Under The Spotlight: UnitedHealth Group

Photo by Chris Liverani on Unsplash

UnitedHealth Group (UNH) is a healthcare company with two distinct and complementary businesses. Optum delivers care aided by technology and data, empowering people, partners, and providers with the guidance and tools they need to achieve better health. UnitedHealthcare offers a full range of health benefits, enabling affordable coverage, simplifying the healthcare experience, and delivering access to high-quality care.

Market Leader

UnitedHealth Group traces its roots to Dr. Paul Ellwood, the health-policy guru who coined the term “health maintenance organization” during the 1960s. In 1977, Paul Ellwood helped entrepreneur Richard Burke establish United Healthcare to manage the newly created Physicians Health Plan of Minnesota, an early HMO. By combining best practices in medical care with the best thinking in business management, the company’s founders sought to improve the health of patients by expanding health coverage options and strengthening the healthcare system. Since its founding, the firm has consistently differentiated itself from its peers through the effective use of technology to improve care. Today, UnitedHealthcare, the firm’s health care insurance arm, collaborates with Optum, its information, and technology-enabled health services arm, to deliver better clinical outcomes while bending the cost curve.

UnitedHealthcare, which generated 77% of UNH’s total 2022 revenues and 51% of its operating income, serves 149 million people. As the nation’s largest health insurer, the firm provides insurance through individual and employer plans, Medicare Supplemental and Advantage plans, Medicare plans plus benefits, and health care delivery in more than 130 countries worldwide. Optum, which generated 23% of UNH’s total 2022 sales and 49% of its operating income, provides technology-enabled health services for patients, providers, pharmacies, hospitals, payers, and life sciences organizations. The largest business within Optum is OptumRx, a pharmacy benefit manager.

2022 Financial Results

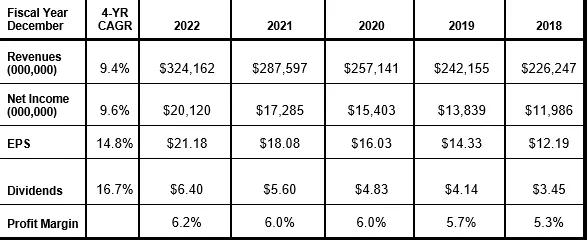

UnitedHealth Group reported healthy fourth-quarter results with revenues rising 12% to $82.8 billion, net income increasing 17% to $4.8 billion and EPS up 18% to $5.03. For the full year 2022, revenues rose 13% to $324.2 billion as net income jumped 16% to $20.1 billion with EPS up 17% to $21.18. The company delivered broad-based growth thanks to double-digit growth at both Optum and UnitedHealthcare drove primarily by serving more people and serving them more comprehensively. Domestically, people served by UnitedHealthcare grew by over 1.2 million in 2022.

Return on shareholders’ equity for the year was a healthy 25%, reflecting the company’s strong overall growth and efficient capital structure. Free cash flow increased 18% during the year to $23.4 billion with the company paying $6 billion in dividends and repurchasing $7 billion of its common shares. Cash paid for acquisitions during the year, including Change Healthcare, topped $21 billion with the acquisitions expanding the company’s capabilities.

2023 Financial Outlook

The company continues to see tremendous growth opportunities through its investments in technology and innovation with long-term EPS growth expected in the annual 13%- 16% range. Business performance and capital deployment are expected to yield a return on equity of 20% or higher and a return on invested capital in the mid-teens percent or greater.

UnitedHealth Group affirmed its 2023 growth outlook with revenues expected to increase 10%-11% to a range of $357 billion to $360 billion with net earnings increasing 9%-12% to $23.15 to $23.65 per share. Cash flow from operations for the year is expected to increase to a range of $27 billion to $28 billion in 2023. Thanks to strong cash flows, UNH has authorized a double-digit increase of the dividend each year since 2010, to the current annualized level of $6.60 per share. Investors seeking healthy long-term returns should consider UnitedHealth Group, a high-quality market leader with profitable growth, growing dividends, and a favorable outlook. Buy.

More By This Author:

Stock Profile: Texas RoadhouseStock Profile: LVMH Moët Hennessy – Louis Vuitton

Portfolio Highlights: Quarterly Movers & Shakers, March 2023

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more