, especially since UPS’ return on equity has been more than four times better than the logistics industry average.

The shares were recently trading at a forward price-to-earnings ratio of 14 times this year’s estimated profit. Even if we use a lower 2024 estimate, the stock’s forward price-to-earnings ratio of 17 is below the S&P 500’s current valuation of almost 20 times estimated earnings over the next 12 months.

My recommended action would be to consider buying shares of UPS.

About the Author

Nilus Mattive bought his first stock in the sixth grade and has remained fascinated by the financial markets ever since. After graduating with a triple major in philosophy, theology, and English, he began his professional career at Jonathan Steinberg's Individual Investor Group. Mr. Mattive later edited Standard & Poor's flagship investment newsletter for five years and wrote The Standard & Poor's Guide for the New Investor, published by McGraw Hill.

He has since built up an enviable 15-year track record of winning income at the helm of various newsletters and trading services, including Weiss Ratings' Income Superstars and Superstar Trader. He now serves as editor of Weiss Ratings' Safe Money Report.

More By This Author:

Activist Investors Are Increasingly Active. Can You Profit By Riding Their Coattails?Enterprise Products: "Buy And Hold Forever"

History Is On Your Side After A Strong H1 2023 For Stocks

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.