Update: Zenabis Global's "Rights Offering" Successful - $20.8m Raised

The Zenabis Global Inc. (TSX: ZENA, ZBISF) “Rights Offering”, which expired this past Wednesday November 27, 2019, was over-subscribed and will result in the issuance of the maximum of 139,086,624 common shares of the Company at a price of $0.15 per Common Share for gross proceeds of approximately $20.8 million. This article is a follow up to the original article that was posted here on TalkMarkets in October.

What Are Rights?

A Right is a privilege granted to a shareholder to acquire a pro rata portion of additional shares of the issuer's stock directly from the issuing company at a specific price per share which is typically set at a discount to the recent trading price of the issuer's stock. The offerings are usually 4 to 6 weeks in duration.

Why Are Rights Offered?

Companies choose to raise additional capital through a Rights Offering for the following reasons:

- Existing shareholders may be more inclined than the public at large to buy shares in the company.

- Gives existing shareholders the opportunity to acquire additional shares.

- Allows existing shareholders to maintain their proportionate interest in the company.

What's the difference Between Transferable and Non-transferable Rights?

- Most Rights Offerings are non‐transferable so if a shareholder decides not to exercise the opportunity to acquire additional shares at the discounted within the allocated time period then the shareholder’s current ownership in the issuer will be diluted by those shareholders who exercise their rights.

- Some Rights Offerings, however, are structured by an issuer to permit rights to be transferable and in such instances those shareholders who choose not to exercise their transferable rights can trade them in the secondary market during the offering period. The money earned from trading the Rights enables the shareholders to offset dilution by earning a profit trading the Rights.

Rights trade on the exchange where the issuer’s common stock is listed, or over the counter if the issuer’s stock is not listed on an exchange. They can produce large gains if the stock price goes up by even a small amount but they can also be risky because they are a type of leverage.

Conclusion

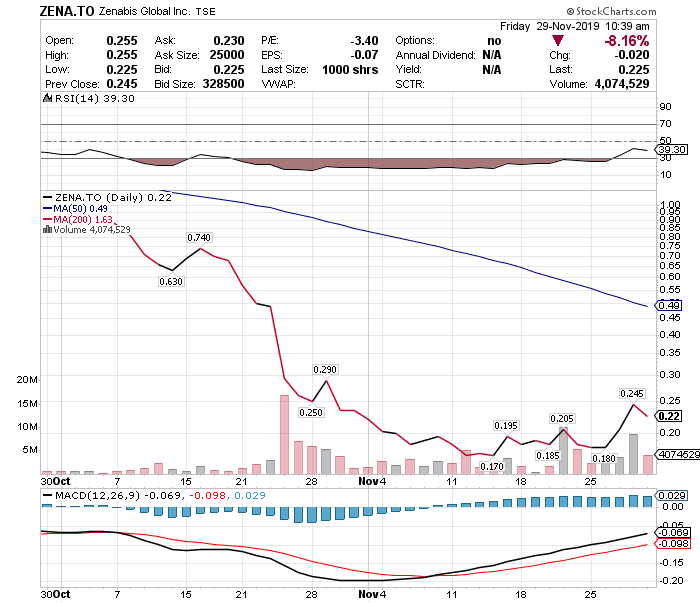

The market reaction to Zenabis Global's offering was particularly harsh with the stock declining 77% during the 4-week offering period before jumping 36% the day after its conclusion as can be seen in the chart below: